Lobbyists, of all people, may soon inadvertently bring us what lobbyists have long fought against – – a flatter, simpler tax code that offers fewer gifts for special interests. As a bonus, it would also help bring down the deficit.

To understand why this happy result may be in reach, we must return to a subject you’re sick of: the much-maligned deal Congress struck to lift the debt ceiling. That deal set up a process that might not be advantageous to the forces of extortion in the same way the old one did.

The new law cuts about $900 billion in discretionary spending and establishes a 12-person “supercommittee” to find $1.5 trillion in additional savings over 10 years. At least they’ll be looking in the right places: tax reform and entitlement reform. With a mere majority of the 12 required, they must present a bill to Congress for an up-or-down vote (no amendments) by Christmas. If the bill fails, the now-famous triggers will automatically cut $1.2 trillion, half from defense and half from non-defense programs, including Medicare.

The rock-hard assumption in Washington this week is that the supercommittee can’t possibly get anything done. Depressed Democrats, girding to fight the last war, are certain that Republicans will gladly take hostages once again rather than make concessions on the revenue side.

In this scenario, the triggers will be allowed to go off because the cuts aren’t scheduled to begin until 2013. Both sides will put off the reckoning until the lame-duck session of Congress after the 2012 elections. At that point, with the Bush tax cuts about to expire, Republicans would finally have an incentive to make a deal.

Sword of Damocles

Maybe the whole thing will go as predicted. But this pessimistic outlook neglects what will happen when the supercommittee, arguably the most powerful joint committee in the past century, meets for 2 1/2 months this fall. It has the option to hold public hearings, which were included in part to make clear the Sword of Damocles hanging over the process.

Lobbyists will face a tough choice: accept either drastic cuts to programs they care about or an end to loopholes that benefit their clients. Usually, when it comes to simplifying the tax code, all the lobbying muscle lines up in united opposition. This time, a big chunk of special interests will fight in favor of reform — because the alternative will be worse.

Both in public and private, the committee will hear from defense contractors and the Pentagon about the devastating effects that $600 billion in across-the-board defense cuts would have on the armed forces and on the communities in all 50 states that depend on military spending. Defense Secretary Leon Panetta warned in a letter posted online Wednesday that such cuts “would do real damage to our security, our troops and their families.” The delay of a year before the cuts bite would be little comfort.

Simultaneously, lobbyists for the hospitals and doctors who would absorb part of the other $600 billion in across-the-board cuts will crawl all over Capitol Hill, with the AARP not far behind. These are among the most powerful lobbyists around.

Entitlements and Taxes

So, with the threat of these cuts looming, the incentive is actually there for progress on entitlement and tax reform. To show they aren’t intransigent like Republicans, Democrats on the supercommittee might agree to some adjustments in the way the Consumer Price Index is calculated. The so-called chained CPI issue is complicated enough that it could slide through without being denounced as an unconscionable cut in benefits. It would save $300 billion over 10 years.

The greater action will probably be on taxes. As much as $1 trillion could be saved by eliminating deductions and credits. Part of the savings could be used to lower the corporate rate and other taxes, a crowd-pleaser for Republicans, and part for deficit reduction.

The Bowles-Simpson deficit-reduction commission estimated that if all tax favors were eliminated, income-tax brackets of 12 percent, 18 percent and 22 percent would yield the same revenue as today’s code.

Simplify, Simplify

That’s not going to happen. The mortgage-interest deduction won’t be repealed or even much adjusted in the middle of a housing meltdown. Nor will the tax break for charity. But the larger idea of lowering some rates and simplifying the tax code in exchange for eliminating deductions “is the only tax reform that has legs,” says Maya MacGuineas of the Committee for a Responsible Federal Budget. “You could get into serious, significant revenue that way.”

The early omens aren’t good. House Speaker John Boehner and Senate Minority Leader Mitch McConnell have already said the six Republican members they will appoint must oppose new tax revenue. Senate Majority Leader Harry Reid and House Minority Leader Nancy Pelosi say the same about their six Democratic appointees and cuts to entitlements.

