Surging Economy Leaves Middle Class Behind

We keep hearing about this wonderful economy of ours. Jobs plentiful. Inflation low. Interest rates low. Where’s the problem?

Problem is, the uptick in pay has been modest while the prices for things the middle class thinks it’s due are beyond reach — or rather, impossible to obtain without borrowing. Thus, middle-class families are racking up big debt to keep up middle-class appearances.

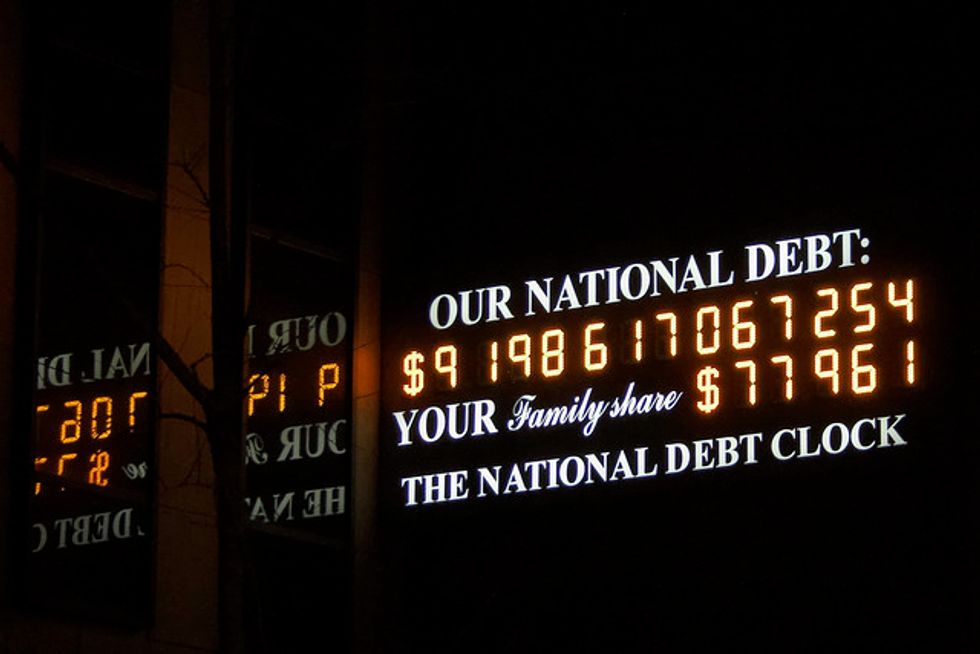

Prudent people (and countries) reduce debt at times of prosperity. This country and its people are not. Such scenarios rarely end well.

Consumer borrowing has hit a record $4 trillion after inflation, not counting mortgage debt, according to an analysis in The Wall Street Journal. Credit card debt is headed skyward, as people borrow for vacations, restaurant dining and other items they can’t pay for outright.

Auto debt has climbed nearly 40 percent after inflation in the past 10 years. Unlike homes, vehicles are rapidly depreciating assets.

Over three decades, average house prices have jumped 290 percent. Not bad if you’ve long owned a home. Really tough if you’re a first-time buyer. More Americans in the middle are putting off homebuying, while many making the plunge have taken on heavy mortgages.

If they have an adjustable-rate mortgage and interest rates go up, so will their monthly mortgage payments. The average size of a new adjustable-rate mortgage is over two times that of a new fixed-rate mortgage, the Mortgage Bankers Association reports. This suggests that homebuyers are choosing adjustable-rate mortgages with their artificially low introductory rates so they can borrow more — a seemingly strange thing to do when rates on fixed-rate mortgages are still low.

Homeowners are increasingly tapping their equity for cash to buy stuff, according to the government-sponsored mortgage corporation Freddie Mac. They often do this through mortgage refinancing. Even when interest rates were rising last fall, more Americans were taking cash out of their homes and assuming a mortgage with a higher principal balance.

The average tuition at public four-year colleges has soared 549 percent over three decades. (That in itself is a scandal.) This has contributed to a frightening level of student debt, now a crisis at $1.5 trillion.

Then there are wheels. Experian reports that the average loan for new cars is now $32,187. How can that be when a brand-new Honda Accord can be bought for under $24,000 and a larger Chevy Impala for under $29,000?

Turns out trucks were the “big story” driving new-vehicle prices higher, according to a Kelley Blue Book analyst. Many Americans feel they must have an SUV or a truck. A sedan just won’t do.

As for stock investments, in these days of trade warfare and exploding federal deficits, who knows? Americans who depend on the farm economy, meanwhile, are in our prayers.

Thus, you have couples with two big car loans, hefty student debt, a sizable mortgage and growing unpaid balances on their credit cards. Some are able to handle it, but just barely. They assume no one loses a job or gets really sick without adequate health coverage.

What’s driving much of this consumer behavior is that people who thought themselves middle-class have not recognized the new economic reality. The median household income in 2017 was $61,372.

Good economic times don’t last forever. Jobs can disappear. Note that the Federal Reserve Bank just lowered interest rates out of concern that the economy is slowing. When things go in the other direction, many Americans will learn yet another lesson in the economic risk of piling on debt. Expect more anger and more pain.