The stickiness of abortion as an issue has never been as clear as it is right now with the Alabama Supreme Court essentially declaring that life begins at conception and applying that principle to IVF, and the Arizona Supreme Court concluding that they’re happy breathing life into an anti-abortion law that was written before Arizona was even a state.

The Arizona law was like those some states, mainly in the South, have on the books that make adultery illegal or forbid women or Black people from signing contracts or holding a bank account. The Republicans are like, yeah, sure, we know those ancient statutes are still around, but we’d rather just ignore them and move on, because we’re only trying to turn the clock back to the 1950’s, not the 1860’s.

But these two Supreme Courts blew the lid off the pro-life movement’s decades-long wish to seem reasonable and exposed the anti-abortion movement for what it has always been. It’s why they came up with the name “pro-life” rather than “anti-abortion.” They were trying to make it seem like they didn’t just want to ban women from getting an abortion; what really concerned them were the babies.

But even that was a lie. Babies, once they are born, never interested them. They want women either on the birthing table or at the sink scrubbing those pots and pans. In Texas, the desire to control women was so strong that the legislature wrote a law turning women’s neighbors into spies and giving them the power to sue women who had abortions as well as any person who helped or enabled women to abort a pregnancy after six weeks.

Watching the Republican Party, and especially its Maximum Leader, Donald Trump, try to tap dance around these two state Supreme Courts is providing us with some welcome opportunities for schadenfreude. You almost have to feel sorry for the poor fools serving on the Supreme Court of Alabama, with nine Republican justices either elected or appointed by Republican Governor Kay Ivey. They have got to be sitting there today thinking, wait a minute! What just happened? I just did what my party expected me to do, in fact, what they put me on the court to do! And now they’re getting roasted for it.

The analogy that pundits have seized to describe the current moment for Republicans is the proverbial dog who caught the proverbial car. What does the dog do now? Well, it turns out that what the dog does is look wildly around for a way to dislodge the car from its jaws, the car being the Dobbs decision and its rapid fall-out around the nation, all those anti-abortion laws that sprang to life in state after state, some of them truly draconian. The stories of women’s lives being endangered by the new anti-abortion laws have proliferated, including the one about the 10 year old girl in Ohio who was raped and had to travel out of state for an abortion because Ohio didn’t have an exception for rape or incest, even for a little girl.

All those Republican legislators and governors are sitting there today patting themselves on the back congratulating each other because they did what they were elected to do. And now comes the scrambling, not to fix the ugly laws they passed, but to repair the damage they know they’re going to suffer at the ballot box.

