Yes, Republicans Are Happy To Raise Taxes -- On Poor And Working People

President Donald Trump displays signed executive order on tariffs

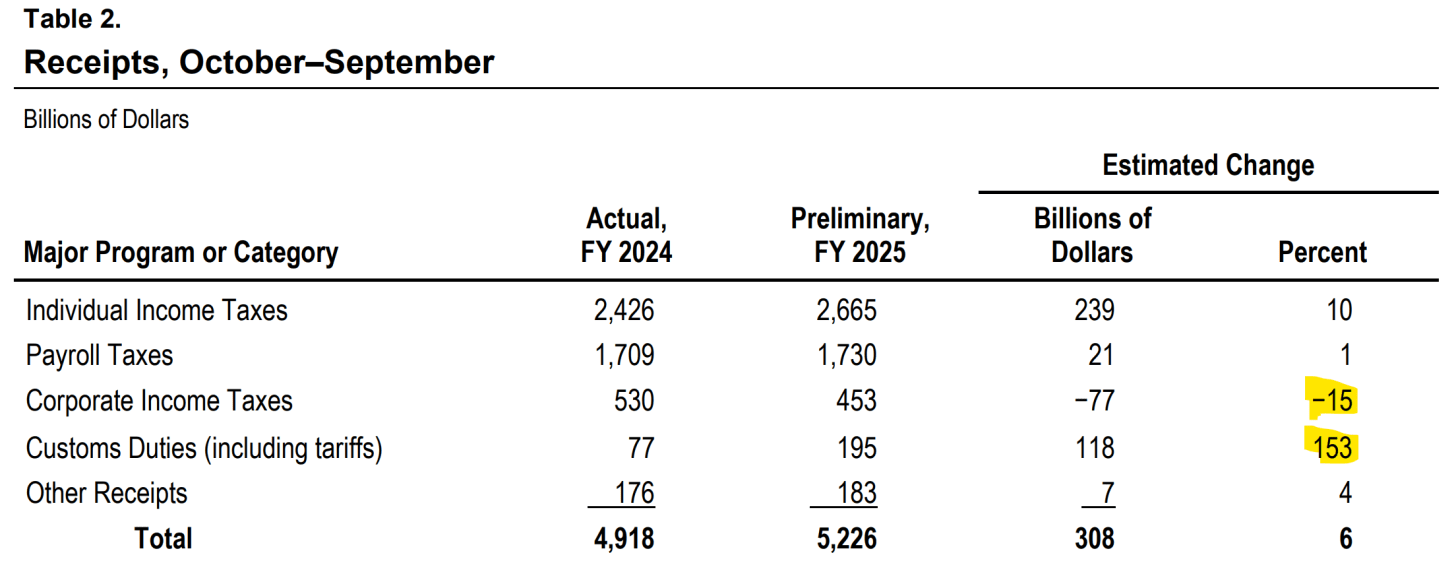

Here’s the latest fiscal data from Congressional Budget Office, a first look at fiscal year 2025 outlays and receipts (the table shows the latter):

The solid job market contributed to higher income and payroll taxes, but you’ll note that the largest percentage changes occurred for corporate taxes, down 15 percent, $77bn, and import taxes, up 153 percent, $118bn.

According to CBO, the decline in corporate receipts partly reflects early impacts of the Trump/Republican budget bill, in this case larger deductions for investments. The “customs duties” are, of course, the tariffs.

Two points.

First, contrary to ancient lore, clearly Republicans raise taxes. It’s just a matter of whose taxes they raise.

Now, as someone who is worried about our longer-term fiscal outlook—I didn’t used to feel that way, but the combination of rising interest rates1 and bipartisan disregard for the outlook flipped me—I’m the last person to blanketly condemn a tax increase.

But, and here’s the second point, why would you do so on the most vulnerable taxpayers, which is who tariffs mostly hit, versus the wealthy, which is who corporate taxes mostly hit? That there’s one of them rhetorical questions.

