Donald Trump fired the chairman of the Joint Chiefs of Staff, who is Black, and replaced him with a retired Air Force General, a white Trumper who Trump says pledged his loyalty to the president personally with a lethal promise.

Also fired were the chief of naval operations, a woman, and another general. Earlier, the woman who headed the Coast Guard was given the boot.

Disturbingly, the chief lawyers for each military branch were canned last Friday too.

Firing the top military lawyers is crucial to Trump’s abusing his Constitutional duty as commander-in-chief. With Trump loyalists as judge advocates general, Trump need not worry that military lawyers will label anything he does illegal or unconstitutional. Given that Trump has talked about using American troops against the American people, this is a crucial and powerful lever of control.

Replacing military lawyers with subservient attorneys fits with what Donald learned from the man he calls his “second father,” the notoriously corrupt and hate-filled Roy Cohn, the vicious attorney-attack-dog for Senator Joe McCarthy’s witch hunt committee. By his own account, the late Cohn spent most of his adult life under indictment, representing a vile melange of mobsters, celebrities, and Donald Trump.

Trump promptly seized control of the Justice Department, its prosecutors, and FBI agents and removed the inspectors general, whose job is to root out abuse, fraud, and waste. This will enable the illegitimate exercise of power with no internal accountability.

Trump is also using a devious loyalty test for those seeking federal jobs. To get hired, they must say whether they believe the Jan. 6 insurrection was an FBI inside job.

The icing on the totalitarian cake is the military corps, whose officers take an oath to defend our Constitution. Unlike grunts and sailors, officers don’t pledge to follow presidential orders, only to our founding document. This officer-level oath has been crucial to our nonpolitical military. To Trump, it’s a mere annoyance to be swept away.

Once Trump installs enough top officers who are personally loyal to him, nothing will prevent him from achieving his absolute power and control.

Trump’s dictatorship is taking shape right in front of our eyes.

Never forget Trump’s past statements that he wished he had never left the White House after Joe Biden handily defeated him in 2020 and that he could suspend the constitutional privilege—not right, but a mere privilege—of habeas corpus.

I’ve been warning people for 9 1/2 years that Donald is a wannabe dictator. A lot of people back then said I was out of my mind crazy, but here we are, and once again, when it comes to Donald Trump, I’ve been proven right.

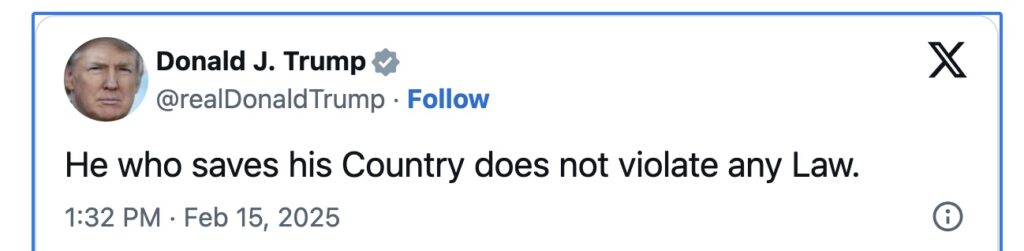

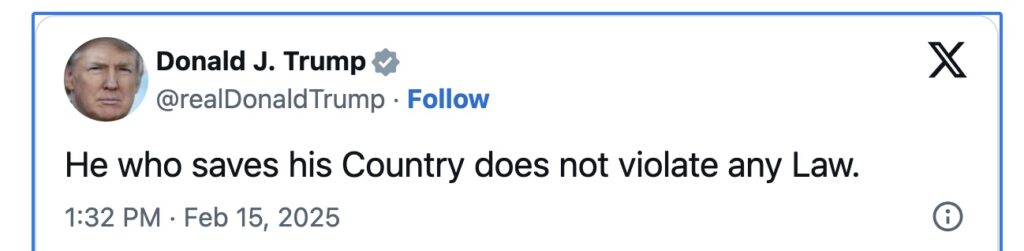

On February 15, for example, he posted this on Elon Musk’s X website:

This quote, dubiously attributed to French tyrant Napolean Bonaparte and Trump lawyer and mentor Roy Cohn, is a clear assertion by Trump that he is above the law.

This quote, dubiously attributed to French tyrant Napolean Bonaparte and Trump lawyer and mentor Roy Cohn, is a clear assertion by Trump that he is above the law.

Trump, in 2022, asserted Presidential power to suspend our Constitution, a baseless claim made to advance his lie that the 2020 Presidential election was stolen. Never forget that in five dozen cases, Trump lawyers could not provide a scintilla of evidence to support wild claims that the election was rigged. Indeed, of the few instances of people improperly voting, most were by Trumpers.

Trump declared himself king last week, though news reports may confuse you. That’s because instead of banner headlines worthy of exclamation points, what dominated the news were limp stories asking, “What does it mean that the Trump White House repeatedly posted images of Trump with a crown and the line ‘Long Live The King?'”

