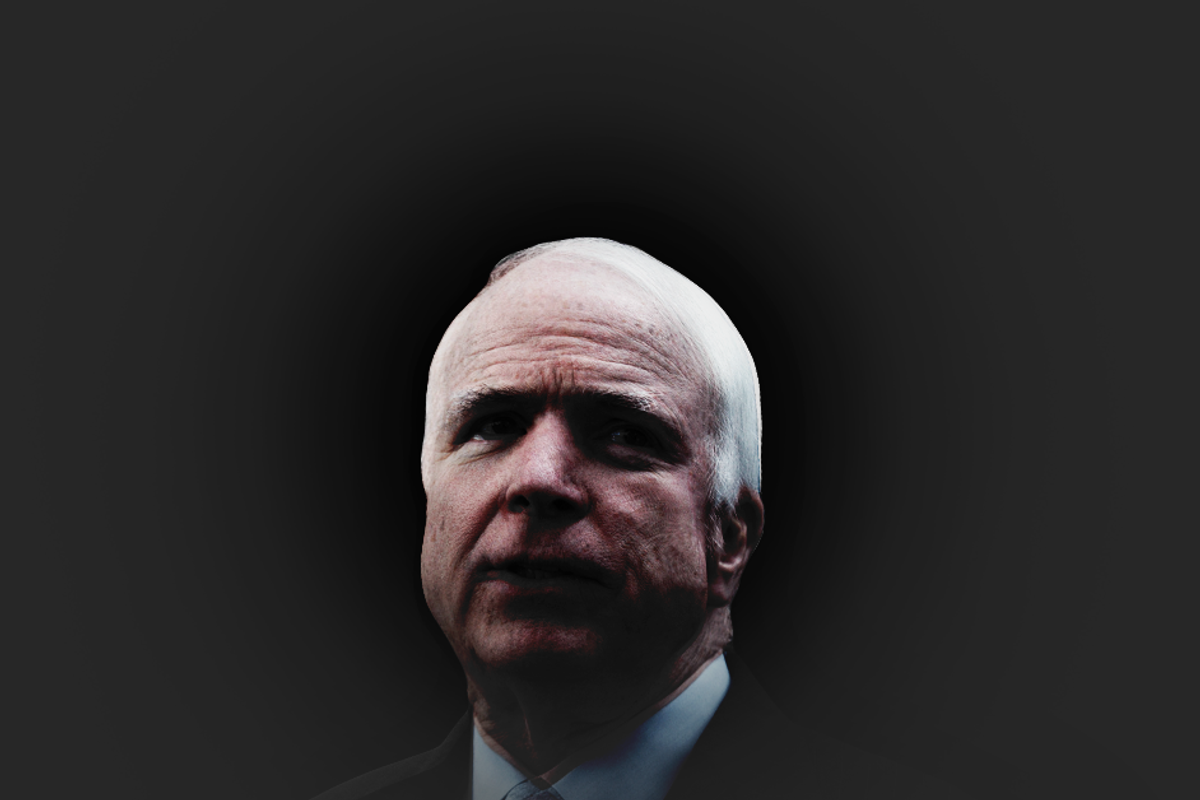

The late Sen. John McCain

The late Sen. John McCain didn't much like Obamacare, but in 2018, the Arizona Republican pulled it out from under then-President Donald Trump's hatchet. Why? Because McCain saw the "skinny repeal" measure as a sneaky attempt to eviscerate the health coverage of little guys to free up money for tax cuts favoring the wealthy.

Hold that thought as you look upon Trump's vow to extend much of his 2017 tax cuts in a second term. Here are some shocking numbers:

Extending the tax cuts would cost $4.6 trillion over 10 years at a time of already high deficits, according to the Congressional Budget Office. And projected U.S. debt as a share of GDP would rise by 36 percentage points to over 200% by 2054, numbers from the Center for American Progress.

Of course, there's a way for that not to happen. Huge cuts could be made to Social Security, Medicare, and the Affordable Care Act. Also Defense, research at the National Institutes of Health and even farm subsidies. And then what? Trump and company will say, hey, the debt crisis has left us with a choice. Social Security is simply unsustainable. That's the plan.

Drop the baloney about the 2017 tax cuts "paying for themselves," which is how they were falsely marketed. It's true that a few changes goosed some investments, according to Harvard economist Gabriel Chodorow-Reich, but the cuts didn't come close to offsetting the cost of them. On the contrary, they were deficit-financed, and so would be their extension.

While the middle class may lose benefits long taken for granted, its members would see little in the way of reduced taxes under Trump's proposed extension. While households with income in the top one percent would enjoy an average tax cut of more than $60,000 in 2025, those in the bottom 60% would see less than $500, according to the nonpartisan Center on Budget and Policy Priorities.

As for the original 2017 tax cuts, Trump claimed they would "very conservatively" boost household incomes by $4,000. As it happened, workers who earned less than $114,000 on average in 2016 saw zero benefit from the cut in the corporate tax rate. The top tenth of the one percent did considerably better with an average after-tax boost of $252,300 in income.

Trump's vow of another payday has some Wall Street magnates and tech billionaires setting aside their previous objections to his attempt to violently overthrow the American government. Not long ago, Blackstone Group co-founder Stephen Schwarzman, a big Republican donor, wisely argued that his party should look elsewhere for leadership. Now the multi-billionaire donor is back in harness and all for Trump.

"Wall Street has never been known for high character and high values," Dan Lufkin, co-founder of Donaldson, Lufkin & Jenrette, the investment bank where Schwarzman once worked, bluntly told Bloomberg News.

Bear in mind that many Silicon Valley and Wall Street billionaires are not rising to the bait, but arguing that Trump's contempt for the rule of law is actually bad for business. Reid Hoffman, co-founder of LinkedIn, wrote that without America's predictable, rules-based environment, "New York, and America, would not have become the hubs of innovation, investment, profit and progress that they are."

And what about Joe Biden? He would keep the tax cuts for Americans making less than $400,000 a year and let most of the other provisions in the 2017 law expire on schedule.

McCain was a conservative patriot who believed America was about more than money. The billionaires slobbering for more tax cuts are all about the money.

It's OK to like money. It's not OK to take it out of the little guys' hides.

Reprinted with permission from Creators.

- Five Shockingly Stupid (And Dangerous) Things Republicans Now Believe ›

- Florida Governor Lavished Trump Tax Break On Superyacht Marina ›

- Biden May Have Lost A Step -- But Trump Is Dazed, Confused And Kooky (VIDEO) ›

- Will Lara Trump Turn GOP Into 'GoFundMe' For Trump Defense Costs? ›