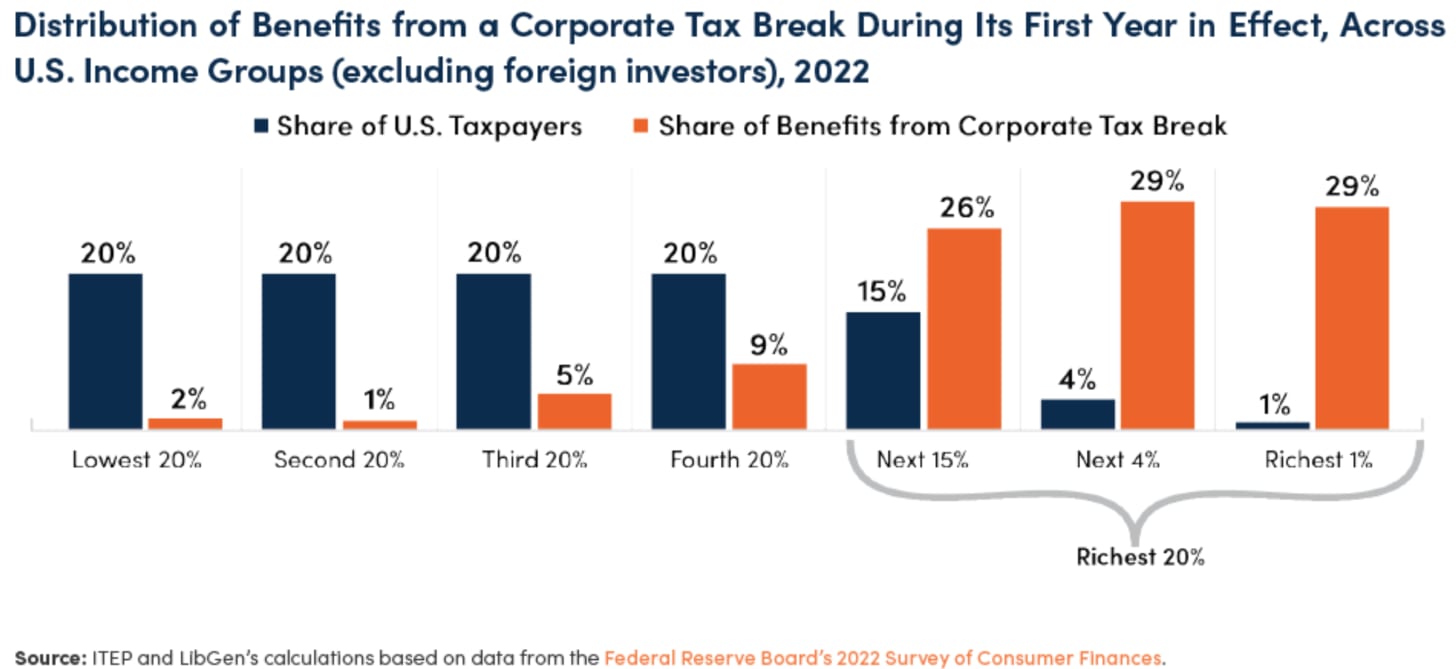

Here’s the distribution of corporate taxes from the excellent ITEP:

Note that 84% of the benefits of a corporate tax break accrue to the richest 20%, and 29% to the top 1%.

