Economists who never spoke up about financial sector subsidies are in an uproar over President Obama’s support for manufacturing. But what’s their alternative?

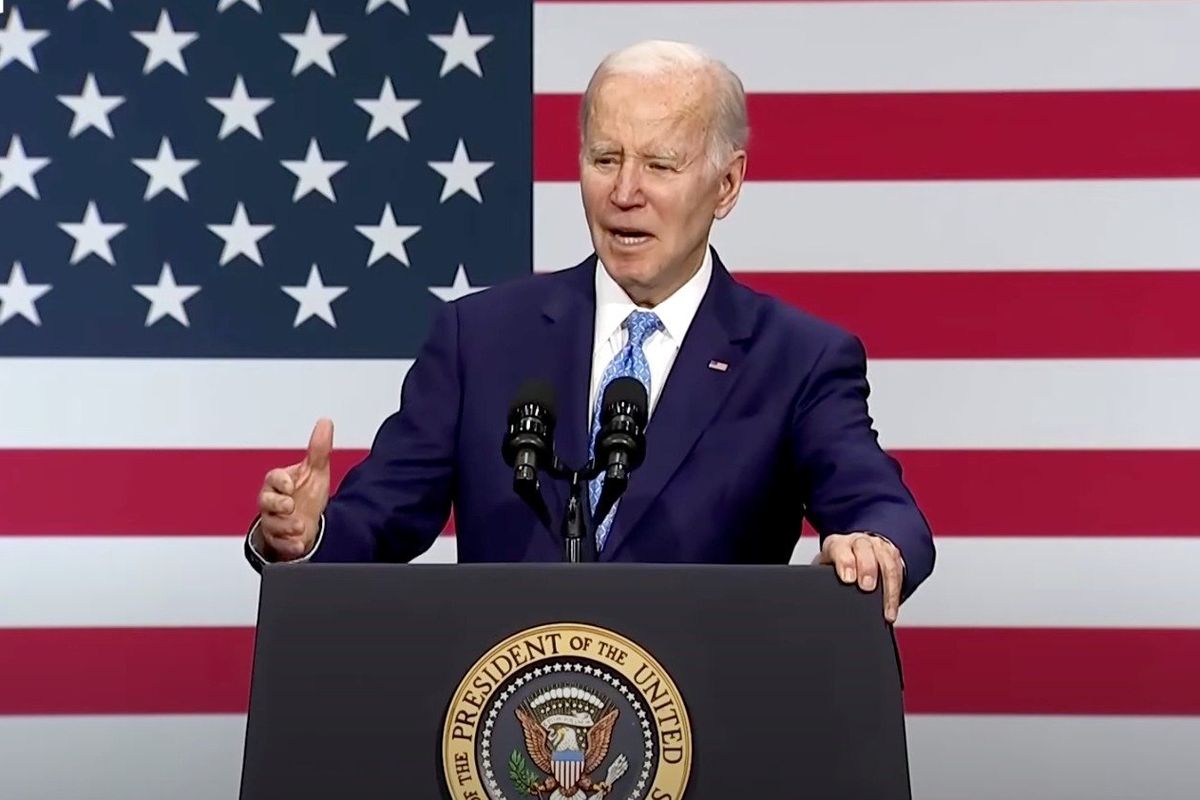

Why are mainstream economists, right and left, so determined to push back any attempt to subsidize manufacturing in America? The question will arise anew tonight when President Obama presents his budget, complete with tax provisions to support manufacturing. After the president addressed the issue as his first topic in the State of the Union a couple of weeks ago, many esteemed economists seemed to rush to the offense. Obama proposed using tax carrots and sticks to encourage manufacturers to stay here, return here, or get out of those low-wage emerging markets. Some mainstreamers, seeming to represent the conventional wisdom among them, openly scorned the idea. At least one, Laura Tyson, has stood her ground in favor of a policy focus on manufacturing.

I understand the mainstream economic reflex. After working so hard to get world nations to reduce trade barriers for the last 40 to 50 years, they and their successors view subsidizing manufacturing in the U.S. as a retreat. It could provoke retaliation as well. And moving the world toward free trade makes eminently good theoretical sense — to a degree. The anti-manufacturing subsidy bias is really a subset of the firm, almost unshakable allegiance to free trade theory among the American mainstream.

I also understand the mainstream neoclassical reflex, having taken a few of those courses. Indeed, sometimes I am a neoclassical myself. When you fundamentally believe that economies adjust efficiently, and that the markets will decide, if left unimpeded, which industries should naturally rise and fall, it is profoundly difficult to accept tinkering with matters unless very much warranted. If manufacturing is declining in America, the conventional thinkers say it is largely because first, the same business can be done more efficiently elsewhere, or second, American business has better places to put its money, usually by investing in services-oriented industries, some of them highly sophisticated. There may be manufacturing “market failures” to compensate for, but probably not many.

