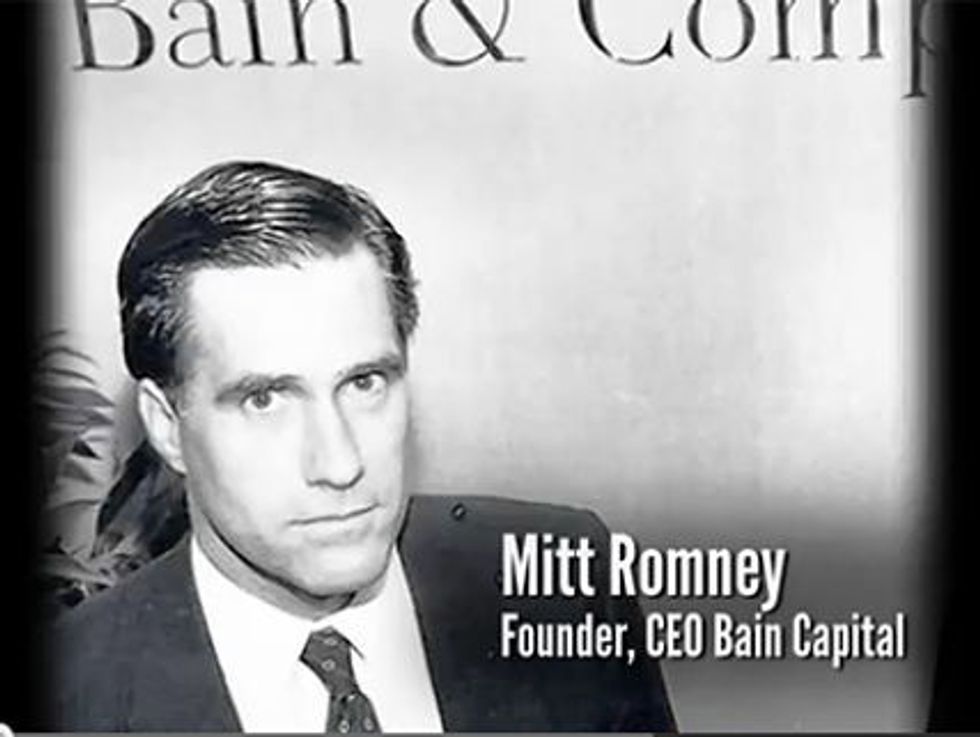

Why Does Mitt Romney Like Firing People? Because He Made $20,000 On Every Laid-Off Worker

Mitt Romney would prefer for you to recall just one number regarding his record at Bain Capital. That would be 100,000 — the number of jobs that the Republican candidate claims he created during 15 years at the private equity firm.

But now there is a more interesting, plausible and relevant number: $20,000. That’s how much money Romney is estimated to have made from each worker laid off during Bain’s many corporate takeovers.

In fairness, Romney’s goal at Bain was never to create jobs but to reap the biggest returns for their valued investors. Judging by that metric, he did exceedingly well, as even Bill Clinton accidentally admitted when discussing Romney’s “sterling” business career. And of course, Romney’s fortune, estimated somewhere between $190 million and 250 million, attests to that assessment.

But over the course of the Romney’s years at Bain Capital, at least five of the companies he took over eventually went bankrupt, while still rewarding Bain investors handsomely:

• American Pad & Paper: Bain invested $5 million in the Ohio paper company in 1992, and reportedly collected $100 million in dividends on that investment. But AMPAD went bankrupt in 2000, resulting in 385 employees losing their jobs.

• Dade Behring: Bain invested $415 million in a leveraged buyout in 1994, borrowed an additional $421 million, and ultimately walked away with $1.78 billion. Dade filed for bankruptcy in 2002, and laid off 2,000 employees.

• DDI Corporation: Bain reportedly invested $46.3 million in the electronic parts manufacturer 1997, earning $85.5 million in profits plus $10 million more in management fees. When the company went bankrupt several years later, 2,100 workers were laid off.

• GS Industries: In 1993, Bain invested $60 million in the Kansas City steel maker, borrowed a lot of money, and then took $65 million in dividends. But GS eventually went bankrupt in 2002, and 750 workers lost their jobs and pensions.

• Stage Stores: Bain invested $5 million to purchase the Houston-based retailer and took it public in the mid-’90s, reaping $100 million from stock offerings. In 200o, following Romney’s departure from Bain, Stage filed for bankruptcy and 5,795 workers were reportedly dismissed.

While it is true that some of those companies went under after Romney had left Bain, the job growth for which he now seeks credit also occurred after his departure in 1999. But the bankruptcies — and the bust-out scenario that helped Bain to profit anyway — are not news. What AOL’s Daily Finance has contributed to the Bain debate is a simple calculation: Bain Capital booked $1.995 billion in profits from the layoffs of 11,030 workers at various firms. And by that scoring, Romney earned roughly $20,000 himself for each of those fired employees. Nice work if you can get it (or take it away from someone else).