Sen. Mitt Romney

Democrats in Congress are proposing a new tax on American billionaires as part of President Joe Biden's Build Back Better jobs package.

Originally, Democrats had proposed a plan that would have raised taxes on corporations and individuals earning $400,000 or more.

Now, they are instead reportedly trying to adopt a Billionaires Income Tax on the roughly 700 Americans who are worth $1 billion or who make $100 million for three years in a row.

The plan would tax America's 0.01 percent for the passive income they gain from stocks, bonds, real estate, and other assets.

Republican lawmakers have shot back at Democrats' proposal by arguing it is unfair to raise taxes on Americans who hold more than $1,000,000,000 in assets.

Sen. Mitt Romney (R-UT) told Fox News that taxing billionaires a slightly larger amount would tell them, "Don't come to America, don't start your business here."

"Multibillionaires, they're going to look at it and say, I don't want to invest in the stock market because as that goes up I'm going to get taxed," Romney said. "So maybe I will instead invest in a ranch or in paintings or things that don't build jobs that create a stronger economy."

Sen. Mitch McConnell (R-KY) took to the Senate floor on Monday to oppose the idea as punitive to the ultra-wealthy.

"This harebrained scheme would have the IRS penalizing people who invested wisely and compensating people who have invested poorly — all independent of whether they have actually made or lost any money," McConnell said. "Our Democratic colleagues have become so tax-hike-happy, they're throwing spaghetti at the wall to see what sticks."

"No new taxes. Ever," Rep. Jim Jordan (R-OH) tweeted on Tuesday.

At a town hall on Oct. 6, Sen. Ron Johnson (R-WI) said that the top 1 percent of Americans pays "pretty close to a fair share" in taxes.

In reality, the wealthiest Americans pay a lower effective tax rate than most U.S. workers.

A June investigation by ProPublica found that the 25 wealthiest Americans pay an average of 15.8 percent in federal income taxes each year, while an American worker making $45,000 pays an average of 19 percent in federal taxes each year.

America's uber-wealthy likely pay far less in taxes than what is reported. ProPublica calculated that between 2014 and 2018, the 25 richest Americans paid a true tax rate of just 3.4 percent.

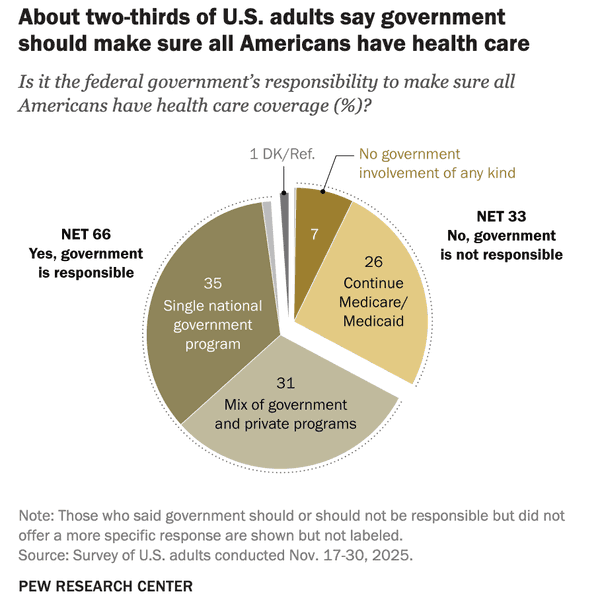

Polls have consistently shown strong public support for Biden's proposed tax increases on the wealthiest Americans. The public also broadly supports using the increased federal revenue on clean energy and caregiving programs.

After weeks of negotiations, Democrats are reportedly close to agreeing on a $1.75 trillion version of the massive infrastructure plan.

Under Senate rules, Democrats can enact the plan without a single GOP vote — so long as Senate Majority Leader Chuck Schumer (D-NY) can get all of his members to vote for it.

Published with permission of The American Independent Foundation.

- Trump's tax cuts helped billionaires pay less than the working class ... ›

- Is Trump cutting Medicare to give tax breaks to billionaires? ›

- Trump Tax Cuts Have Failed To Deliver On GOP's Promises : NPR ›

- Trump Tax Cuts Helped Billionaires Pay Less Taxes Than The ... ›

- Did billionaires pay off Republicans for passing the Trump tax bill ... ›