At this point, it’s clear to see that the Trump administration, along with their Congressional allies, who sit on their hands when told (tariffs) and raise them when told (the budget bill), are aggressively and successfully implementing a big, new economic agenda. As I’ll describe, it won’t work. It’s wrongheaded, ill-founded, and will hurt the people they said they want to help.

But before we get into that, I will give them this: they’ve been remarkably successful at moving policy through a clunky, incalcitrant political system, in part because they’ve legislated none of it so far (should it pass, the budget bill will be their first big piece of economic legislation; their crypto/stablecoin bill is stuck in the House, though this too is part of the plan, as I note below).

When I say “remarkably successful,” I mean the rest of us should learn from them. I’ve spent many years in gov’t, including in the Obama and Biden admins, and we self-imposed infinitely more barriers on what we wanted to do then the Trumpies (the same could be said for any admin since FDR, though he, of course, went the legislative route, one the Trumpies avoid). Basically, when a lawyer said “can’t do that,” or a political adviser said, “can’t go there because X won’t like it,” we listened.

Not these folks. They just do what Trump wants, and if the courts or some constituent group doesn’t like it, too bad. Their relentless energy to jam through their agenda, evil as it is, is a site to behold. I keep thinking, what if we did this with higher minimum wages, or abortion rights, or gun control, housing and child care, etc.?

I don’t want to overstate this case. Of course, exec orders can be and are flipped on day one by a new admin. And, as a naturally cautious, risk-averse dude, I’m sympathetic to measure thrice, cut once, vs. the Trumpies, “don’t measure! Cut!” But Ds need to learn some boldness from these folks about implementing your agenda.

Okay, with that off my chest, let’s look at their economic agenda, which is now in plain sight.

—Reduce global trade in order to reduce the trade deficit and reindustrialize U.S. industry. This one will fail for many reasons. First, they mistakenly view any trade imbalance as evidence of someone ripping us off, which is no more valid than arguing your grocery ripped you off when you willingly shopped there. Second, it’s too late to unscramble the globalization omelet: almost half of our imports are inputs into our own domestic manufacturing, which is why trade wars hurt, not help, domestic production. Third, there will be no reindustrializing. Even countries with persistent trade surpluses have their manufacturing job shares in decline.

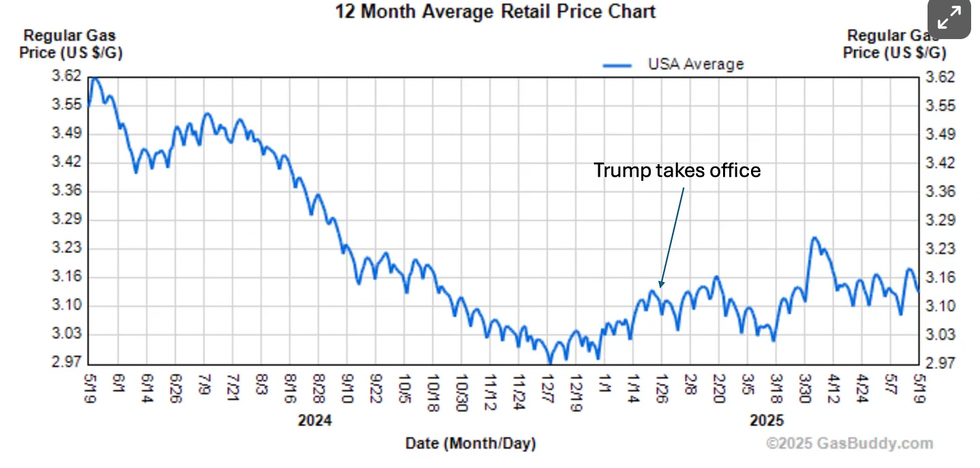

What will happen instead is higher prices for imports, some new revenue from the tariffs, some protected industries, like steel, doing better than they would have otherwise, though at the expense of other industries that buy tariff-induced, now-more-expensive outputs. Growth will, on net, be a bit slower for a time (assuming they eventually set the tariff rate and stick with it, a strong assumption), and inflation and interest rates higher for a time as well.

