Expert Warns Trump Has A Real Plan To Destroy Social Security

Reprinted with permission from Alternet

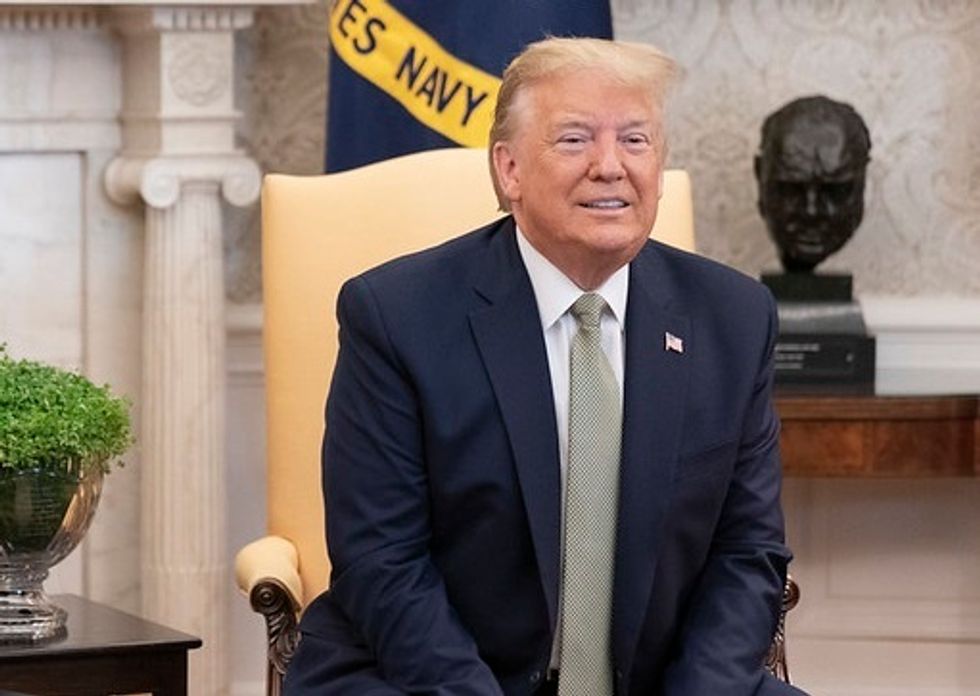

Donald Trump's nonstop lies, together with his endless cries of "fake news" and "hoax," make the role of media fact checkers more important than ever. Unfortunately, on the crucial issue of Social Security, too many of them are furiously defending Trump from his own words.

Instead of acting as a check on Trump's lies, they act like bullied children seeking to appease. They provide him cover, grade him on a curve, and give him every benefit of the doubt while denying that same leniency to Joe Biden and others. This is an extreme disservice in the lead-up to the election, muddying the debate over an issue about which voters care deeply.

I am as objective as any fact checker. In the past, I have worked for Republicans, including as a political appointee in the administration of President Ronald Reagan. I currently head my own nonprofit. My allegiance is to Social Security, because of its importance to America's working families, and to the truth. While I do not expect fact checkers to share my concern or my knowledge about Social Security, I do expect them to share my desire for accuracy.

Those who follow the issue closely know that Trump is deeply hostile to Social Security. The hostility is clear from his statements before running for president and his actions once in office. Trump's recent declaration that, if reelected, he will permanently "terminate" the payroll contributions which fund Social Security is consistent with many past Trump statements.

His obsession with ending those Social Security contributions is also in accord with a threat he made in July to veto the next COVID-19 relief package if it didn't cut Social Security's dedicated revenue. When even congressional Republicans refused to buckle to his veto threat, accurately labeling the move a raid on Social Security, Trump did what he does so often. He decided he would find a way to do it on his own.

Using an obscure provision of the Internal Revenue Code, he took the unprecedented, alarming step of unilaterally deferring a portion of Social Security's insurance contributions. This was only possible because Trump had earlier taken the unprecedented action of declaring a disaster across the entire nation.

No one should doubt or downplay Trump's serious threat to Social Security. Though few seem to realize it, Trump has provided the nation with a roadmap of how he could unilaterally destroy Social Security, without the need for Congress, once the election is over.

