WASHINGTON (Reuters) – President Donald Trump swore in former Goldman Sachs banker and Hollywood financier, Steven Mnuchin, as Treasury secretary on Monday, putting him to work on tax reform, financial de-regulation, and economic diplomacy efforts.

The U.S. Senate voted to confirm Mnuchin 53-47, with all but one Democrat opposing him over his handling of thousands of foreclosures as head of OneWest Bank after the 2007-2009 housing collapse.

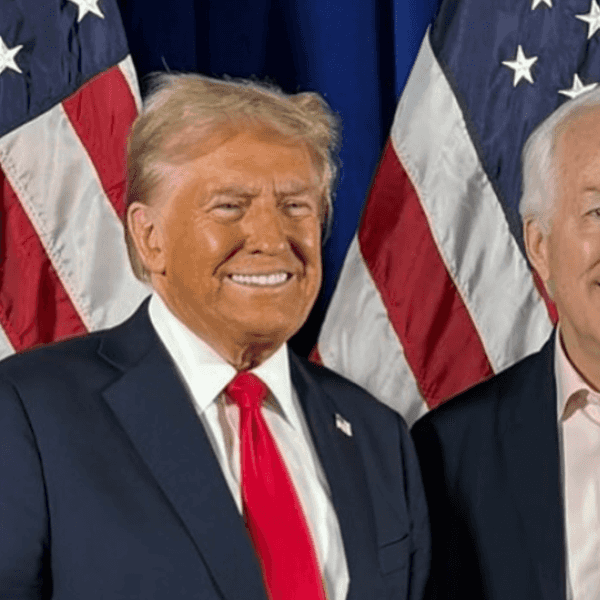

At a White House swearing-in ceremony, Trump said Mnuchin would be a “great champion” for U.S. citizens.

“He will fight for middle-class tax reductions, financial reforms that open up lending and create millions of new jobs, and fiercely defend the American tax dollar and your financial security,” Trump said. “And he will also defend our manufacturing jobs from those who cheat and steal and rob us blind.”

Lawmakers, lobbyists, and business groups have been nervously waiting for Mnuchin to take office and fill in the many blanks on how he will pursue tax reform and handle delicate economic cooperation efforts with China, Mexico, and other trading partners worried that Trump’s “America First” strategy will upend decades-old trade rules and currency practices.

Mnuchin, 54, provided no details of his plans as he was sworn in.

“I am committed to using the full powers of this office to create more jobs, to combat terrorist activities and financing, and to make America great again,” Mnuchin said.

Trump has pledged to roll back the stricter financial regulation under the Dodd-Frank reform law enacted after the financial crisis, pursue tougher trade policies on China and Mexico to reduce U.S. trade deficits, and reduce business tax rates.

CHALLENGES COMING UP FAST

Mnuchin faces immediate challenges with the March 15 expiration of a U.S. debt ceiling suspension, ushering in the threat of a new default showdown, and a March 17 meeting of finance ministers from the Group of 20 major economies, where he will face tough questions about Trump’s plans to increase trade protections.

In April, Mnuchin will have to determine whether to declare China a currency manipulator as part of Treasury’s semi-annual currency report.

“There is a real open question as to whether this administration is going to cut itself off from international monetary cooperation, whether it’s exchange rate policies or attitudes towards multilateral institutions or international regulatory policy,” said Edwin Truman, a former Treasury and Federal Reserve official now with the Peterson Institute for International Economics

Among Mnuchin’s biggest jobs is managing a sprawling congressional tax reform effort that seeks to slash business tax rates and enact a new border tax adjustment system aimed at boosting U.S. exports.

Mnuchin will quickly need to build a core management team to handle such challenges.

Treasury and White House representatives did not respond to requests for comment on Monday on reports that Trump would soon nominate David Malpass, a former economist at failed Wall Street bank Bear Stearns, as Treasury undersecretary for international affairs, the agency’s top economic diplomacy job.

Malpass, a Trump campaign adviser who had been leading Treasury transition efforts, was seen as a leading candidate for the job, with experience from international economic posts in the Ronald Reagan and George H.W. Bush administrations.

Other names that have been floated for senior posts include Goldman Sachs banker Jim Donovan for deputy Treasury secretary and Justin Muzinich, a former Morgan Stanley banker, for undersecretary of domestic finance.

“FORECLOSURE MACHINE”

Mnuchin, a second-generation Goldman Sachs banker who led the firm’s mortgage bond trading but left the bank in 2002, came under fire from Democrats over his investor group’s 2009 acquisition of another failed lender, IndyMac Bank, from the Federal Deposit Insurance Corp.

The bank, rebranded as OneWest, subsequently foreclosed on more than 36,000 homeowners, drawing charges from housing advocates that it was a “foreclosure machine.”

Mnuchin grew OneWest into Southern California’s largest lender and sold it for $3.4 billion in 2015. He has also helped finance Hollywood blockbusters such as “Avatar,” “American Sniper” and this past weekend’s box office champion, “The Lego Batman Movie,” which took in $55.6 million.

The Senate on Monday also unanimously confirmed David Shulkin as secretary of veterans affairs, putting the only holdover from the Obama administration in charge of the second largest federal agency. Shulkin had been in charge of the VA’s sprawling health system for the past 18 months.

(Additional reporting by Emily Stephenson; Editing by Peter Cooney and Leslie Adler)

IMAGE: U.S. President Donald Trump (L) watches as Vice President Mike Pence (R) swears in Steve Mnuchin as Treasury Secretary next to his fiancée Louise Linton in the Oval Office of the White House in Washington February 13, 2017. REUTERS/Yuri Gripas