—Deport undocumented immigrants for the crime of being undocumented. I’ve had the misfortune of hearing Stephen Miller talk about the economics of this plan, which suggests he stuck with econ 101 for a few weeks and bailed too soon. His idea is that if we reduce the supply of labor by kicking out undocumented workers, employers will have to pay more to domestic workers.

This won’t work either. That is, as the figure shows (from Axios this AM), it will work in reducing net immigration, and, as I’ll discuss below, border control is a highly legit goal (of course, this goes way beyond that). But it will hurt the economy. For one, reducing labor supply is a negative for growth, one which will especially pinch in sectors like construction, health care, restaurants, meatpacking, hospitality services. For another, and this is a flaw in Miller and many others’ understanding of these dynamics, immigrants don’t just bring supply. They also bring demand.

With the push against immigration, "the economy will find itself slightly diminished in the long run and inflation will run a touch higher," economist Bernard Yaros writes in a report for Oxford Economics…

“The arrests cast a shadow over the local economy. Restaurant tables emptied. Kitchen workers stayed home. Fruit vendors disappeared from the streets. The number of shoppers at stores shrank, and those who still went didn't linger for long…"

"That means crops are not being picked and fruit and vegetables are rotting at peak harvest time," farmers and farmworkers told Reuters.

—Gut the safety net to very partially offset large tax cuts for the wealthy. This one is quite different from the first two because it explicitly and demonstrably hurts working class people (the above two do so as well, but as second-order effects; this one is first order). Here we have Trump in traditional R mode, passing a deficit-financed budget with which Reagan and the Bushes would be very familiar. But even they would be, like, “Wait up, Donnie. We always gave a few crumbs to the bottom end so we could say we we were helping everyone. We gave a little to the poor and a lot to the rich; we didn’t take from the bottom to give to the top.”

Like everything else here, it won’t work in terms of helping working class people because trickle-down never works. It will “work” in terms of enriching their traditional donor class. It it is also likely to eventually raise interest rates, potentially making debt service a much heavier lift than we’ve seen before (as we argue in a new paper, out soon).

—Block the production of renewable energy. This couldn’t be clearer in the big, stupid bill, and it’s so ridiculous that even traditional Rs like the Chamber of Commerce and energy companies that recognize renewable energy production is part of their and our futures don’t get it. It seems to be driven wholly by Trump’s nostalgia for coal and distaste for wind turbines blocking his view.

It won’t work in the sense that it will cost jobs, make energy more expensive, and slow us down in the global AI race.

There are other cats and dogs I won’t go into. A big one is compromising Federal Reserve independence. Kings don’t like independent Fed chairs, but this one will also backfire bigtime. History is clear that loss of central-bank independence is inflationary. (Jason Furman and I had a good talk yesterday about this and much of the rest of the above, here.) They’re also trying to normalize crypto and integrate it into the larger financial system. To say “that won’t work” is an understatement. Depending how far this highly volatile asset with zero use cases integrates into the system, it’s a future financial crisis in the making.

Also, as noted, controlling the border is, by definition, integral to having a country. And unfair trading partners exist. IOW, there are germs of truth in those parts of the agenda, but, and this is an aspect of their approach we should decidedly not emulate, they always go to the sledgehammer when the scalpel is what’s needed.

To say, as I do here, that an agenda that is in place won’t work is to make a empirical bet. I’m predicting worse growth, price, job, and interest rate outcomes than would otherwise occur. And this being economics, with millions of other variables endlessly zipping around, I could be wrong. If so—and it will take some time to know—I’ll be the first to say so. But I think and fear that I’m right.

Jared Bernstein is a former chair of the White House Council of Economic Advisers under President Joe Biden. He is a senior fellow at the Council on Budget and Policy Priorities. Please consider subscribing to his column for free at Jared's Substack.

Reprinted with permission from Substack.