Out national politics journalists—with a few exceptions— are still caught in the trap of covering the horse race and explaining Trump as a different kind of politician, not as a career criminal who has conned his way into a post that will let him destroy our Constitutional order.

The crucial last step to becoming king is firing competent admirals and generals. Those canned were people of color or women who followed their oath to support our Constitution. Donald is replacing them with toadies who pledge loyalty to Donald.

Indeed, retired Air Force Lieutenant General Dan Caine is so loyal that, according to Trump, Caine declared to him: “I love you, sir. I think you’re great, sir. I’ll kill for you, sir.”

Murder by presidential request is what Caine promised. If Senate Republicans confirm his appointment, as I fully expect, it will show how obsequious they have chosen to become.

This is what Trump did to the FBI in his first term. He demanded personal loyalty from James Comey. When Comey kept saying his duty was to uphold our Constitution, Trump fired him.

Now he has his toadie, the utterly unqualified Kash Patel, running the FBI. Patel wants to savage the FBI’s counterintelligence division. If you’re going to make Russia our ally and make us vulnerable to hostile foreign powers, then kneecapping the FBI’s counterintelligence function would be near the top of your list. Tsar Putin, President Xi, North Korean dictator Kim, and even the mullahs in Tehran are all thrilled at what Trump is doing to the FBI.

Iran, you may recall, has said it intends to assassinate Mark Milley, the former Joint Chiefs chair. Three weeks ago, Trump withdrew Milley’s security detail, making it easier for the Iranian regime to carry out its evil plans.

Further weakening our national security, Trump named Pete Hegseth as secretary of defense, choosing a hard-drinking television personality with a history of sexual assault, including once paying hush money to a woman. No other president would have taken such an extreme security risk, not to mention Hegseth’s utter lack of qualifications.

And don’t forget that Donald has said he wants to use the American military against the American people.

He can also suspend habeas corpus, which under our Constitution is not a right but a privilege. That means Donald can arrest people on bogus charges and hold them incommunicado for as long as he chooses.

His utterly corrupt but personally loyal Attorney General Pam Bondi is already working to advance Donald’s agenda of protecting violent felons who advance Trump’s antidemocratic plot and instead pursue honest people who oppose his nascent dictatorship.

Judges are finding narrow legalistic grounds with which to look the other way while Donald exercises unconstitutional power to the destruction of our liberties. In one case, a federal court complaint filed by Attorneys General in blue states showed poor quality lawyering. In other cases, federal judges can dismiss complaints because those suing lack standing (the right to sue) or because the judge finds Trump’s conduct, while awful, will not reach the level of irreversible harm.

So long as Republicans control the House and Senate, acting as subservient Trump enablers rather than defenders of their branch of our government, Congress would defend our liberties and rights.

The spinelessness of all but a handful of GOP Senators earns them a new moniker: quislings.(If you don’t know that word, please click here, here, and here because it’s essential. My Norwegian maternal grandmother ensured that I understood that word and the broader concept, broadly applicable to Trump, by age six.)

Donald also benefits from the chaos spread by his alter ego Elon Musk’s loyalists, including at least one teenager and a swarm of twenty-somethings. They now enjoy unfettered access to some of our most sensitive government computer systems and are seeking access to more systems.

At some federal agencies, and you can bet at all agencies in the future, they will exercise “root access,” making them all-powerful in those systems.

In some systems, like the Los Angeles Times when I worked there, the top access to the newsroom computer system was given the name “god,” a clear statement of the ability to create, destroy, and compromise a computer system.

Imagine how easily controlling Justice Department and FBI computer systems would enable compromising evidence. That would then require prosecutors to abandon indictments of Trump allies no matter how serious and threatening their crimes.

Do you find that hard to imagine? Musk has already fired inspectors general who were investigating him and dismissed other IGs despite lacking any lawful authority to do so. Accountability? How passé.

It took roughly 40 years for Rome to transition from a republic to a dictatorship, with the Senate still intact but mere window dressing. Hitler needed just 53 days to impose Nazi control on Germany. Trump’s blitzkrieg attack on our liberties and the checks and balances of our Constitution took just 32 days.

Trump will do more, much more, to consolidate power, but make no mistake: As of Friday, February 21, 2025, Trump became our de facto dictator.

David Cay Johnston, a former columnist for The National Memo, co-founded DCReport. He is a best-selling author, investigative journalist and former reporter for The New York Times, where he won a Pulitzer Prize in 2001. He teaches law and journalism at Rochester Institute of Technology.

Reprinted with permission from DCReport

Notes: The New York State increase took effect on December 21, 2021. Source: Economic Policy Institute

Notes: The New York State increase took effect on December 21, 2021. Source: Economic Policy Institute