Due to legal decisions about how to structure the rules governing student debt, student loans stay forever, are virtually impossible to discharge under hardship, churn fees when they go bad, and creditors can access anything, including Social Security, in their attempts to be repaid. This is significantly more strict than the rules for other kinds of debt. Here’s a great way to describe the legal frame we use to treat student loans, from Elizabeth Warren in 2007: “Why should students who are trying to finance an education be treated more harshly than someone who negligently ran over a child or someone who racked up tens of thousands of dollars gambling?”

So what’s the solution? There’s a short-term and a long-term problem. The long-term problem, in my mind, can only be solved by unapologetically embracing the promise of a “public option”: free public universities that are capable of constraining cost inflation. This requires us to also face and resist the corporatization and privatization of our existing public universities.

But that doesn’t get us out of the current situation. What can be done? I propose two things:

1. Party Like It’s 1989

Instead of being so bold as to ask that people trying to invest in themselves, and ultimately the country, are treated as fairly as someone who negligently ran over a child, I’m just going to suggest we just do a mulligan on the 1990s and 2000s student loan “reforms.”

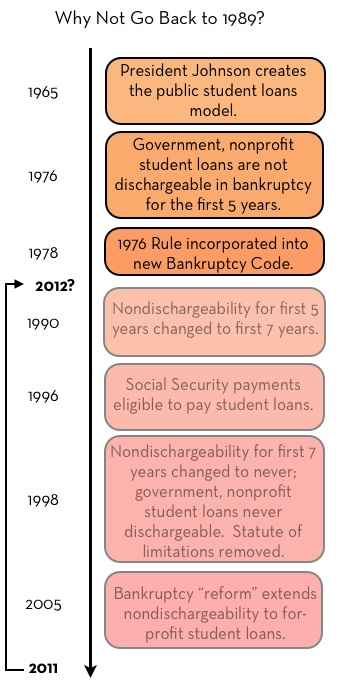

Here’s a quick, high-level history of student loans and the bankruptcy code, courtesy of University of Illinois law professor Bob Lawless:

In 1976, Congress first added an exception to the bankruptcy discharge dealing with student loan debt. That exception was continued in the 1978 Bankruptcy Code, and the exception was expressly limited to student loans from a governmental unit or nonprofit institution. Even then a student loan could be discharged if more than five years had passed since the loan first became due (typically after graduation) or if the debtor could show payment of the student loan would cause undue hardship, which is a difficult burden to show. In 1990, five years was changed to seven years and in 1998 was dropped altogether, leaving undue hardship the only reason a court could discharge a student loan from a governmental unit or nonprofit institution. As part of the 2005 changes to the U.S. bankruptcy law, Congress again amended the student loan discharge exception to allow even loans from for-profit lenders to be excepted from the bankruptcy discharge.

Let’s put that in a chart, adding the other issues of Social Security and no statute of limitations I talked about here:

Why not just undo the rules from the 1990s and 2000s? It is hard to see these as anything other than a giant subsidy to private agents. If you look at Sallie Mae’s leaked lobbying documentation, you’ll find that “[t]he number two item… wasn’t increasing federal student loan limits or beating back the loan consolidation companies… It was bankruptcy; specifically, preserving the special status that private student loans gained in the broad changes to bankruptcy laws that Congress enacted in 2005. To Sallie Mae, that provision is the key to its version of ‘private credit economics.’” There’s little evidence these reforms increased access for anyone and functioned more as an easily captured subsidy.

We can keep nondischargeability for five years if people are concerned about moral hazard. That concern emanates from the 1970s and stories of doctors declaring bankruptcy the day after they graduated medical school. This will at least stabilize and formalize the system of indenture that is required for people to fully develop their talents and abilities in our country, instead of our system that currently keeps people for life. Let’s regraph what it looks like when we go back to 1989:

That looks way better. But how do we deal with the current affordability crisis? Getting unemployment down and incomes up are an obvious solution. Sarah Jaffe suggests mass debt forgiveness, Justin Wolfers disagrees. I have a suggestion that splits the difference.

2. Convert the American People into a Bank

A miraculous thing happened in late September 2008. Goldman Sachs and Morgan Stanley were reborn from investment banks into bank holding companies by a decree of the Federal Reserve. Normally getting a license like this takes a year and a half and requires following extensive regulatory rules. The Federal Reserve did it over a weekend for Goldman, Morgan Stanley, and a host of other financial firms.

This allowed them many banking privileges that helped during the crisis, including access to the discount window, but none of the scrutiny that normally comes with them. As Alan Grayson and others noted, Goldman’s CFO bragged that “our model never really changed.” They got to escape normal banking regulatory rules during the subsequent time period. These “deathbed conversions” from investment bank to bank holding company were yet another part of the extensive way the bailouts worked beyond TARP, and they were proof that the firms were Too Big To Fail.

Since regular Americans are also in crisis mode and Too Big To Fail, why not symbolically declare regular Americans a bank too? Why not also do a “deathbed conversion” on those who are suffering under the burden of heavy student debts and low incomes and let them immediately refinance all their student loan rates at the current ultra-low discount window rate? Why not mass refinance them into the current low rates the financial sector enjoys? This would give the 99% just a hint of the kind of total government support places like Goldman Sachs have experienced.

We’ve thrown open the floodgates for the financial sector. Why not for regular Americans? There have been past congressional efforts to lower the interest rate, ones that passed the House, so this is feasible. And it would be the logical conclusion of the crisis we’ve just lived through, delivering stimulus to the economy and reducing the burden of debts on those trying to rebuild the economy. Open the discount window.

Crisis Economics

For the economics people, this two-step solution helps with the liquidity problem (cheaper refinancing), the solvency problem (bankruptcy), and the balance sheet problem (lower rates, more purchasing power) — the three problems one needs to deal with in the aftermath of a financial crisis. In terms of monetary policy, those who have been carrying out QE have been begging for policymakers to find ways to get ultra-low rates to the front lines as quickly as possible, most notably in housing policy. As Bernanke said at his latest press conference:

One area where monetary policy has been blunted, the effects have been blunted, has been the mortgage market where very tight credit standards have prevented many people from purchasing or refinancing their homes and therefore the low mortgage rates that we’ve achieved have not been as effective as we had hoped. So, monetary policy maybe is somewhat less powerful in the current context than it has been in the past but nevertheless it is affecting economic growth and job creation.

That’s Fed speak for the fact that the administration dropped the ball on the mortgage market (HARP, especially) and has in turn screwed up its ability to do its jobs in helping the economy. But what is good for housing is also good for student loans. Aggressive monetary policy flowing into student loans would have a similar amplification, which makes targets more credible and gets more money being spent, which makes balance-sheet repair easier and has a general virtuous cycle on demand.

Wins all around. So what are the problems?

Mike Konczal is a Fellow at the Roosevelt Institute.

Cross-Posted From The Roosevelt Institute’s New Deal 2.0 Blog

The Roosevelt Institute is a non-profit organization devoted to carrying forward the legacy and values of Franklin and Eleanor Roosevelt.