Will Congress Be Duped Again On Offshore Taxes?

Like a savvy bargainer on a used-car lot, big multinational corporations have mastered the art of feigning indifference and walking away.

What they walk away with is their profits, stockpiling them abroad where they legally remain untaxed until returned to the United States. Then these corporations threaten to keep the cash offshore permanently unless Uncle Sam gives them a deep discount on their tax rates.

It’s a timeworn, but effective, trick. While the rest of us are stuck paying the sticker price, Congress is considering a special deluxe tax rate for these giant corporations.

Congress last fell for the old “walk away” in 2004. And the American people got burned.

That year, legislators gave 843 giant firms an 85 percent discount on offshore profits they “repatriated.” This reduced their long-term tax bills by about $100 billion.

Legislators opted for this one-off revenue bump in part because they believed, naively, that the companies would create U.S. jobs with the repatriated funds. They even called the tax break legislation the “American Job Creation Act.”

Like new owners of a bargain basement Beemer, though, the companies basically squealed their tires and sped away. Rather than hiring more workers, many simply used the money to boost shareholder dividends and executive pay.

Meanwhile, the profit-shifting revved up again, as firms maneuvered to create leverage for further discounts.

Big pharmaceutical companies, which are particularly good at tax-dodging tactics like registering their patents in tax haven countries, were some of the biggest abusers of the 2004 tax break.

Pfizer, for example, repatriated $40 billion to take advantage of the discount. Instead of boosting jobs, the drug company laid off more than 58,000 employees over the next six years.

Legislators appear to have learned little from the 2004 boondoggle. Pending bills in both the House and Senate would once again offer deeply discounted rates on repatriated profits.

President Barack Obama has a slightly stronger proposal: All overseas stockpilers would pay a mandatory 14 percent rate on offshore profits they currently hold, and then 19 percent thereafter. But that’s still a huge reduction over the ordinary 35 percent corporate tax rate, giving companies a powerful incentive to continue to shift profits overseas.

A handful of corporate giants stand to reap the vast majority of benefits from this trick.

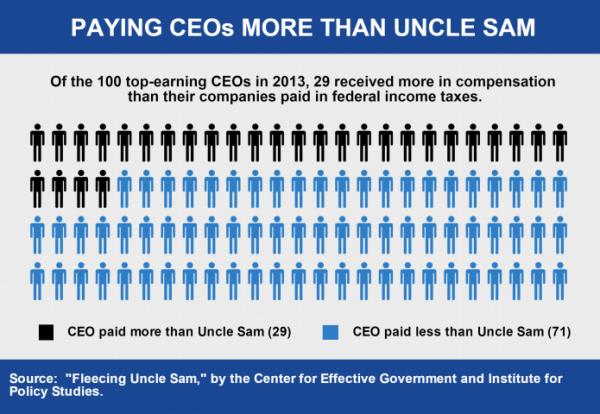

According to a new report I co-authored for the Institute for Policy Studies and the Center for Effective Government, just 26 companies account for more than half of the $2.1 trillion in untaxed profits U.S. corporations currently hold offshore. Since 2004, these 26 firms’ overseas stashes have grown more than fivefold.

Lawmakers claim that short-term revenue from a discount tax on offshore profits is needed to pay for urgent investments in public infrastructure. But if we’re serious about fixing our crumbling bridges, roads, and dams, we should start by fixing our broken corporate tax system.

The taxes Pfizer and six other drug companies currently owe on their offshore profits, for example, would be enough to fix the 1 out of every 9 U.S. bridges in disrepair. We need to insist that all U.S. businesses pay their fair share of infrastructure and other public services.

Otherwise, we’ll just be taken for a ride.

OtherWords columnist Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies and is a co-author of the report “Burning Our Bridges.”

Distributed by OtherWords.org.

Photo: 401(K)2013 via Flickr