New York (AFP) – U.S. stocks moved lower in early trade Monday ahead of a busy week of economic data following the Thanksgiving holiday.

About 35 minutes into trade, the Dow Jones Industrial Average fell 30.57 (0.19 percent) to 16,055.84.

The broad-based S&P 500 slipped 0.80 (0.04 percent) to 1,805.01, while the tech-rich Nasdaq Composite Index dropped 2.05 (0.05 percent) at 4,057.83

A busy week of data releases was kicked off with a positive report on manufacturing. The ISM purchasing managers index rose to 57.3 from 56.4 the previous month, against expectations of a slight fall. It was the sixth straight month of growth for the sector.

In addition, the Commerce Department said the U.S. construction sector registered solid growth in October, also better than predicted.

Investors will also be keeping an eye on data on holiday shopping. The National Retail Federation said Sunday that 141 million people shopped over the big Thanksgiving weekend, up from 139 million last year.

However, the average shopper spent $407.02, down from $423.55, the NRF said.

Industrial and equipment supplier 3M, a Dow component, fell 2.2 percent after Morgan Stanley downgraded the stock, saying it has a high valuation compared with peers.

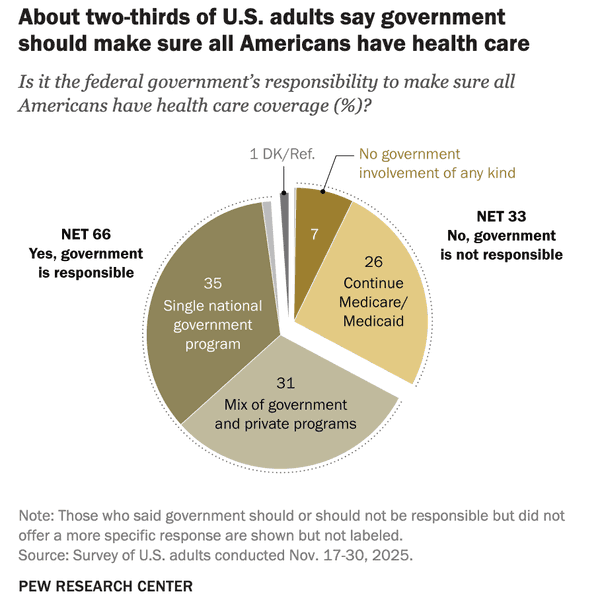

UnitedHealth Group shed 0.3 percent after giving a disappointing earnings forecast. The company said 2014 profits would run $5.40 to $5.60 per share, below the $5.67 seen by analysts, the Wall Street Journal reported.

Dow Chemical advanced 2.3 percent after announcing plans to “carve out” a large segment of its low-margin chlorine businesses. The business, which registered $5 billion in annual revenue, could be divested or reorganized into joint ventures.

EBay gained 3.6 percent after notching strong online sales during Black Friday weekend. Topeka Capital Markets said the online vendor’s sales rose 31 percent through the first three days of a key five-day shopping stretch, “a meaningful positive for the stock.”

Bank of America rose 0.8 percent after announcing that it would pay mortgage financier Freddie Mac $404 million to resolve claims over subprime loans the bank sold before the housing crisis.

Bond prices declined. The yield on the 10-year U.S. Treasury rose to 2.78 percent from 2.74 percent Friday, while the 30-year increased to 3.84 percent from 3.81 percent. Bond prices and yields move inversely.