The $12.5 Trillion-Dollar Question: When Will That AI Bubble Burst?

I often get that question. I can’t say I have a very good answer.

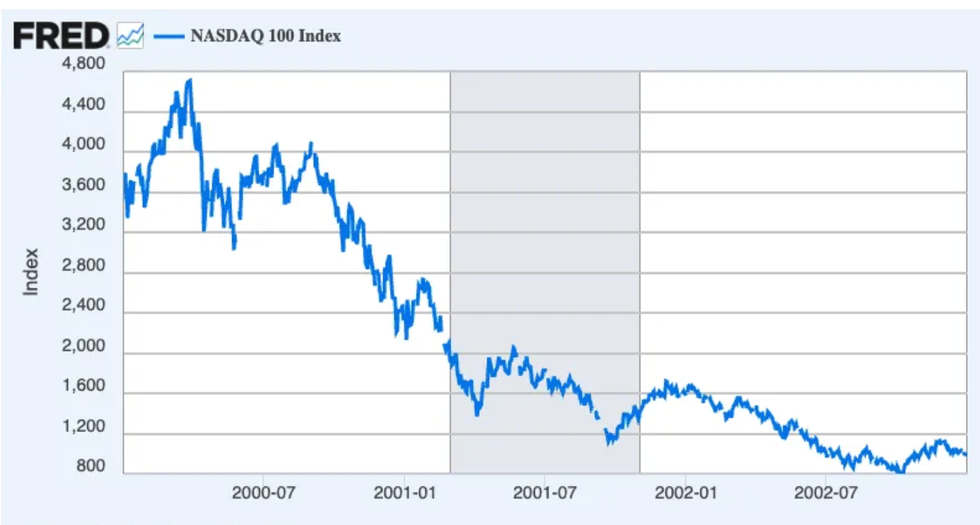

Going back to the last bubbles, it would be difficult to identify any events in the world that precipitated the collapse of either the 90s tech bubble or the housing bubble in the 00s. Both times the economy seemed to be moving along at healthy clip just prior to the collapse.

There had been warnings in both cases. In the 1990s bubble it was hardly a secret that many totally crazy businesses were raising hundreds of millions of dollars in IPOs. Investors were worried about missing out on the next Microsoft, so they were willing to throw big bucks at seemingly hare-brained schemes, just in case.

In the housing bubble, the fact that many of the mortgage loans being issued were of rather dubious quality was hardly a secret. Lenders were issuing loans at 100 percent of appraised value and sometimes more. In many cases, people were borrowing in excess of the value of their home to cover closing costs or moving expenses. The verification on these loans was minimal. There were frequent jokes about “liar loans” or NINJA loans, with NINJA standing for “no income, no job, and no assets.”

But these warnings came well before the crashes. There is no obvious event that caused the stock market to turn in March of 2000 or the housing bubble to peak in the summer of 2006.

The Federal Reserve arguably played a role in the latter. The federal funds rate rose from its tech recession low of 1.0 percent in the spring of 2004 to a peak of 5.25 percent in the summer of 2006. This made mortgages more expensive, which made it harder for people to pay bubble inflated prices to buy homes. But the increases were gradual and the impact on 30-year mortgages was minimal. Of course, since many borrowers were taking out adjustable-rate mortgages at the time, higher short-term rates did matter.

In the 1990s, there was only a very modest increase in the federal funds rate, rising from 5.5 percent in the fall to 6.0 percent by March. It rose further into the spring, but the market had already turned at that point.

With this history, I don’t know what might cause the bubble to burst. Just to pick up on a point I made last summer, it is very hard to tell a story where the current price of the big AI-related companies makes sense. Nvidia has a current market capitalization of $4.8 trillion. If investors expect a 10 percent nominal return on the stock, in ten years it would have a market capitalization of $12.5 trillion. If we assume its earning have caught up so that it has a price/earnings ratio at that time of 20 (pretty high for a mature company), then its after-tax profits in 2036 would be $620 billion. That would be almost 15 percent of all after-tax profits in the U.S. economy, according to the Congressional Budget Office’s projections.

The idea that one company would have 15 percent of all corporate profits is not impossible, but it doesn’t seem like the most likely scenario. Alphabet, which is obviously an incredibly successful company, currently has about 4.6 percent of after-tax profits, so will Nvidia be more than three times as large relative to the economy in a decade than Alphabet is today?

Furthermore, is that anyone’s best bet? If this is a possible but not likely scenario then people must be expecting considerably higher returns on their investments in Nvidia stock, say 15 percent or 20 percent. In those cases, we would need for the company’s profits to be 25 or 30 percent of all corporate earnings in 2036 to make sense of Nvidia’s share price. This seems to be getting pretty far-fetched.

Who knows when or what will make the bubble burst. Maybe the Chinese competitors get enough market share with their lower-priced AI that it will become clear even to the Silicon Valley geniuses that their big jackpot exists only in their heads. Maybe their revenues will stop meeting projections. But whatever causes it, the story of the collapse is not likely to be pretty.

Dean Baker is a senior economist at the Center for Economic and Policy Research and the author of the 2016 book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer. Please consider subscribing to his Substack.

Reprinted with permission from Dean Baker.

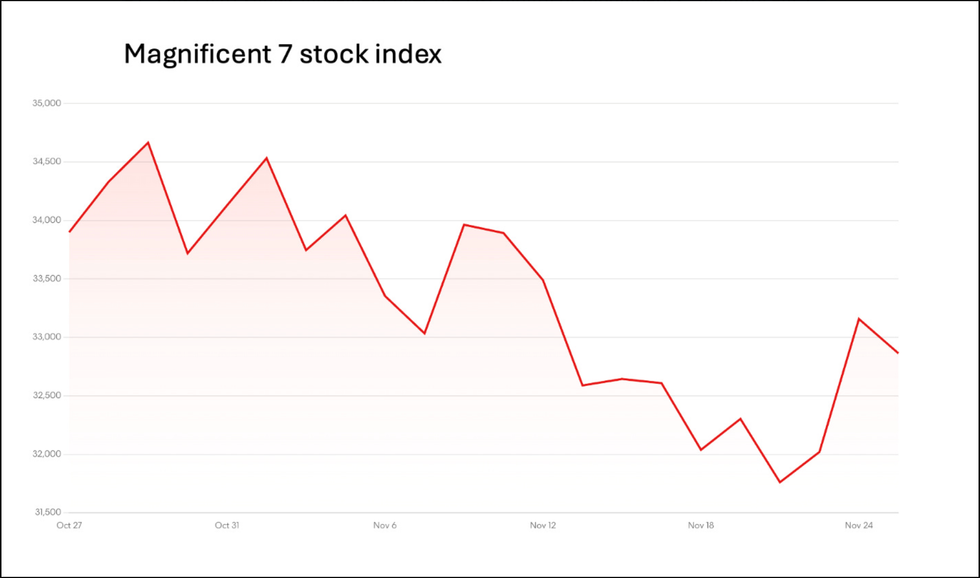

Source: Bloomberg News

Source: Bloomberg News Source: NASDAQ via FRED/St.Louis Federal Reserve (stlouisfed.org)

Source: NASDAQ via FRED/St.Louis Federal Reserve (stlouisfed.org) Source: NASDAQ via FRED/St.Louis Federal Reserve

Source: NASDAQ via FRED/St.Louis Federal Reserve