Today, for the first time, I am officially notifying the honchos of Bain Capital, Blackstone Group, Carlyle Group, Kohlberg Kravis Roberts and other big-time private equity funds that I am available. My little company, Saddle Burr Productions, can be had. For a price.

I publish this notice in response to a recent news item revealing that these firms have a unique and perplexing problem: They have too much money on hand. In all, they’re holding a cool trillion dollars that super-rich speculators, banks and others have entrusted to them. Private equity funds are corporate predators that borrow huge sums from these richies, using the cash to buy out targeted corporations, dismantle them and sell off the parts to make a fat profit for the investors and themselves.

However, in these iffy economic times, these flush funds have hesitated to do big takeovers, so they’ve just been sitting on all that money (which the predators refer to as “dry powder”). The problem is that under the rules of this high-stakes casino game, the firms have to spend their borrowed money by a set time — or give it back. And the clock is ticking.

So, using Wall Street’s macho lingo, the big players have announced that they’re now ready to go “elephant hunting” and are prepared to fire big bucks to bag some companies. To which I say: Fire away at Saddle Burr Productions!

OK, my company is hardly an elephant. But maybe it could be what the equity hucksters refer to as a “hot potato.” That’s what they call it when one fund grabs a company just to sell it to another fund, which might pass it off to yet another.

This year, equity firms are expected to spend more than $22 billion this year selling hot potatoes to each other — in part, just to move cash out the door so they don’t have to give it back.

This is what passes for good business sense in the truly screwy world of private equity. It’s just churning money, producing absolutely nothing — except, of course, huge fees for the churners. But if that’s the game, hey, put me in the mix. A billion dollars sounds about right.

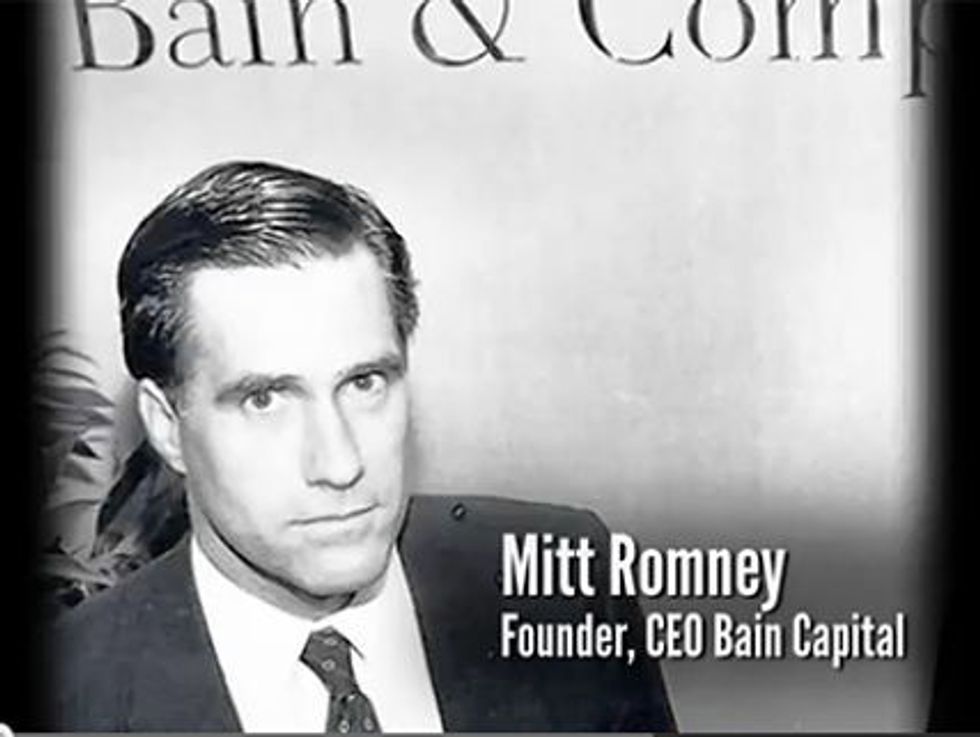

Executives in private equity firms — such as Mitt Romney of Bain Capital and Henry Kravis of Kohlberg Kravis Roberts — tend to be peacocks who think quite highly of themselves.

Fanning their splendid tail feathers, they unabashedly claim to be the ultimate free-enterprise risk-takers — worth every dime of the multimillion-dollar paychecks they award themselves each year. Excuse me, but the risks by these self-anointed “heroes of the market” are actually taken with other people’s money, not their own. That’s quite a bit short of “heroic.” But here’s a revelation that really ruffles their feathers: It seems they’ve been hauling in their massive profits not by bold and savvy competition in the marketplace, but through old-fashioned financial collusion with each other.

An antitrust civil lawsuit filed in federal court against 11 of the biggest equity firms includes internal emails in which they agree not to compete. In 2006, for example, the head of Blackstone sent an email to the co-founder of KKR: “We would much rather work with you guys than against you. Together we can be unstoppable, but in opposition we can cost each other a lot of money.” The KKR honcho happily emailed back a one-word response: “Agreed.”

Collusion, of course, perverts the marketplace they pretend to worship, artificially lowering the market price they’d otherwise pay. And they are not shy about playing this mutual back-scratching game. In the 2008 takeover of the giant HCA hospital chain, KKR expressly asked its market rivals “to step down on HCA” and not bid. Agreeing to this blatantly illegal collusion, one rival wrote in an email: “All we can do is do unto others as we want them to do unto us. It will pay off in the long run.”

For his part, Romney insists that any collusion by Bain occurred after he left the firm. “He had no role,” says a spokeswoman. Well, none besides pocketing the loot. Documents from the lawsuit show that Romney clearly received millions in profits from deals that Bain appears to have made through its collusion in the grand game of market manipulation. If so, can we expect him to return those ill-gotten gains?

To find out more about Jim Hightower, and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate webpage at www.creators.com.