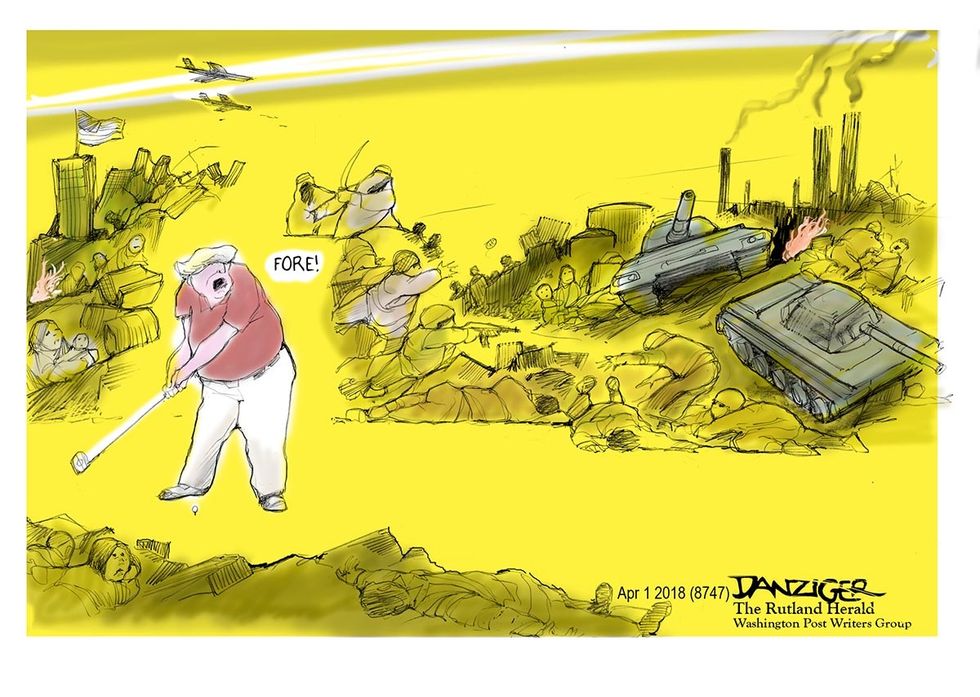

Jeff Danziger lives in New York City. He is represented by CWS Syndicate and the Washington Post Writers Group. He is the recipient of the Herblock Prize and the Thomas Nast (Landau) Prize. He served in the US Army in Vietnam and was awarded the Bronze Star and the Air Medal. He has published eleven books of cartoons and one novel. Visit him at DanzigerCartoons.com.