Only a veto-proof majority in Congress would have the power to stop him. It is not clear that someone would have standing to bring a lawsuit. And even if a plaintiff were found to have standing, the Supreme Court has found that similar statutory language of the Internal Revenue Code gives Trump "broad discretion." (Indeed, a concurring opinion characterizes the discretion as "free from judicial scrutiny.")

Appropriately, the Biden campaign ran a completely accurate ad identifying Trump's threat to Social Security. In response, the Washington Post's fact checker, Glenn Kessler, insisted that the ad was false. To come to that conclusion, Kessler quibbles over the meaning of the word "plan."

If I plan to go to the store, that is a plan. Indeed, Trump said himself, "I plan to…make permanent cuts to the payroll tax." But against all logic, Kessler says that Trump's plan "doesn't exist" and holds the Biden ad false, in true Orwellian fashion, because it refers to Trump's plan as Trump's plan.

Kessler also takes issue with the Biden campaign for taking Trump's words literally. He deviates from the facts and makes unjustifiable assumptions to fit his conclusion that the Biden ad is somehow false.

Kessler claims that if Trump sought to terminate Social Security contributions, "one would presume that any forgiveness [of the contributions] would be accompanied by [general revenue] transfers." [Emphasis added.] I, for one, presume the opposite, and for good reason. Congress would have to spend an extra trillion dollars each and every year to make up for the terminated contributions. (Even forgiving just the already deferred contributions would require a transfer of more than $100 billion.)

Kessler gratuitously and unfairly disparages Democratic efforts to sound the alarm about the Trump threat. The piece calls the effort by Democrats to have the Social Security Administration spell out the impact of Trump's plan as "playing some mischief."

Mouthing a Republican talking point, Kessler complains, "Without fail during a tough election season, Democrats bring up Social Security." As if talking about Social Security is somehow inappropriate, at a time when voters must decide whether to vote for a Democrat who promises to expand Social Security or a Republican who threatens to radically transform it.

Kessler even goes so far as to defend Trump with an obvious lie, writing, "As an executive order, Trump's action does not have the force of law." Those targeted by Trump's executive order banning travel from predominantly Muslim countries would certainly rate Kessler's claim as false!

Of course, Trump's deferral of Social Security contributions has the force of law. What Kessler apparently meant is that the action Trump has already taken includes no sanctions if employers fail to comply. But that has nothing to do with the legally binding nature of Trump's actions.

Kessler's false statement about the legally binding nature of executive action appears to be a ham-handed attempt to reassure supporters of Social Security that Trump's words should not be taken seriously. There are no facts whatsoever to provide that reassurance. Quite the contrary.

Presumably knowing how far out on a limb he crawled, Kessler concludes with this ridiculous CYA move: "If Trump yet again opens the door to permanent elimination of the payroll tax, we will revisit this fact check." I guess that means that if Trump says what he said enough times, the Biden ad will be accurate after all!

Kessler and other self-labeled fact checkers are far harsher on others. Another Post fact checker rated a statistic from Sen. Bernie Sanders (I-Vt.)—500,000 Americans are bankrupted by medical bills every year—as false, even though the statistic is from a study published in the American Journal of Public Health and the authors of that study found the Sanders usage was accurate. The Post justification for the false finding: the fact checker didn't consider the peer-review process used by that journal sufficiently rigorous and, though the authors provided their underlying data, "those numbers deserve scientific scrutiny before they can be taken as fact."

This double standard is dangerous. In an apparent false quest for "balance," Kessler and other fact checkers are failing the American people. They seem to think that if they fact check a Trump lie, they must also find a Biden lie—whether or not it exists. Neutrality doesn't work when you're dealing with a president who lies 20 times a day.

So, in the name of accuracy, let me, a Social Security expert who has no reason to shade the facts, be as clear and fair-minded as I can. The choice this November could not be starker or more important for the future of our Social Security system.

Joe Biden and the Democratic Party are promising to expand Social Security and ensure that all benefits can be paid in full and on time for the foreseeable future by requiring the wealthiest to pay more. Donald Trump promises to end Social Security as we know it.

No amount of obfuscation by the Trump administration, Trump allies, surrogates, and so-called fact checkers should hide that very clear and very real fact.

Nancy J. Altman is president of Social Security Works and chair of the Strengthen Social Security coalition. She has a 40-year background in the areas of Social Security and private pensions. Her latest book is The Truth About Social Security. She is also the author of The Battle for Social Security and co-author of Social Security Works!