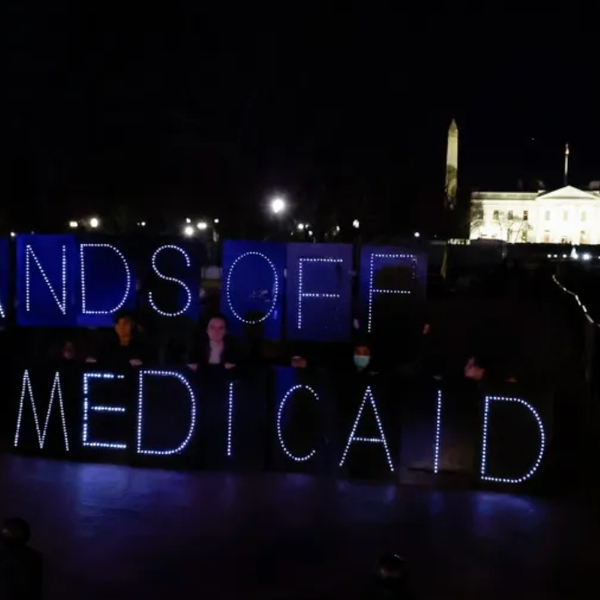

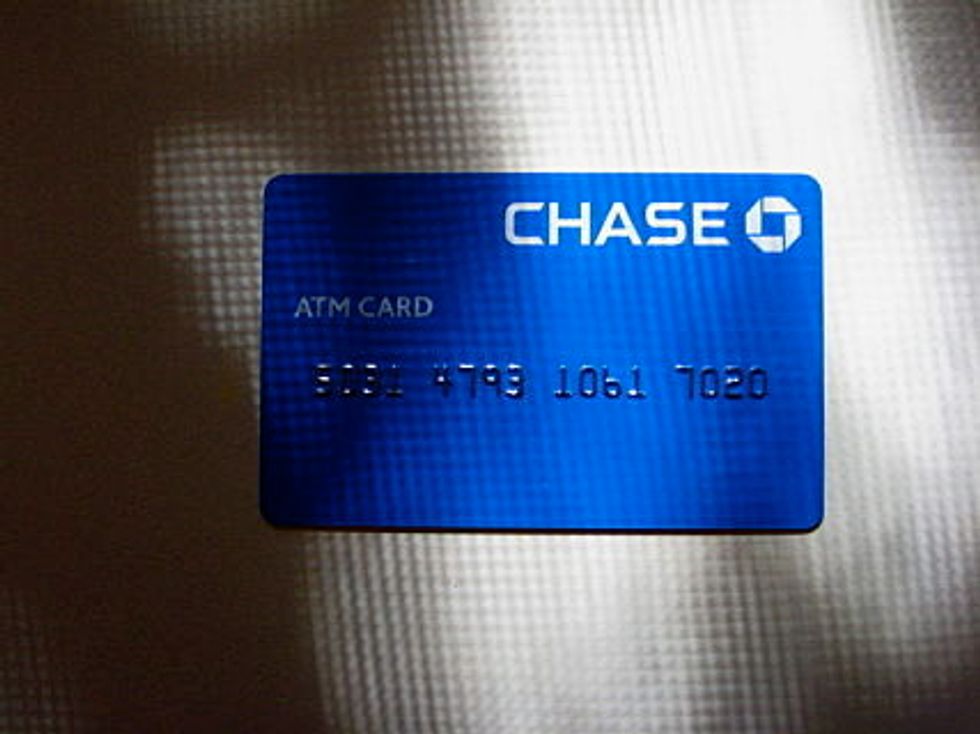

Nov. 22 (Bloomberg) — For years the public has vented about half-baked government settlements in which corporations and white-collar defendants “neither admit nor deny” the allegations against them. The Justice Department wasn’t about to go down that path when it unveiled its big, not-really-$13 billion deal this week with JPMorgan Chase & Co.