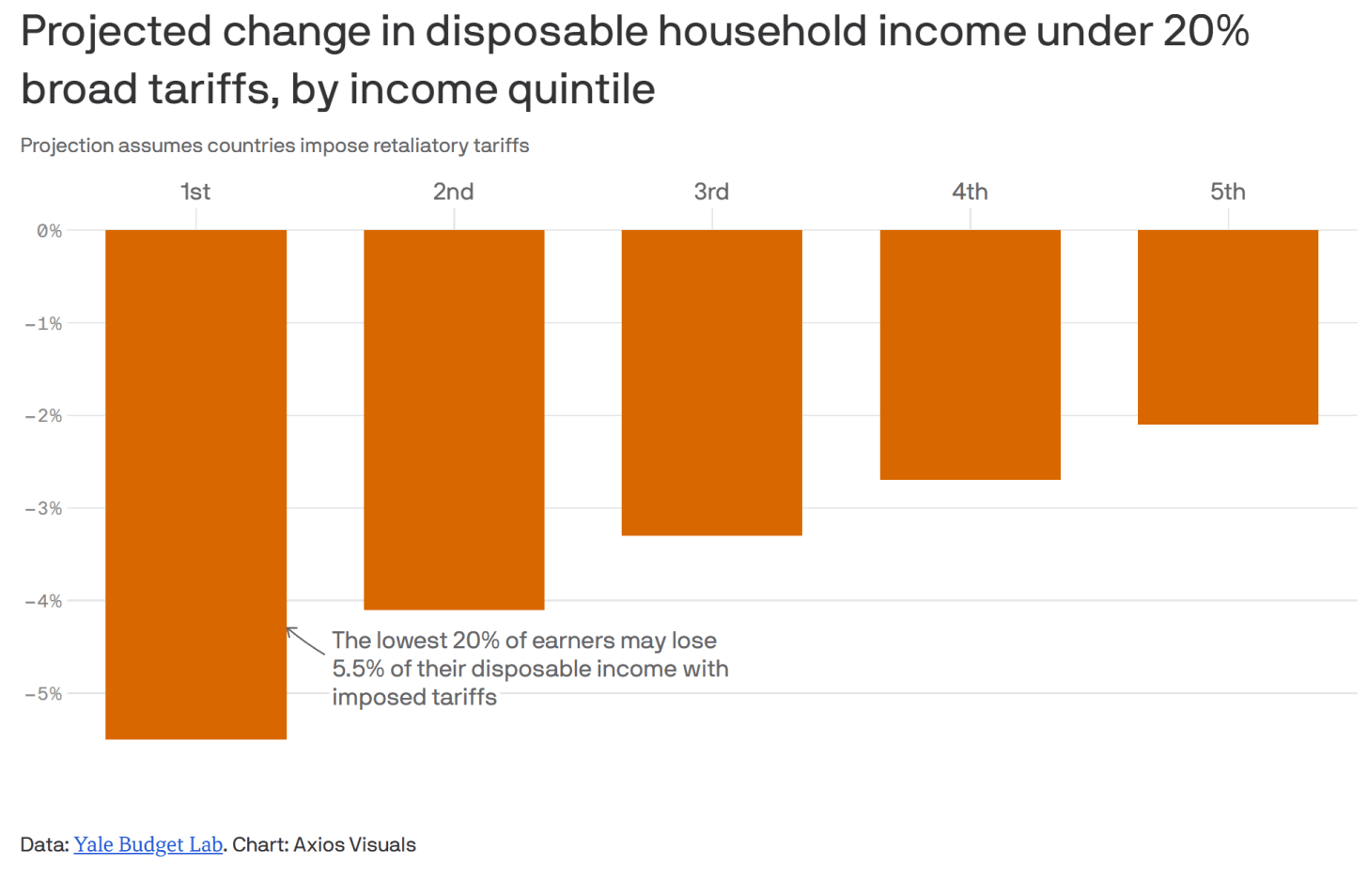

Here’s the tariff impact on household income, from Yale Budget Lab via Axios:

The “tax incidence” of tariffs falls more on middle- and low-income households, as imports are a larger share of their consumption baskets relative to higher-income households. Thus, tariffs are a regressive tax.

Because corporate taxes fall mostly on shareholders, who tend to have higher incomes, the corporate tax is considered to be progressive.

So, yes, we need more tax revenue. The CBO data show that the FY25 deficit will amount to ~6 percent of GDP, way too high for an economy that spent much of that year near full employment. In fact, the disconnection of revenue flows to the US Treasury from economic growth is a foundational fiscal problem, one born largely of decades of high-end tax cuts.

When I was in the Biden administration, I and many other revenue seekers always bridled at our policy of “not one penny!” of tax increases on households under $400,000. But the idea that you’d address this revenue shortfall by taxing the purchases of working class families already in the relentless grip of the affordability squeeze while cutting far more taxes for the wealthiest households makes no sense on either fiscal or fairness grounds. And I’m not even getting into the cuts in the health coverage of low- and middle-income households to partially offset the cost of those high-end cuts.

Speaking of health coverage, remember these tables and figures, and more importantly, the $4 trillion in debt-financing for their budget bill, when you hear the Rs squawking about not being able to pay for the restoration of the tax credits to help pay for health coverage, the terms Ds are demanding to end the shutdown.

At least for now, Ds are winning that fight, which makes a lot of sense to me, as we are in the middle of one of those moments where it’s crystal clear as to who is fight for whom.

Jared Bernstein is a former chair of the White House Council of Economic Advisers under President Joe Biden. He is a senior fellow at the Council on Budget and Policy Priorities. Please consider subscribing to his Substack.

Reprinted with permission from Econjared.

- Medicaid Cuts Loom As House Republicans Declare War On Red States ›

- Still No Jobs Report, But Trump's Labor Market Isn't Looking Good - National Memo ›

- - National Memo ›

- Fox News Spinning Madly To Make Sense Of Trump's 'Affordability' Message - National Memo ›

- How Trump Is Schooling Americans On The Economics Of Punitive Tariffs - National Memo ›

- Yes, The Fed Should Lower Interest Rates (Because Trump Is Wrong On The Economy) - National Memo ›