Wisconsin Bill Would Let Government Access Bank Accounts Of Those On Unemployment Benefits

We all know much conservatives hate the idea of government intrusion into our personal lives (well, except for controlling who we marry, what or even if we worship, and what we choose to do with our uteri) and how much more they hate the government getting its thieving hands on our money, the almighty dollar being the patron saint of conservatism.

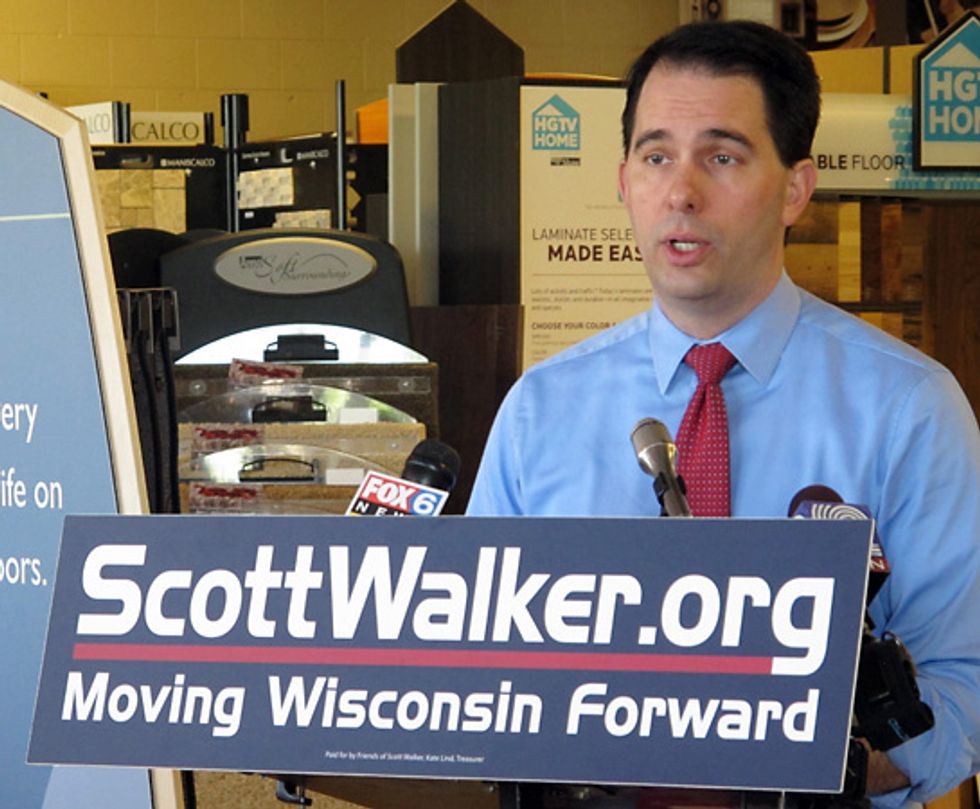

Well, as you might expect, there are even exceptions to that last one. When you’re jobless and receiving benefits, it seems anything goes if you live in Scott “Limited Government” Walker’s Wisconsin.

A bill making its way through the state Legislature would allow government officials access to the bank accounts of the unemployed to recover overpayments, penalize those trying to update their skills and improve job prospects with training, and punish jobless people who have been already victimized by identity theft, if unauthorized parties are able to fraudulently access benefits.

Among the draconian measures in the bill, according to Madison.com/the WSJ Wisconsin State Journal:

—Someone denied benefits after failing to accept a job offer would remain ineligible until finding a job and earning six times his or her weekly benefit rate. Under current law the requirement is four times the weekly benefit rate.

—Jobless benefits would no longer be extended beyond their normal expiration date for people who are completing vocational training or basic education courses.

—Unemployed people who failed to keep their identification number, user name and password secure could be liable for any benefits obtained by unauthorized persons.

—Financial institutions doing business with the state would be required to disclose information about accounts held by people who owe money to the unemployment system.

—The state would try to collect overpayments made as a result of administrative errors or computer malfunctions. Officials could sue to freeze bank accounts holding money wrongly paid out.

Says the Huffington Post, “Under the legislation, at least once every three months the state’s Department of Workforce Development would send financial institutions information on people who improperly received unemployment insurance. The information on such ‘unemployment debtors’ would include ‘names, addresses, and social security numbers,’ according to the bill text. If the debtor has an account with the bank, then the institution would tell the state the account type, number, and balance.”

“This is to protect the workers and lessen the burden on employers who are paying all the bills,” said the bill’s predictably Republican co-author, Rep. Dan Knodl. However, the people who would like to be workers are not only getting no protection at all, but are being treated like common criminals for the sin of not being able to find a job.

AP Photo/Scott Bauer