Tariffs Spike Inflation -- And A Cut In Workers' Real Wages

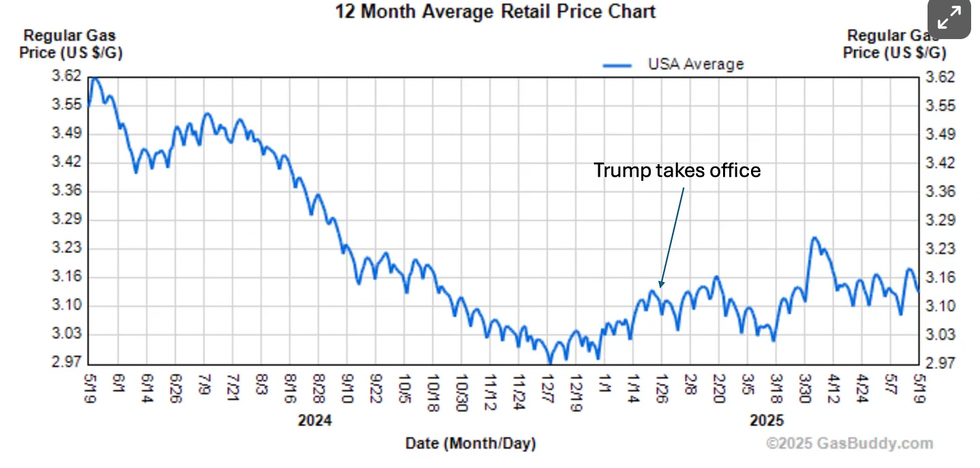

It no longer is deniable that we are seeing a surge in inflation due to Trump’s tariffs. Last fall the Fed was projecting that inflation would be back close to its 2.0 percent target in 2025. It now looks like we will be above 3.0 percent, and possibly considerably higher.

This realization has shifted the debate from whether we will see tariff-induced inflation to how enduring the uptick will be. Trump supporters are assuring us that the rise in inflation will be transitory, with inflation settling back down to its pre-tariff pace after a period of time. On the other hand, we have the possibility that we will see a persistently higher rate of inflation, and possibly even an inflationary spiral.

As a card-carrying member of Team Transitory a few years back, I think it is worth distinguishing what “transitory” means in the context of tariff driven inflation, as opposed to inflation driven by supply-chain bottlenecks.

The big factor in determining whether inflation is transitory or enduring is whether it leads to a faster path of nominal wage growth. If the pace of wage growth increases in response to higher inflation, the more rapid rate of inflation is likely to persist. The higher wages will then get passed on in higher prices, and this continues until something like a recession and a big jump in unemployment breaks the pattern.

When the Trump crew tells us that their tariff-induced inflation is transitory, they are saying that there will be no pick-up in wage growth. In effect workers will be forced to eat the tariffs in the form of less purchasing power for their paychecks.

If we get an uptick in the inflation rate of 1.0 percentage point for two years, they are looking at a 2.0 percent drop in their real wage. If the uptick averages 1.5 percentage points, that would mean a drop of 3.0 percent in purchasing power. For a worker making the median wage of roughly $25 an hour, this would mean a cut of between $1,000 and $1,500 a year in their real wage.

By contrast, the claim of Team Transitory during the supply chain inflation was that the bottlenecks driving up prices would be resolved and that prices of the affected goods would stop rising and possibly even fall back toward their pre-pandemic level. In that story, workers would not see an enduring cut in their real wages.

The transitory story on supply-chain inflation turned out to be largely correct. It took longer for the bottlenecks to resolve themselves than most of us expected. This was primarily because subsequent waves of Covid both disrupted shipping, and continued to steer consumption from services to goods, as people continued to be scared of going to restaurants and movies, and other forms of service consumption. In any case, we clearly didn’t see the inflationary spiral that some feared, nor did we need a big jump in unemployment to push inflation back down.

The story of Trump’s Team Transitory (TTT) is far less benign. It’s a story where workers have permanently lower real wages and living standards than they would have in the absence of the tariffs. That might be good news on the inflation front, but it is not especially good news for the people who depend on their paycheck for their livelihood.

Dean Baker is an economist, author, and co-founder of the Center for Economic Policy and Research. His writing has appeared in many major publications, including The Atlantic, The Washington Post, and The Financial Times.

Reprinted with permission from Substack.