Type to search

Tag: college

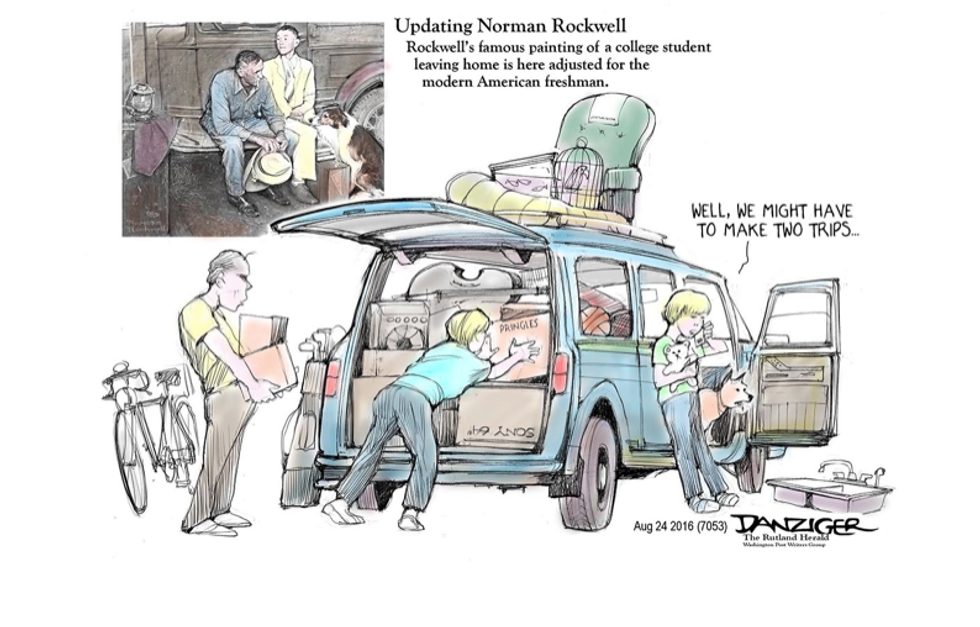

How Bernie Sanders Made A Meaningless Procedural Document Matter

July 11, 2016

Bernie Sanders and his supporters cheered a slew of progressive proposed amendments to the Democratic Party platform, but were ultimately dealt a setback in Orlando over the weekend when Hillary Clinton and Debbie Wasserman Schultz’s representatives on the party’s platform committee led the way in voting down amendments that would have supported a nationwide ban on fracking, criticism of Israel’s apartheid regime against Palestinians, the establishment of a single payer healthcare system, and indefinitely delaying a vote on the Trans-Pacific Partnership trade deal.

The setbacks came in the final meeting between representatives on the platform committee and only days before Sanders’ expected endorsement of Clinton Tuesday in a joint rally in New Hampshire, where he defeated her by a 22-point margin in the Democratic primary in February.

The Sanders campaign has been in close contact with the Clinton campaign in recent weeks, as the two sides have tried to find common ground ahead of the Democratic National Convention on July 25. The Democratic counterparts first met in mid-June, a tense meeting during which Clinton reportedly asked what it would take to land an endorsement from the Vermont Senator, who dominated Clinton with the youth vote.

To that end, Sanders’ camp has been able to force Clinton to earn his endorsement by pushing the presumptive nominee to the left on issues such as $15 minimum wage and health care: The language on the minimum wage — complete with Sanders’ very own “starvation wage” campaign terminology — was included in the final platform draft, and Clinton has included language supporting a “public option” for healthcare in recent statements to the press — mirroring some elements of Sanders’ medicare-for-all proposal. Sanders also was able to secure commitments from Clinton to support free in-state college tuition for families earning $125,000 or less annually.

Sanders has praised Clinton for the speedy progress in recent weeks, noting that “the Clinton campaign and our campaign are coming closer and closer together.” But Sanders has avoided an all-out endorsement, to the frustration of most in his adopted party.

In addition to the stalemates on fracking and Israel’s occupation of the West Bank, Clinton’s representatives on the platform committee voted down multiple initiatives relating to Social Security: an elimination of the cap on Social Security taxes as well as a new cost-of-living index for Social Security benefits. Sanders also has criticized the Democratic Party for its embrace of the Trans-Pacific Partnership, a trade deal he has railed against and for which Clinton has switched her stance after initially calling it the “gold standard in trade agreements.”

Sanders has been much more vociferous in his opposition to TPP, slamming it as a corpotist attack on American jobs and regulatory measures and a potential source of human rights violations around the world. Sanders recently said as much in an op-ed for the New York Times, calling upon Democrats to “defeat the Trans-Pacific Partnership.”

While Clinton has said she opposes TPP, her campaign and many of her representatives on the platform committee have a history of sticking close to the legislative priorities of President Obama, who has promoted TPP repeatedly as a partnership that would give the U.S. an edge over China and would strengthen America’s relationships with countries around the world.

Amid frustration from the left on the committee’s refusal to pass Sanders’ reforms — particularly on the issue of TPP — some Sanders supporters observing the process chanted “Shame!” and “Are you Democrats?”

Nevertheless, the party platform, usually a symbolic document, has hewed left perhaps more than Sanders expected and is probably enough for him to proceed with his planned endorsement of Clinton Tuesday. In fact, he could use the platform to hold Clinton accountable to his base — as a checklist of issues on which Clinton has pledged to reach out to progressives in the party.

It is the most progressive Democratic platform ever, thanks to Sanders directing his supporters’ attention to the drafting process. It will be up to those supporters to hold Clinton and other Democrats to the promises that document makes.