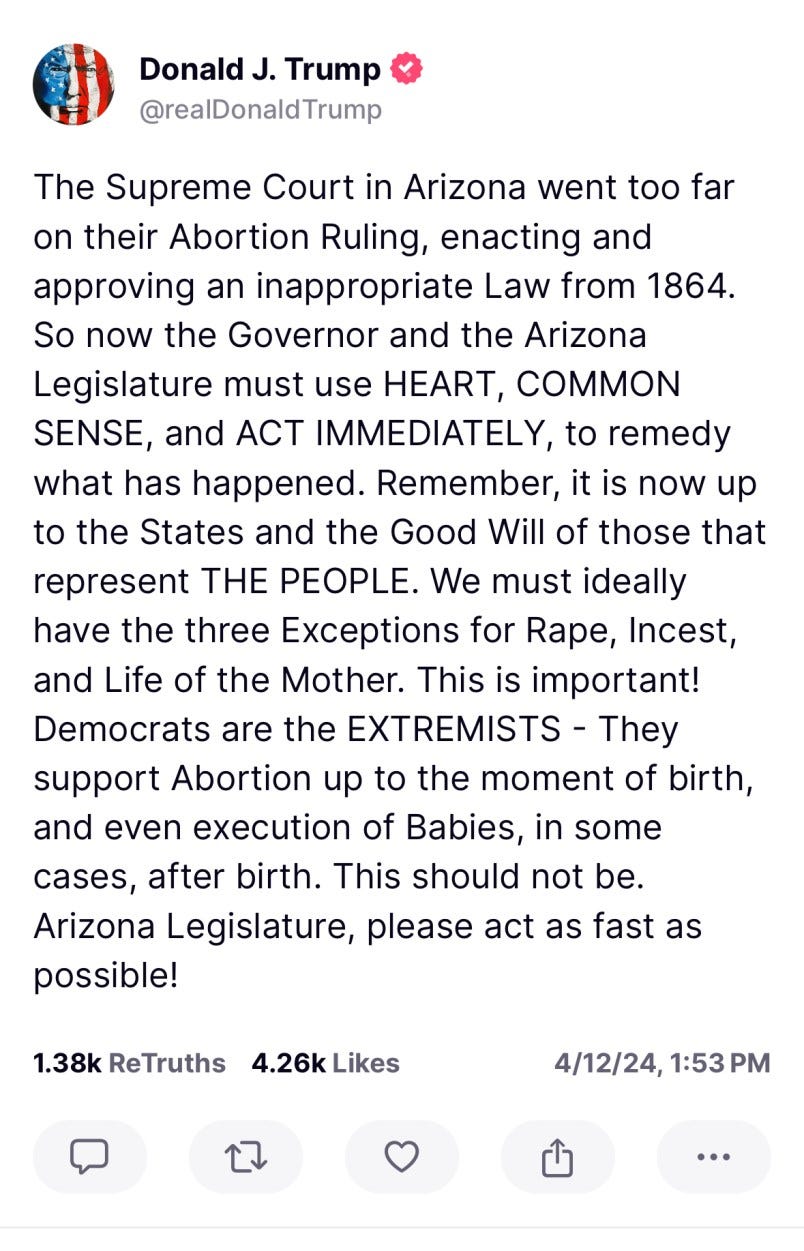

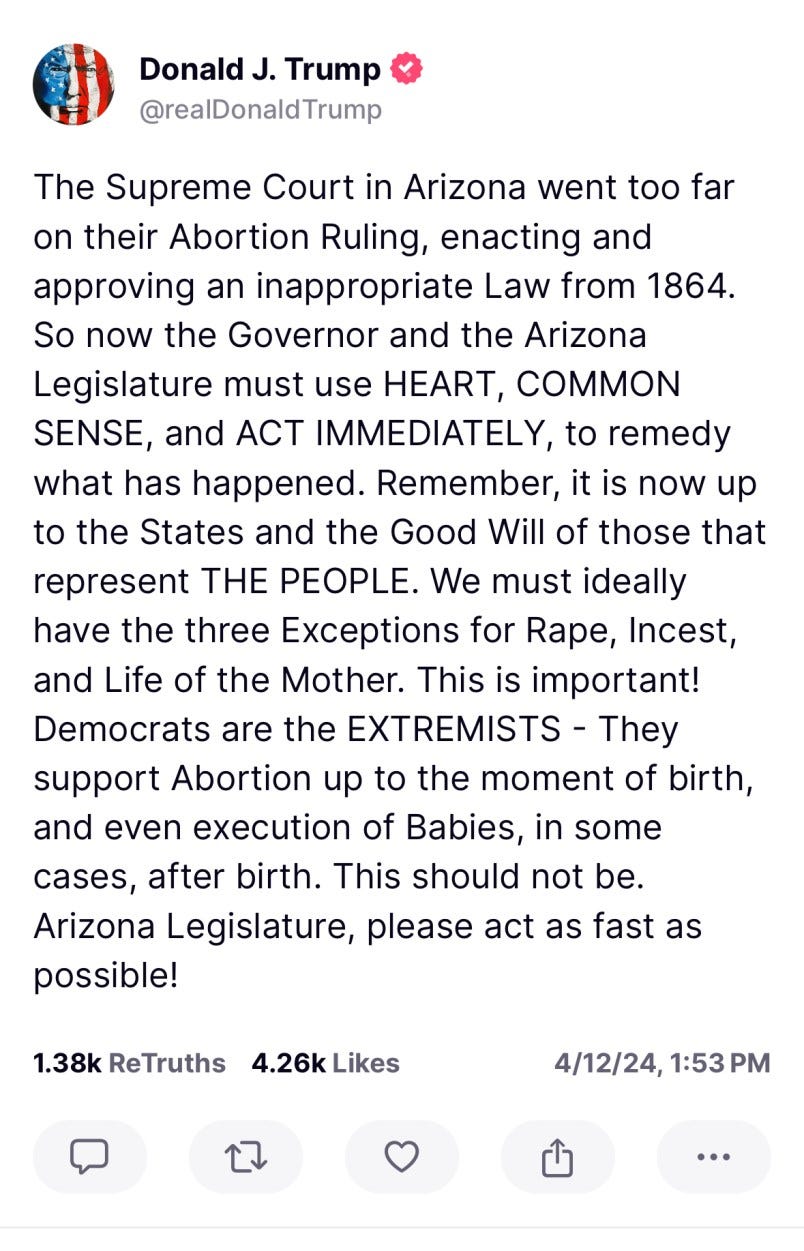

Donald Trump, bless his black heart, is leading the way. Look at this nonsense he posted on Truth Social today:

Trump is so panicked, so afraid of actually taking a position that would have any real meaning and effect, he is reprising his wishful thinking that the whole thing has been solved by the return of control of laws on abortion to the states. Well, here’s a state, asshole, and it’s a battleground state, Arizona, and what’s he calling for as a “remedy?” Exceptions for rape, incest, and the life of the mother which aren’t in the 1864 nightmare of a law the Arizona Supreme Court just put back on the books. Boy, that’ll get it done, huh?

This kind of reshuffling of the deck of cards isn’t going to work, especially with an amendment enshrining the right to abortion in the Arizona constitution expected to be on the November ballot…along with the name of Donald Trump, the dog trying to get that damn car out of his mouth who is running for president.

If you want to see some professional-level reshuffling, allow me to recommend the David French op-ed published in the New York Times on Thursday. Here we have one of the preeminent pro-life intellectuals lamenting the fact that his movement doesn’t have a political party to call its own anymore, because Alabama Republicans quickly did an about-face on IVF after the Supreme Court shut it down in that state. Of course, legalizing IVF necessitates the destruction of fertilized embryos, which are, according to French, unborn children, and “the unborn child must not be intentionally killed.”

French, of course, is supposed to be one of the New York Times' “reasonable” conservatives, in this case, the “reasonable” pro-life one, who assures us elsewhere in his thousand-plus-word lament that he has been pro-life for “my entire adult life,” and defends his movement against charges that what it’s doing is seeking to control women’s lives, French assures us he has “never seen a desire for subjugation and control” in the pro-life movement.

