We can thank Ben Bernanke for the phrase “fiscal cliff” – a phrase many observers have tried to soften by pointing out they think it’s more like falling down a slope, sliding down a curve, or even tripping over a curb. I can understand trying to find other metaphors to replace the nearly always fatal results of going off a cliff.

But maybe those observers missed one effect that Bernanke knows drives the economy more than any else: housing.

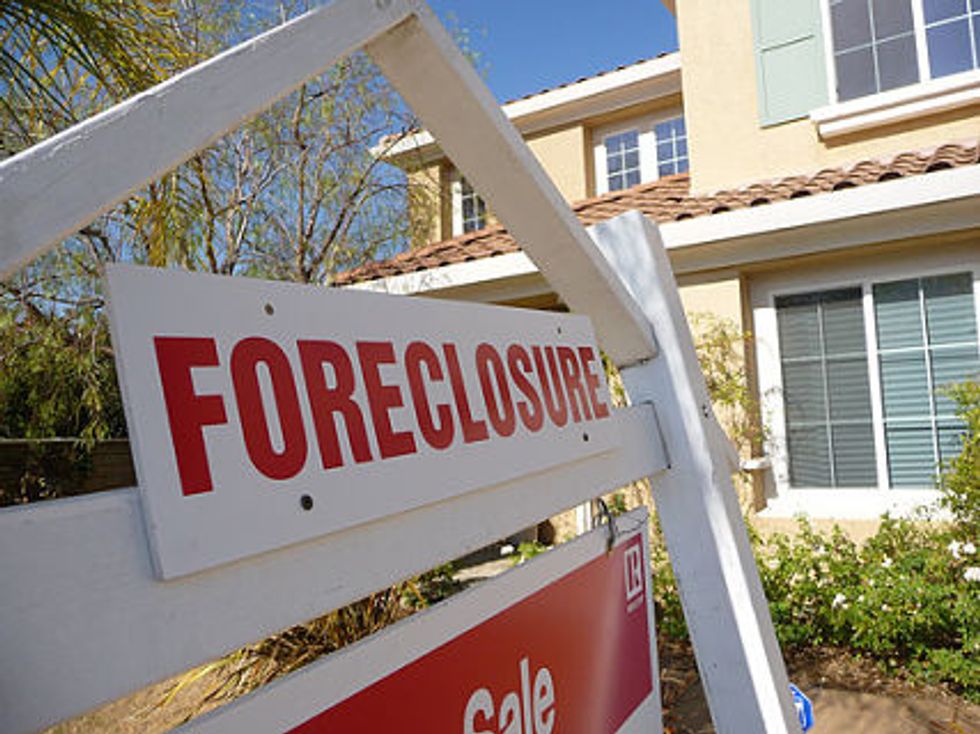

You’d think we’d know by now that America’s economy depends on housing more than any other industry. Certainly the fact that unemployment is still nearly 8% while corporate profits have roared to all-time highs is a clue. So is persistently low consumer confidence in spite of those stellar profits and a stock market that has nearly doubled over the past four years.

But housing is at least stabilizing nationwide, and even heading upwards in the regions hit hardest by the housing bust that started the “Great Recession” in the first place.

But we’re not out of the woods quite yet, and one aspect of the impending spending cuts that begin January 1st is almost certain to change that progress on the housing front into a full blown retreat. And that retreat will start immediately, not gradually over the year, as do the other effects of the law passed in 2011 following the debt ceiling hostage crisis.

Starting this week, two million unemployed people now collecting extended federal unemployment benefits will get nothing. What if a million or more of them have mortgages? Will they be able to pay? Not bloody likely. People who have been out of work longer than six months generally don’t have much in the way of savings left.

That’s the reason extended unemployment benefits is such a huge winner when used as a stimulant for the economy. Unlike infrastructure spending, which takes months or years to begin to have a “multiplier effect” in the economy, extended unemployment benefit money gets recycled into additional activity almost immediately. Most economic studies show that roughly $2 of increased GDP comes from each dollar of unemployment benefits.

Contrast that with deficit spending resulting from tax cuts. That kind of spending only gives pennies in GDP growth for each dollar borrowed to subsidize those cuts.

The reason Bernanke called the impending fiscal policies in the “sequestration” a cliff was probably not because those who do have jobs will have more taxes taken from their pay, though they certainly won’t be spending more money and growing the economy with those smaller paychecks. That’s a small and gradual effect. The reason he called it a cliff is that the most destructive single thing you could do to our economy is to hurt, yet again, the largest asset of all but a few of us – our homes.

So before we say that it doesn’t matter when they fix the gun-to-the-head spending cuts and tax hikes that begin this week as long as they fix it over the next few weeks or months, consider what will happen to the value of your house if your neighbor goes into foreclosure next month. Two million neighbors are already having a hard time making their payments for the basics like housing and food. Surely some of them will fail when their main source of income is suddenly shut off.

Howard Hill is a former investment banker who created a number of groundbreaking deal structures and analytic techniques on Wall Street, and later helped manage a $100 billion portfolio. He writes and blogs at mindonmoney.wordpress.com. Follow on Twitter: @hhill61