$20 Trillion Investment? Searching For Trump's Imaginary Economic Boom

I suppose it is not nice to make fun of a 79-year-old man suffering from mental decline. But when that person is president and threatening to throw millions of people in jail and/or deport them, and also threatening war on countries around the world, their age and mental infirmity does not shield them from criticism. Just as he claims to have settled wars that either never existed or have not been settled, Trump keeps insisting he has created an unprecedented economic boom that is not visible anywhere in the data.

Most immediately, Trump boasts about his accomplishments in improving affordability by bringing prices down. He can take credit that the price of gas is down by around two percent, or six cents a gallon, from its year ago level, but that still leaves it just under $3.00 a gallon. It is not at the $2.00 a gallon he boasts about anywhere in the country. Rather than going down, food prices are up 2.7 percent from a year ago, with items like beef and coffee scoring double-digit increases.

Trump’s big thing is the $20 trillion in investment that he imagines is coming into the country. This sum is equal to two thirds of annual GDP and almost seven times the current annual level of investment. But there is zero evidence of it anywhere in the data.

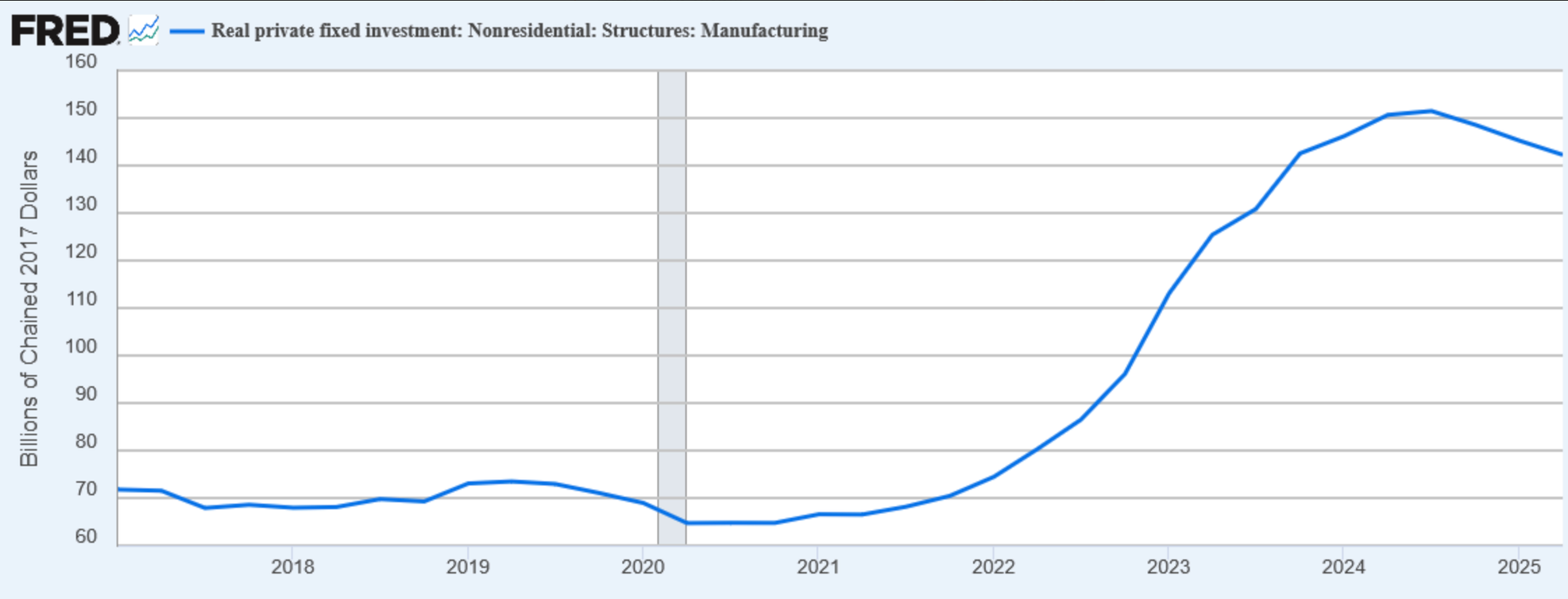

After an unprecedented boom under Biden, investment in factory construction has trended downward under Trump. It’s hard to imagine some huge explosion of investment that won’t involve building some new factories or renovating existing ones.

There also is no evidence of Trump’s investment boom in new orders for capital goods. This series fluctuates a great deal, as orders, especially of airplanes, tend to clump together. But the average for the third quarter of this year was just 12.0 percent above the average for the last quarter of the Biden administration, before adjusting for inflation. That’s not bad, but hardly a huge boom. In fact, it’s still down by 1.4 percent from the last quarter of 2023, again before adjusting for inflation.

The story doesn’t look any better from the standpoint of manufacturing employment, which Trump has put at the center of his economic agenda. Manufacturing employment is down by 49,000 from when Trump took office in January. Employment had already been falling in 2024, but manufacturing jobs are still going in the wrong direction.

Even Trump’s claims of trillions coming into the Treasury from his import taxes (tariffs) is also a delusion. In October, the most recent month for which we have data, the Treasury collected $31 billion in tariff revenue, roughly $24 billion more than it raised last year. That amounts to a massive tax increase of almost $300 billion a year, or $2,400 per household.

This does not come close to balancing the budget, and we certainly aren’t paying down the debt, as our deluded president claims. However, the tariffs are the major cause of the higher inflation households have seen since Trump took office, in addition to the higher costs imposed by deporting much of the immigrant labor force.

In fact, because of increased spending, the deficit was higher in October of 2025 than it was last October. In addition to normal increases in spending due to higher payments for programs like Social Security and Medicare, it also costs money to have thousands of ICE agents terrorizing people in major cities and to send the military to blow up small ships in the Caribbean with advanced weaponry.

In short, when it comes to Donald Trump’s boasts about the economy, it is all delusion. Psychologists or people who have read his MRI may be able to determine the extent to which Trump is telling deliberate lies, as opposed to really living in his world of make believe. But for those viewing from a distance, the important thing to know is that it is all nonsense.

Dean Baker is a senior economist at the Center for Economic and Policy Research and the author of the 2016 book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer. Please consider subscribing to his Substack.

Reprinted with permission from Dean Baker.