But here my questions begin to arise. These are by and large the same economists who, as a group, rarely raised public ire over the many subsidies the federal government bestowed on U.S. finance, at least until the recent financial crisis. Who did the American high dollar policy since the 1990s help? Finance, which could import mounds of capital and lend at low rates. Consider how little complaint there was about the interest rate tax deduction. Should you really get an interest rate deduction when you borrow to take over another company through an LBO or a privatization, and then keep a big slice of the equity for yourself? Should you get that deduction for leveraging up your investment bank’s trading department or your underwriting of collateralized debt obligations?

Did economists rise in chorus over conflicts of interest with ratings agencies, asymmetric compensation incentives at Wall Street banks, or the almost complete secrecy under which derivatives are traded? All of these were express violations, not merely of progressive economic thinking, but of conservative laissez-fare thinking. If they had done so with the same vigor with which they attack those who want to stimulate manufactures through government subsidies, perhaps I would understand their passion. But they did not.

Since there is plenty of uncertainty — including my own — about this issue, let me just pose some rhetorical questions to a phantom mainstream economist in hopes he or she will clarify the issues.

1. Doesn’t America already have an anti-manufacturing strategy? It has enthusiastically supported a high value for the dollar since the 1990s. The high dollar raises export prices but, as noted, very much helps Wall Street attract capital flows and lend at low rates. Shouldn’t we get the value of the dollar down?

2. Don’t Germany, China, and many other countries subsidize their own manufacturing industries? Do you really think the World Trade Organization works all these out? If they do subsidize, isn’t it only fair to place manufacturing on a level playing field and subsidize our own?

3. Doesn’t manufacturing having a multiplier effect? Some say we can never boost the share of manufacturing adequately. So what if we create even as much as another 2 or 3 million manufacturing jobs. (The president is settling for a couple of hundred thousand.) But wouldn’t manufacturing’s multiplier effect stimulate the rise of other manufacturing and service industries and the creation of other jobs?

4. How can we get our trade deficit down if we don’t sell more manufactures? They account for about seven-eighths of our exports. I know the answer some of you will give: savings. But do you really think raising our savings rate will reduce capital inflows adequately to lower the dollar in order to promote more exports?

5. Without manufacturing, what will we export? Isn’t there a point at which we lose too many industries and labor skills to make a comeback? Given the symbiotic nature of business clusters and supply chains, aren’t we rapidly losing the subsidiary companies that make manufacturing and exports possible?

6. Weren’t persistent trade imbalances a major cause of the 2007-2008 financial crisis as debt levels soared? Don’t you worry that the export-led models of China, Germany, and Japan are unsustainable? On a worldwide basis, they are really debt-led growth models. How do we get balance without promoting our exports?

7. Isn’t manufacturing a source of innovation in and of itself? Isn’t that where the scientists and engineers are? Don’t we learn and innovate by doing? One commentator recently said that those innovations are exploited by others, so it doesn’t matter. Really? Then maybe we should stop promoting R&D altogether.

8. Where will the good jobs come from? You always say high technology. But America now imports more high-technology products than it exports, especially to China. Even Germany has a high-technology deficit with China. I ask again, where will the jobs come from as technology gets more complex? Do you think more education is really an adequate answer, the only answer?

9. Why did the job market do so poorly throughout the 2000s? If you say we can’t know where jobs will come from, that the market will decide, then why aren’t you worried about the job market’s poor performance over the last decade, with huge losses in manufacturing jobs? Again, you say, inadequate education. Yet according to CEPR’s John Schmitt, we have not produced more good jobs as GDP grew — good jobs measured by wages and benefits provided. Is there hard evidence we don’t have the labor to fill the high-technology jobs — and if we did, are there enough jobs going unfilled to make a difference?

10. Will the jobs come from services? The rapid growth of finance has fouled up the numbers. Finance services did provide high-paying jobs, but we now know many of these were phantoms. And the salad days may be over. The other big area of productivity growth in services was retail. We all know what kinds of jobs Wal-Mart provided.

I ask these questions sincerely. The president’s program is not ideal, but it is calling attention to a problem. We need an open discussion about manufacturing policy, infrastructure investment, and industrial policy that avoids snooty recriminations and recognizes that no one has all the answers.

Roosevelt Institute Senior Fellow Jeff Madrick is the author of Age of Greed.

Cross-Posted From The Roosevelt Institute’s New Deal 2.0 Blog

The Roosevelt Institute is a non-profit organization devoted to carrying forward the legacy and values of Franklin and Eleanor Roosevelt.