Real Deal

But there’s more wriggle room than the posturing would suggest. During negotiations with the White House, Boehner tentatively agreed to $400 billion in revenue increases by closing loopholes and ending tax favors. Even House Majority Leader Eric Cantor was willing to accept some loophole-closing before his theatrical exit from the talks.

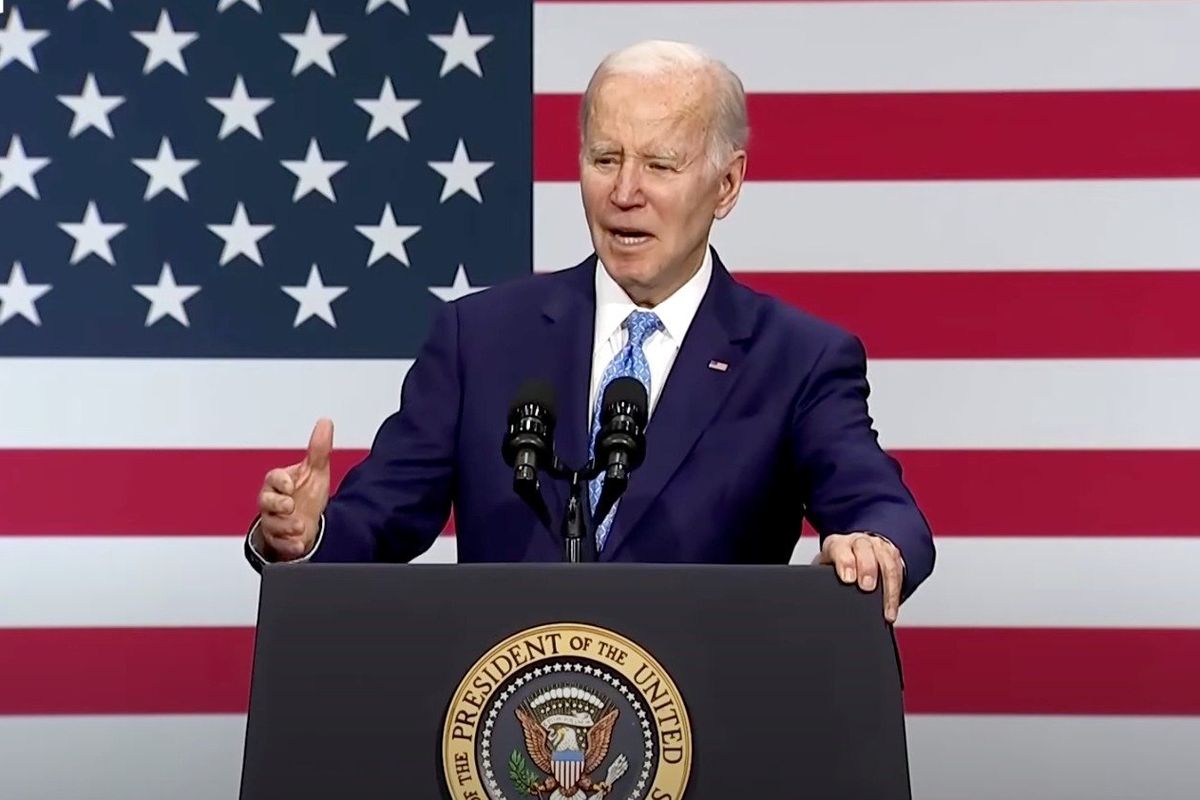

On the other side, the White House acknowledged that any responsible reduction of the deficit must include changes in Medicare. To the consternation of liberals, President Barack Obama was willing to cut hundreds of billions from the program.

Republicans have six seats on the supercommittee but only one, probably from the House, is expected to be filled by a bona fide Tea Party member. (We’ll find out by early September who gets the assignments.) So all it takes to pass a sensible deal on increasing revenue is one Republican who understands the true scope of the deficit problem — and who’s willing to defy the party’s absolutists.

That would help not only our oft-mentioned grandchildren but us, too. With a real deal, we might actually be able to do our taxes without an advanced degree in accounting.

(Jonathan Alter, the author of “The Defining Moment: FDR’s Hundred Days and the Triumph of Hope,” is a Bloomberg View columnist.)

To contact the author of this column: Jonathan Alter at alterjonathan@gmail.com.