So the government made a few sly tweaks. The result is a mutant offspring of the no-admit genre that may be even less satisfying than the parent. JPMorgan didn’t have to admit to any violations of the law. And here’s the rub: The Justice Department didn’t allege any, either.

According to the settlement agreement, the bank will pay a civil penalty “pursuant to” a statute called the Financial Institutions Reform, Recovery and Enforcement Act. However, the Justice Department didn’t lodge any claims against JPMorgan for breaking that law or any other. This was an out-of-court settlement. The Justice Department didn’t file a complaint. No judge’s approval was needed.

The agreement did incorporate an 11-page statement of facts that explained in vague terms what JPMorgan did. Yet none of the acknowledgments by JPMorgan in that document hurt the bank. JPMorgan didn’t admit liability or even any mistakes. That’s no better than the old “neither admit nor deny” boilerplate.

This isn’t justice. It’s more like the greenmail that companies sometimes pay to corporate raiders who demand premium prices for their shares in exchange for going away. No individuals got pinched. We don’t know much about the details of what the Justice Department’s investigation found. It’s unclear why prosecutors didn’t accuse JPMorgan of fraud, although one possible explanation is that the government lacks proof.

The wording of the settlement agreement was awkward at times, too. It said the Justice Department had investigated the mortgage-bond operations of JPMorgan and two failing companies that it bought: Bear Stearns Cos. and Washington Mutual Inc. “Based on those investigations, the United States believes that there is an evidentiary basis to compromise potential legal claims by the United States against JPMorgan, Bear Stearns and Washington Mutual, for violation of federal laws,” the agreement said.

That line makes it seem like the U.S. doubted its own case, although perhaps it was just poorly drafted. The sentence would have made more sense if it said there was enough evidence to “bring” claims against JPMorgan, not “compromise” them. Maybe the prosecutors were trying to say they believed there was sufficient evidence to merit a settlement. But that doesn’t make much sense, either: The act of settling speaks for itself.

As an aside, it’s fitting that Massachusetts attorney general Martha Coakley took part in the same accord. Of the $13 billion headline figure — which combined the Justice Department’s $2 billion penalty with the amounts secured by several state and federal agencies — the settlement agreement earmarked about $34 million for Massachusetts.

In 2009, Coakley took a similar claim-free approach to squeeze money from Goldman Sachs Group Inc. Her office didn’t file a lawsuit or allege that Goldman Sachs violated any statutes or rules. Goldman Sachs didn’t admit anything, either. But it did pay $60 million to make the Massachusetts investigation go away. Coakley’s office had been looking into Goldman Sachs’ packaging of subprime mortgage bonds.

Surely some of the money that JPMorgan shells out will go to good use. Yet something important is lost when law-enforcement officials strike bargains with powerful corporations behind closed doors and fail to be transparent about what their investigations uncovered.

The Justice Department said this week that the settlement “does not absolve JPMorgan or its employees from facing any possible criminal charges.” By this point, though, it’s hard to take the Justice Department seriously when it says to stay tuned.

The department also said that “JPMorgan acknowledged it made serious misrepresentations to the public” as part of the agreed-upon statement of facts. Actually, it did no such thing. The document didn’t use the word “misrepresentation” or similar language to describe any of JPMorgan’s actions.

Usually when corporations settle with the Justice Department, they agree not to contradict the government’s assertions publicly. Yet on this occasion JPMorgan felt compelled to set the record straight. “We didn’t say that we acknowledge serious misrepresentation of the facts,” JPMorgan Chief Financial Officer Marianne Lake said during a Nov. 19 conference call.

She was right: The Justice Department overreached in its characterization. It isn’t a good sign when the company paying billions of dollars to resolve a government probe comes across as more believable than the government lawyers who cut the deal.

(Jonathan Weil is a Bloomberg View columnist.)

Photo via Wikimedia Commons