Ukraine Is Our War -- And Joe Biden Is Our Wartime President

We and our allies are in a war to save civilization. Fortunately for us, Ukrainians are doing the fighting.

Russian President Vladimir Putin's barbaric assault on Ukraine has awakened Europe to the reality that he is truly evil and could continue his march westward. It is no coincidence that Sweden and Finland — once fiercely neutral countries — now show serious interest in joining NATO. Ukraine is not in NATO, which is why members of the military alliance have held back in sending in their forces.

It is also the West's good fortune that Joe Biden is president and not Donald Trump. Overseeing a flood of arms to Ukraine as it fights alone, Biden is playing Franklin Roosevelt to Ukraine's Winston Churchill, President Volodymyr Zelenskyy. And he's doing it carefully, working with allies to squeeze Russia financially and giving Ukraine the means to defend itself, all the while carefully trying to avoid a wider conflict.

This is a full-time job whose consequences are not politically helpful. Confronting Putin has raised the cost of gasoline. It's making food more expensive. The resulting inflation has hiked the cost of borrowing to buy a home.

This, plus the carnage in Ukraine, is making Americans feel bad. The tendency in such circumstances is to blame the president, even when the president is doing the best job possible managing crises that aren't his fault. (The one exception for Biden would be his fuzzy messages about easing immigration restrictions at a time of a surge at the border.)

Those worried about climate change must hold their tongues as Biden releases 1 million barrels of oil a day from the Strategic Petroleum Reserve. Same goes for his plan to open some public lands to new drilling.

It's hard to calculate the threat to national security had Trump won reelection — or succeeded in pulling off a coup after he lost. Trump was God's gift to Putin and his maniacal plans. Russians have owned him for decades.

In 1987, Trump took out full-page newspaper ads urging Americans to stop paying to defend others, the big subtext being to leave NATO. (George W. Bush and Barack Obama also called for other countries to raise defense spending but didn't dream of using that as an excuse to compromise U.S. security.)

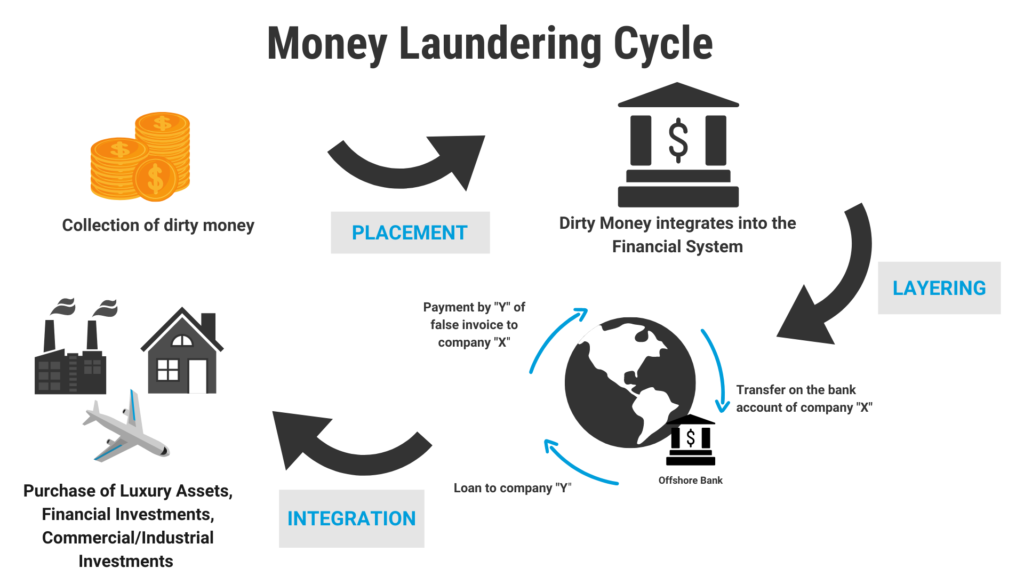

These were Russian talking points parroted by a real estate investor whom the Russians were bailing out of bankruptcies. Trump in return laundered Russian oligarch/mob money through sales of U.S. property in all-cash, anonymous transactions. One example is the deluxe Trump Towers in Miami's Sunny Isles Beach, now known as "Little Russia."

U.S. intelligence agencies concluded that Russians interfered with the 2016 presidential election to help elect comrade Trump. He came through for the Russians three years later when he blocked nearly $400 million in military aid to Ukraine.

Trump claims that Putin would never have invaded Ukraine had he still been president. This is the opposite of true. Trump's advisers reportedly warned him that blowing up NATO would be unpopular and could cost him reelection.

"Yeah, the second term," Trump is said to have responded. "We'll do it in the second term."

Had Trump succeeded, Putin would now have free rein to rampage through Eastern Europe and who knows where else.

After calling Putin "a genius" for invading Ukraine, Trump added, "I know him very well. Very, very well."

Apparently not nearly as well as Putin knows Trump.

As a wartime president, Biden has one mission: to stop the aggressor. He doesn't have the luxury to obsess over rough poll numbers related to inflation. And the culture wars can wait. Right now, the only war that matters is the one directed at defeating Putin.

Follow Froma Harrop on Twitter @FromaHarrop. She can be reached at fharrop@gmail.com. To find out more about Froma Harrop and read features by other Creators writers and cartoonists, visit the Creators webpage at www.creators.com.

Photo credit: jorono at Pixabay