How Selling More DJT Stock Makes Trump Richer -- And Shareholders Poorer

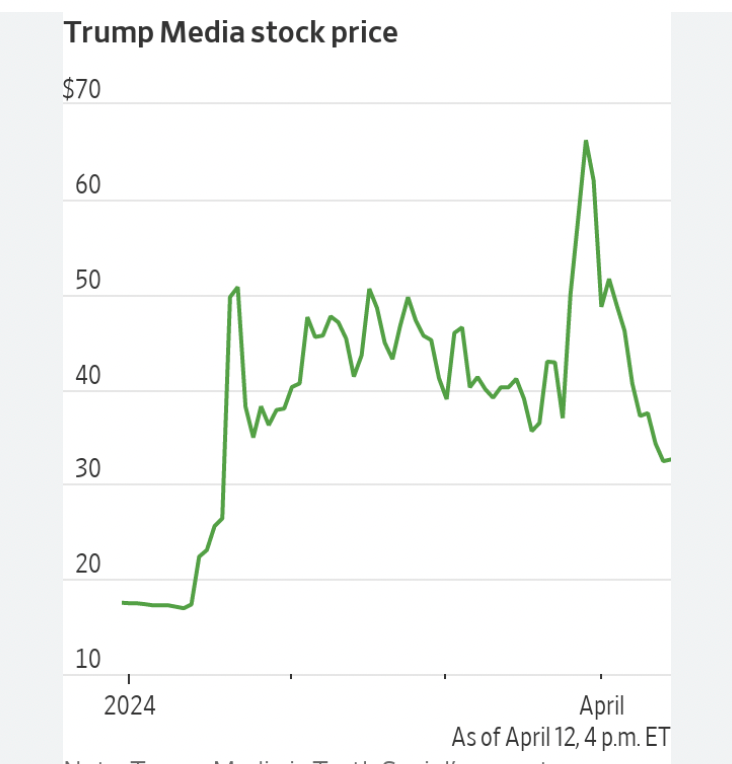

Trump Media share price shows steep decline following its peak in late March

Trump plans to water DJT stock by issuing millions of new shares. It’s part of a new Trump scheme to make money for himself and his bankers from a failing company that rang up just $4.1 million in revenue last year and lost more than $58 million.

At its peak, the market valued the company at $8 billion, which, in market terms, is a delusional fantasy. It’s true value is zero, especially if Trump is incarcerated.

The stock watering plan also reminds us that savvy investors and investment bankers make money when stocks fall and rise. Profiting off a loser company is a lucrative but risky and sophisticated game, not one to try at home. Unless you want to be wiped out financially right down to losing your house, since the potential losses to you are unlimited.

Here is how it works: By Issuing millions more shares of DJT, the Trump company ticker symbol, the company will collect cash to keep it going since it isn’t earning a profit or taking in much from customers. The new shares dilute the stock the way a bar watering the gin makes it less potent.

Shorts borrow shares from investors and sell them, paying a fee to the investor. If the stock price falls, the shorts buy back the same number of shares at the lower price, return them to the person they were borrowed from, and keep the difference in price between the sale and re-purchase.

People who hold shares are called longs. They have a long, or ownership position.

Watering helps those who short stocks, called shorts, in two ways.

Shorts borrow shares of stock, paying the investor a fee for the loan of their shares. The shorts then sell the borrowed shares.

Note: If you own a stock brokerage account that allows you to buy on the margin, the investment house can loan out your shares without you knowing it. The brokerage assumes the risk of making you whole if things go awry.

The first way that shorts benefit from stock watering is that millions of new shares become available to sell short. Right now, there are hardly any shares left to borrow and sell short.

For example, if a short sold at $26, roughly the DJT price Monday, and bought it back for $1 later, the profit would be $25 per share less than the fee paid to borrow the shares. In this scenario, the short seller makes a bank vault of cash while the loyal Trump supporter who held onto their shares gets wiped out.

While that’s a nifty and lucrative result, what happens if the stock price rises? Should the stock price rise, say to $51 from $26, the person with the short position would lose $25 per borrowed share. Ouch.

Second, issuing more shares lowers the value of each existing share, putting more downward pressure on DJT.

DJT trading began three weeks ago. DJT shares peaked March 26 at $79.38 and started falling. On April 15, the day Trump’s first criminal trial began in Manhattan, DJT shares traded at about $26. That means the stock has already lost more than two-thirds — down 71%, closing today at $22.84 — from its peak value. Ouch for real.

Trump owns 58 percent of the pre-dilution shares. But he can’t sell his shares for five months under a so-called “lock up” intended to reassure investors that the company isn’t a pump-and-dump scam to run up the share price so the insiders can cash out, leaving the buyers with losses when the stock collapses.

But Donald can still cash in and walk away with a fortune, perhaps several billion dollars, since at its peak, the company was valued at about $8 billion for reasons that have nothing to do with market fundamentals like profits and expectations of future profits.

How would that work?

Donald can pledge his DJT shares to an investment bank. The bank then loans Donald cash secured by those shares.

CEOs have done this for decades, pocketing cash without selling their shares — or having to tell investors! In those deals, the CEO or founder could borrow as much as 90 percent of the share value. If the stock rose, the investment house got the first 35 percent or so of the increase. If the stock fell, as we see with DJT shares, the investment house also makes money because it shorts the stock.

After the price collapses, the investment bank closes its short position by buying back cheap shares, and Trump’s loan is paid off.

The bankers keep the fat fees charged for arranging the deal plus any surplus on the short.

In this case, the investment bank might loan Trump only half of the value of his shares. In that scenario, it would double its money because when the bank closes its short position, its gross profit would be twice as much money as it loaned Trump. And then there are the fees the bank collects for arranging the deal.

It’s a win-win for Trump and the bank — and nothing but losses for people who went long, buying and holding DJT shares as they fell from almost $80 to zero.

At the upcoming April 22 hearing before Justice Arthur Engoron on Trump’s putative bond in the persistent fraud case, New York Attorney General Letitia James should ask if Trump hypothecated his DJT shares and collected cash through a loan against them.

If he did — and I think that is highly likely — this could seriously complicate collecting the nearly half a billion dollars Donald owes in disgorgement and interest. Trump can delay payment while he appeals, but he has no chance of reversing the finding of fraud, only of persuading a court to shave back the size of the award. That, too, seems unlikely for anything but a modest amount of what he owes.

Whether it’s cheating at golf, cheating novice roulette players at the Trump Castle casino, cheating illegal immigrants out of their wages in building Trump Tower, cheating on his wives, cheating insurance companies, cheating on damages from 9/11 — he suffered none but collected big time — cheating on his income taxes, cheating on his property taxes, or trying to cheat by stealing an election and overthrowing the government, remember that Trump is always and everywhere looking to make money for himself with no regard for who gets hurt.

Reprinted with permission from DC Report.

- As Stock Plunges, Trump Sues His Truth Social Partners ›

- Is Trump Media A 'Pump And Dump' Scheme? Fox News And Fox Business Disagree ›

- How Trump's Hush-Money Trial Is Testing Mainstream Journalism - National Memo ›

- Trump Media Has Lost Over $300M So Far In 2024 - National Memo ›