Banker Robbery And Corporate Mediocrity Add Up To Grand Larceny

Exciting news from Wall Street: Our wealth markets are booming!

For the 15th month in a row, everything from the Dow Jones Average to gold prices to bank stocks are rocketing to new records, showering us with wealth from above. Oh ... wait. Maybe you're one of the majority of workaday Americans who don't own stocks or gold, so maybe you're not celebrating Wall Street's big boom. But just chill, because conventional corporate wisdom assures us that the wealthy will invest their good fortunes in enterprises that someday, somewhere will create jobs and eventually will produce trickle-down gains for everyone.

Excuse me for rudeness, but let's take a peek at how those who're reaping today's big-buck bonanza are actually investing that wealth. Surprise — they're largely putting the increase into schemes that further benefit them ... not you!

Consider Wall Streeters themselves. While workers, Main Street businesses, poverty groups, et al. have been knocked down during the past several months, the big banks have been making money like ... well, like bankers. Just since this January, their stock prices have zoomed up by 28 percent. So, how are these moneyed elites spending this windfall? Not by making job-creating investments, but by simply giving the money to their own shareholders, including their own top executives — nearly all of whom are already among the richest people on Earth.

The main way they do this is through a sleight of hand called a "stock buyback." The honchos simply cash out the bulk of that 28 percent increase in the value of the banks' stock price, using that money to repurchase their banks' own stock from lesser shareholders. Hocus-pocus, this manipulation artificially pumps up the value of the stock these insider shareholders already own — making each of them even richer than rich, although they've done absolutely nothing to earn this increased wealth.

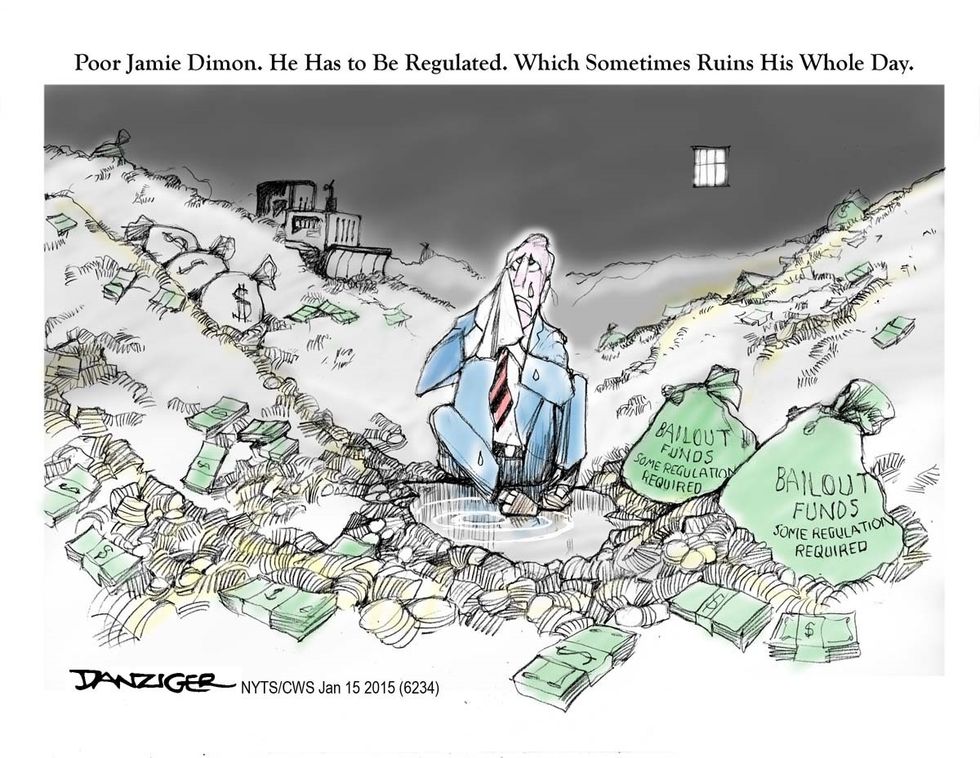

It's not a small scam. JPMorgan Chase is now sinking $30 billion into buying its own stock. Wells Fargo is shifting $18 billion into the scheme, and Bank of America is throwing $25 billion into its buyback. Hello — Wall Street bankers are the biggest robbers in America.

Most people believe the American economy is being rigged by and for big bankers, CEOs, and other superrich elites, because ... well, because it is!

With their hired armies of lawmakers, lobbyists, lawyers and the like, they fix the economic rules so ever more of society's money and power flow uphill, from us to them. Take corporate CEOs. While 2020 was somewhere between a downer and devastating for most people, the CEO class made out like bandits. Indeed, last year, the three top paid corporate honchos in America pocketed personal paychecks of $211 million, $414 million, and $1.1 billion.

Are they geniuses, superproducers or what? What. All three of their corporations ended 2020 with big financial losses and declining value, so how can such mediocrity produce such lavish rewards? Simple — rig the pay machine.

Today's corporate system of setting compensation for top executives is a flimflam disguised as a model of management rectitude. On its face, the system ties the chief's pay to the success of the business. "Pay for performance," it's called — the CEO does well if the company does well. Good theory!

But their trick is in narrowly defining "doing well" to exclude doing good — i.e., treating workers, consumers, the environment, et al. fairly. Thus, rewarding the Big Boss is rooted in nothing more substantial or productive than the sterile ethics of monetary selfishness.

Even implementing that shriveled ethical standard is a scam at most major corporations, because the standard of financial performance that the chief must meet to quality for a huge payday is set by each corporation's board of directors. Guess who they are? Commonly, board members are the CEO's hand-picked brothers-in-law, golfing buddies, and corporate cronies. So, they set the bar for winning multimillion-dollar executive paychecks so low that a sack of concrete could jump over it.

Well, insist these flimflammers, it's the corporate shareholders who are the ultimate stopgap against CEO greed. These "owners" can just vote "no" on any executive pay they consider excessive. Nice try, but even "shareholder democracy" is rigged — corporate rules decree that votes by shareholders are merely "advisory," meaning top executives can simply ignore them, grab the money and run. The system is fixed ... and we need to break it!

To find out more about Jim Hightower and read features by other Creators Syndicate writers and cartoonists, visit the Creators webpage at www.creators.com