Photo: U.S. Senator Bernie Sanders holds up his notes while speaking about his attempts to influence the Democratic party’s platform during a speech in Albany, New York, U.S., June 24, 2016. REUTERS/Brian Snyder

First Steps for Your Baby’s Financial Future

March 16, 2016

Dear Carrie: I’ve just had a baby! Things are pretty crazy in my house right now, but I want to be sure I give my daughter every opportunity I can. I have a little bit of money saved up, but I’m uncertain what the best use is for it. Should I buy a savings bond, a CD, open an investment account or put it all in a college fund? — A Reader

Dear Reader: First, congratulations to both you and your daughter. I’d say she’s pretty fortunate to have a mother who, in the midst of all the new baby responsibilities, is already thinking about the future. As a parent myself, I can tell you that the future — and all the related expenses — comes all too quickly!

Being ready for those expenses goes hand-in-hand with smart saving habits, so it’s great that you’ve already begun. Whatever the future holds, continuing to save will be the cornerstone of providing a solid financial foundation for your daughter.

In terms of what to do with the money you’ve already saved, that depends on how you expect to use it. While college is often a primary goal, there will be a number of interim financial goals that you’ll want to meet as your daughter grows up. Let’s look at how you might plan for each.

Consider a 529 Account for College Saving

When it comes to planning for higher education, a tax-advantaged college savings account such as a 529 Plan is often the best choice. This is a state-sponsored program that lets parents, relatives and friends invest for a child’s college education. The account belongs to you, not your child, and you remain in control of the money.

Usually you have a choice of professionally managed investment portfolios. Potential earnings grow tax-deferred. And you pay no federal taxes on earnings as long as you use the money for qualified higher education expenses such as tuition, books, and room and board.

Opening minimums vary by state, but can be as low as $25. You’re not limited to your own state’s 529, so you’re free to shop around at different financial institutions (though you should first consider any state tax benefits your own state’s plan may offer). Plus, you can set up automatic contributions — say $50 or $100 a month — making it easy to keep saving.

If grandparents want to help, gift tax rules make it easy for them to contribute larger amounts. This can benefit their estate planning as well as your college planning.

Designate Different Accounts for Other Needs

While a college account may be at the top of your list, there will be other opportunities — say, music lessons or private schools — that you want to provide for your daughter along the way. To save for these eventualities, consider a couple of other types of accounts.

–Custodial Brokerage Account: This is a brokerage account managed by a parent or guardian on a child’s behalf. It offers minor tax advantages and has minimal restrictions on how the money can be spent as long as it’s for the benefit of the child beyond daily living expenses. Unlike a 529, there are no recommended investment portfolios. You can choose from a wide variety of investments — stocks, bonds, mutual funds — according to your feelings about risk. A key difference is that the child takes control of the money at the “age of majority,” which is 18, 21 or 25 depending on state rules. That’s something to think about.

–Regular Brokerage Account: This is a taxable account that you could open in your own name and earmark the savings and investments for your daughter. You’d then have the control and freedom to use the money as you see fit.

–Passbook Savings Account: This could be for short-term savings needs. It’s also an account your daughter could contribute to, as she gets older.

As for investments, equities generally have the greatest potential for long-term growth. Realize, though, that because stocks are volatile, they should be reserved for goals beyond a 3-5 year time frame. For shorter-term goals, CDs and Savings Bonds are safer; the downside is that they carry very low interest rates.

Create a Plan

If you have a savings plan, putting money aside will be easier, so here’s what I suggest right now. Assuming college is your first goal, put the money you currently have saved in a college savings account and commit to adding more each month. There are a number of online calculators to help you determine a realistic monthly savings goal.

As you’re able to save more, consider a brokerage account or passbook savings account for other types of expenses. Once you know your monthly college savings goal, you might also establish a monthly savings goal for this account and put it on automatic.

Don’t Forget your Daughter’s Financial Education

As your daughter gets older, be sure to involve her in the process. Help her create her own savings goals and have her save a portion of any money she gets. This will get her into the savings habit early, teach her how money grows, and help her make good spending decisions. Because no matter how much you save for your child, teaching her to be financially independent is really the greatest opportunity you can give her.

Carrie Schwab-Pomerantz, CERTIFIED FINANCIAL PLANNER(tm), is president of Charles Schwab Foundation and author of The Charles Schwab Guide to Finances After Fifty, available in bookstores nationwide. Read more at http://schwab.com/book. You can e-mail Carrie at askcarrie@schwab.com. This column is no substitute for an individualized recommendation, tax, legal or personalized investment advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner or investment manager. To find out more about Carrie Schwab-Pomerantz and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

COPYRIGHT 2015 CHARLES SCHWAB & CO., INC. MEMBER SIPC.

DIST BY CREATORS SYNDICATE, INC. (0316-1055)

Photo: U.S. Republican presidential candidate Gov. John Kasich (R-OH) holds a baby while former Republican presidential nominee Mitt Romney (R) speaks at a campaign rally at the MAPS Air Museum in North Canton, Ohio March 14, 2016. REUTERS/Aaron P. Bernstein

Need To Slash Student Debt? Watch Out For Rip-Offs

February 10, 2016

Photo: People walk past Princeton University’s Woodrow Wilson School of Public and International Affairs in Princeton, New Jersey, November 20, 2015. REUTERS/Dominick Reuter.

About The National Memo

The National Memo is a political newsletter and website that combines the spirit of investigative journalism with new technology and ideas. We cover campaigns, elections, the White House, Congress, and the world with a fresh outlook. Our own journalism — as well as our selections of the smartest stories available every day — reflects a clear and strong perspective, without the kind of propaganda, ultra-partisanship and overwrought ideology that burden so much of our political discourse.

TAGS