At GOP Town Halls, Furious Voters Condemn Trump's 'Big Beautiful Bill'

Forget Elon Musk—congressional Republicans are facing new fury from voters, this time for voting in support of President Donald Trump’s "One Big, Beautiful Bill Act,” which proposes slashes the social safety net to pay for tax cuts for the rich.

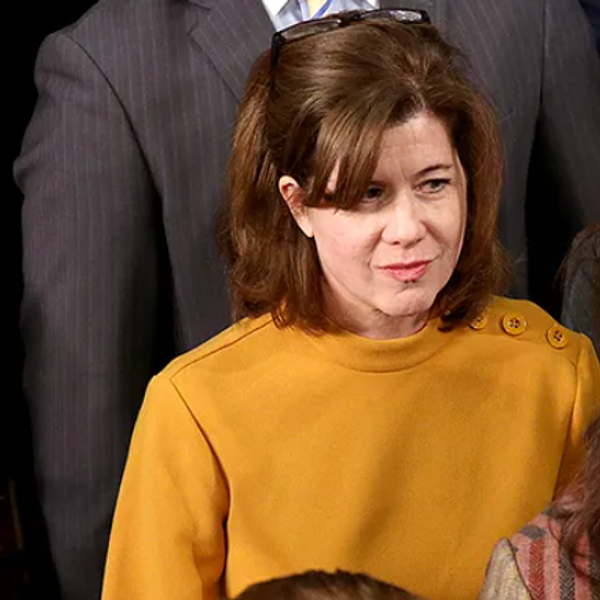

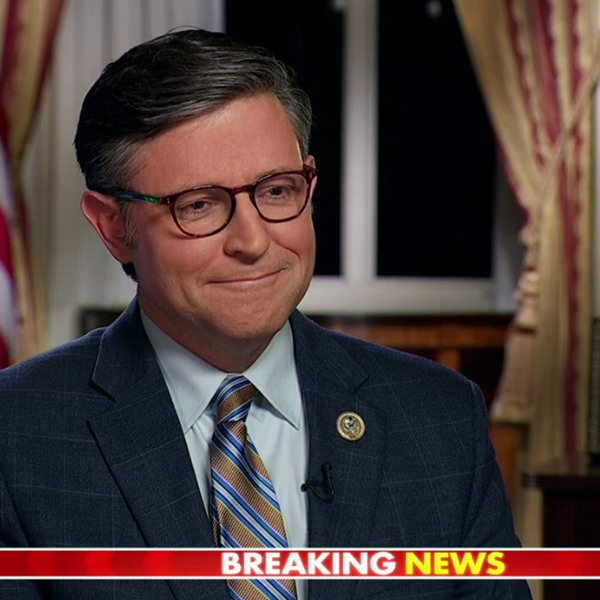

Two Republicans brave enough to hold town halls—Reps. Mike Flood of Nebraska and Ashley Hinson of Iowa—were both met by angry voters who questioned their support for a bill that would strip away health insurance, food aid, and more from millions of Americans.

Hinson was booed by the audience in her deeply Republican district after she said that she was "proud" to vote for the bill.

"This is a generational investment …” Hinson said, trailing off as the boos drowned her out.

And when Hinson claimed that judges who rule against Trump are engaged in "egregious abuses,” she was met by chants from the audience calling her a "fraud.”

Meanwhile, Flood also faced angry voters in his heavily Republican district, with Flood unable to defend certain provisions in the bill, including a last-minute addition that would make it harder for federal judges to enforce contempt rulings.

“This provision was unknown to me when I voted for the bill,” Flood said, admitting that he didn’t read the bill, which GOP leadership put up for debate in the middle of the night just minutes after releasing the amended text.

Given that House Republicans passed the dogshit bill right before Memorial Day weekend, few other GOP lawmakers have had time to hold town halls to see if this anger is widespread.

But polling shows that voters do not support cutting Medicaid and food stamps to fund tax cuts for the rich. So these displays of rage could be just the beginning for GOP lawmakers—most of whom have been hiding from their constituents by either holding heavily scripted events or eschewing town halls altogether.

Now House Republicans are trying to blunt the backlash by lying about what the legislation does. After the bill passed, the National Republican Congressional Committee, which seeks to elect Republicans to the House, issued a memo falsely claiming that it wouldn’t cut Medicaid.

“The One Big, Beautiful Bill is more than a messaging opportunity; it’s a midterm roadmap. Republicans must drive this contrast, simplify our message, and target Democrats every day. This is about fraud vs families. This is about taxes vs take-home pay. This is about securing the border vs subsidizing chaos. This is about putting working families first, not last,” the memo said.

Of course, independent analyses show that millions of Americans will lose Medicaid coverage and Affordable Care Act subsidies. And the lowest income brackets will actually see their take-home pay decline thanks to the bill, should Trump sign it into law.

Indeed, House Democrats are already gearing up to use this vote to hammer Republicans in the 2026 midterms.

“As the economy is tanking, consumer confidence is at historic lows, and millions are struggling to make ends meet, House Republicans decided to ignore it all… and advance an astonishingly detrimental bill – the GOP Tax Scam – that raises costs on working families while benefiting the wealthiest few,” the Democratic Congressional Campaign Committee wrote in a memo.

“It’s a vote that every single vulnerable House Republican will come to regret next year,” it said.

Meanwhile, Senate Republicans are now having their turn to amend the legislation, and they’re doing their usual performance of claiming that they won't back the bill because it adds to the deficit.

“In the House, President Trump can threaten a primary. Those guys want to keep their seats, I understand the pressure. He can’t pressure me that way," Sen. Ron Johnson of Wisconsin, who says he won’t vote for the bill because it increases the deficit, told Punchbowl News.

But given how cowardly Republicans continue to prove themselves to be, there’s no doubt that they’ll fall in line with Dear Leader.

Reprinted with permission from Daily Kos.