Well, thank goodness for that. We all feel so much better now.

What French and the rest of them are doing is backing and filling now that the nation’s Supreme Court and the supreme courts of two states have dug the gigantic abyss they’re staring into. They’re trying to say, gee, we didn’t mean for this whole thing to go that far! We thought we’d throw these exceptions into the anti-abortion laws and that would take care of it for us! We didn’t know there would be this stuff like women going into sepsis! What the hell is sepsis, anyway?

This is what happens when men write laws about women’s bodies they don’t understand any better than the Chief Pussy-Grabber does. The thing that for decades they had treated like a simple issue to garner votes has turned out to be more complicated than they thought. If you want every embryo to be a little person, there are consequences, and as they discovered in Alabama, consequences demand compromises. As David French now whines, compromises are not pure and simple, they involve moral choices you once thought were easy and clean and now discover are messy and icky.

The dogs who caught the car are not happy. Boo fucking hoo.

Lucian K. Truscott IV, a graduate of West Point, has had a 50-year career as a journalist, novelist, and screenwriter. He has covered Watergate, the Stonewall riots, and wars in Lebanon, Iraq, and Afghanistan. He is also the author of five bestselling novels. You can subscribe to his daily columns at luciantruscott.substack.com and follow him on Twitter @LucianKTruscott and on Facebook at Lucian K. Truscott IV.

Please consider subscribing to Lucian Truscott Newsletter, from which this is reprinted with permission.