The AI promoters have made grand promises about how AI will change everything and give us all happier, healthier lives. Maybe that will be proven right, but it’s fair to say they have not yet delivered.

However, AI workers may have the power to do something very important in the present, not some distant or not so distant future. They can save democracy.

Their route to saving democracy is by not doing AI, or at least not doing AI with their current employers. At the moment, AI is clearly driving the economy. Investment in data centers and the power plants to support them directly account for a large share of economic growth.

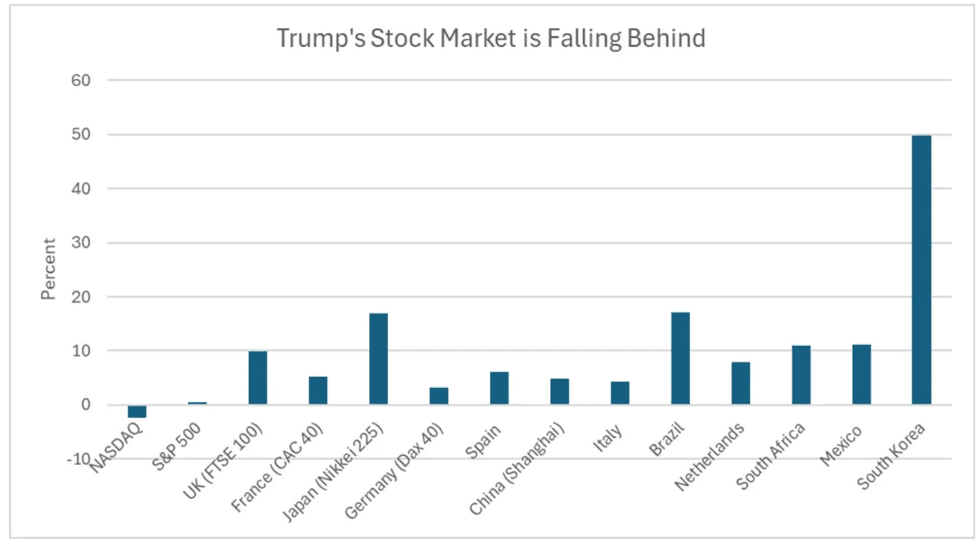

Probably even more important than the direct investment is the impact of AI on stock market wealth and thereby on consumption. We have seen a huge run-up in the stock market driven primarily by companies that are heavily invested in AI.

To take the obvious examples, Nvidia, which makes most of the key chips for AI, now has a market capitalization of almost $4.5 trillion. Its stock has risen 1500 percent in the last five years. Microsoft has a market capitalization of $3.4 trillion. Its stock price has doubled in the last five years. Apple and Meta’s stock prices have risen less dramatically, but now have market capitalizations of $3.8 trillion and $1.6 trillion, respectively.

Stock wealth translates into higher consumption as people spend annually between 2 and 3 cents on a dollar of stock wealth. In the last five years the market has added nearly $30 trillion in wealth as the market has more than doubled in value. That stock gain translates into between $600 billion and $900 billion in annual consumption spending, or 2-3% of GDP. This is clearly a huge factor in driving the economy.

If the AI bubble were to burst, this pattern of growth would come to an end. If I and many others are correct in calling AI a bubble, it will burst in any case, the only question is the timing.

One factor that could hasten the collapse would be if a substantial number of top AI researchers took a hike, and either took some time away from the industry (maybe literally take a hike) or moved into some other area of research. The big AI companies that have gone to great lengths to recruit top researchers would likely see their stock valuations plummet. This could quickly end the current AI frenzy.

How does this save democracy? In my crude analysis of our current politics, Trump has a hard-core base of around 25% of the electorate. This crew will be with Trump no matter what. As he put it some years back, he could kill someone on Fifth Avenue, and they would still support him.

Roughly 50% percent of the population oppose Trump, most of them very strongly as they see clearly the threat he poses to democracy and our fundamental rights. Then there is another 25% or so that may not really like Trump, they might even think he’s a jerk, but hey, their 401(k)s are up, the economy isn’t doing badly, so why not?

This group has been edging away from Trump in the last year, with polls showing his overall approval now hovering near 40%. But they would edge away far more quickly if their 401(k)s suddenly took a big hit and we got our second Trump recession. (The first one was in 2020, for the folks with bad memories.)

If Trump went from being slightly unpopular to being extremely unpopular, we would start to see Republican politicians in the House and Senate suddenly come back to life. Very few of this group have any real commitment to Trump. In fact, some of them were hardcore never Trumpers before he took over the party.

These politicians care first and foremost about their careers, and they will not wed themselves to a 79-year-old man whose popularity is sinking like a rock. They will start again acting like members of Congress and doing things like overseeing spending, limiting Trump’s barrage of executive orders, and reining in ICE, which Trump is using as his personal police force to terrorize the states and cities that support Democrats.

The top AI researchers have the ability to set this ball in motion. It may be some personal sacrifice, but these people’s skills will still carry enormous value a year or two from now. They will not go hungry. And if the bubble is going to burst anyhow, why not get out front and do something great for the world?

To be clear, in my view this is not an issue of doing something bad to the economy. I have written before on how it would be good if the AI bubble bursts sooner rather than later. The same was true for the 1990s tech bubble and the housing bubble in the 00s. In all these cases we would have been much better off if the bubbles had burst years earlier.

Huge amounts of resources were being misallocated. The larger the bubble, the more painful the readjustment process. And to be clear, an economy where all the consumption growth is coming from the richest 20 percent of the population is not a healthy one. Bringing that pattern of growth to an end soon looks pretty good in my book.

We know the top people in tech, folks like Jeff Bezos at Amazon and Mark Zuckerberg at Meta, are just fine with Trump’s destruction of democracy. But these are not the people who make their companies economic powerhouses. If the people who actually do the work step forward, they really can change the world. The rest of us will keep trying too.

Dean Baker is a senior economist at the Center for Economic and Policy Research and the author of the 2016 book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer. Please consider subscribing to his Substack.

Reprinted with permission from Dean Baker.