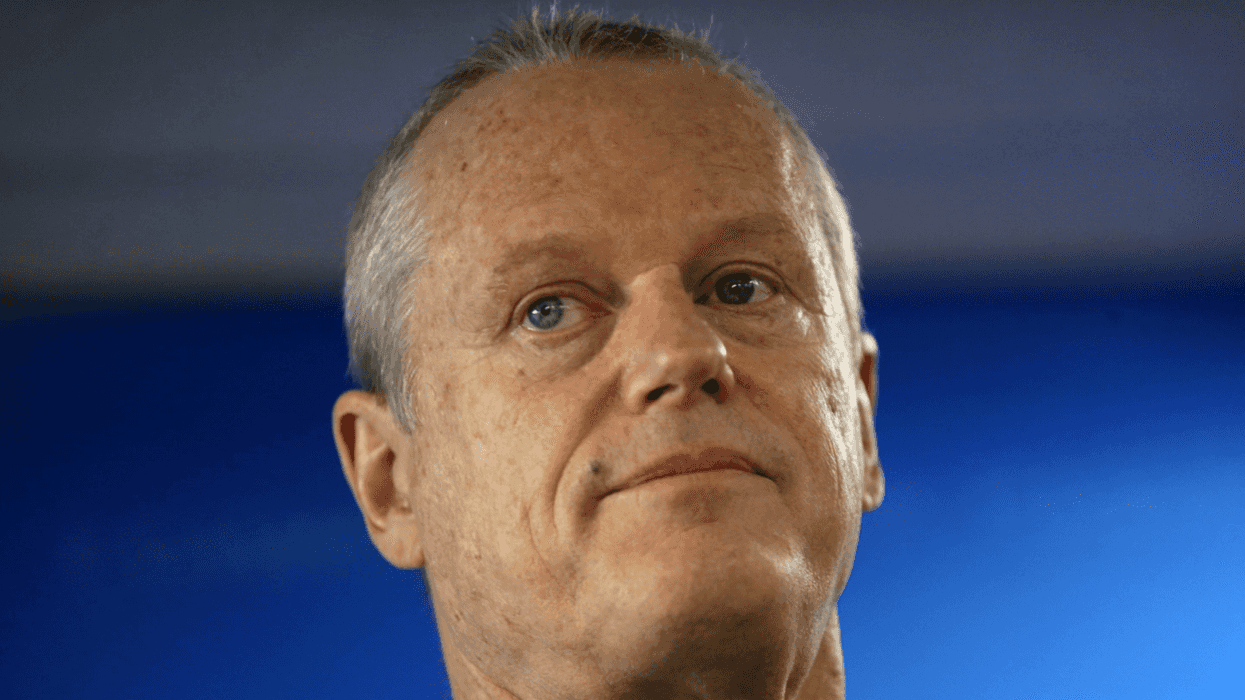

Massachusetts Gov. Charlie Baker Won't Seek Third Term -- And Why Would He?

There's a lot not to like about running as a Republican in New England. Where do we start?

Let's start with Charlie Baker, the Republican governor of Massachusetts. Though Massachusetts is one of the most Democratic states in the country, Baker remains very popular among the voters. His approval ratings rarely strayed below 60 percent, even in the depths of the COVID-19 crisis. If Baker ran for another term in the 2022 general election, he'd probably win handily, but he has decided not to run. Why?

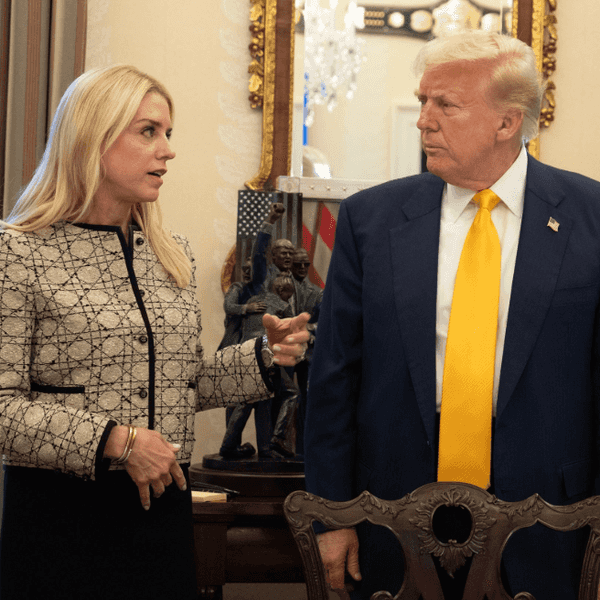

Because between now and next November, he faces a primary in a Republican Party that has gone haywire. Former President Donald Trump has vowed to take down Baker. (He's already endorsed former state Rep. Geoff Diehl, the only well-known Republican running in the party's primary.) Baker evidently doesn't want to play in the nasty clown show sure to follow.

Baker didn't vote for Trump in 2016 and 2020, leaving that presidential line on the ballot blank. He also called for Trump's removal from office following the violent January 6 attack on the Capitol. These are reasons why Trump cannot abide Baker. They're also reasons why Baker could easily win another term as a Republican governor of Massachusetts.

Actually, Massachusetts has had a long line of moderate Republican leaders, notes Bob Whitcomb, who followed them closely as a reporter for the old Boston Herald Traveler.

The Republican governors — John Volpe, Francis Sargent, Bill Weld, Paul Cellucci, Jane Swift, Mitt Romney (at least as governor), and now Baker — "believed in thoughtful and incremental change (no utopian schemes!) to improve life in their state," Whitcomb told me. "Unlike the increasingly nihilist Trump national GOP, which is not 'conservative' but radical right wing, they believed in working with Democrats to actually get things done rather than spending their time spewing rhetoric."

A significant milestone in the party's New England decline was reached early in 2001, when Sen. Jim Jeffords, a Vermont Republican, objected to then-President George W. Bush's $1.6 trillion tax cuts. He thought them fiscally irresponsible, which they were.

The Bush administration hit back with dark hints that revenge might be taken on Vermont's struggling dairy farmers. Jeffords fled the party and became an independent, caucusing with Democrats. That moved control of the Senate from the Republicans to the Democrats. (You can imagine the threats.)

The rich suburbs in Connecticut's Fairfield County used to be reliably Republican. By 2008, Chris Shays, the moderate who represented them, was the last New England Republican to serve in the House. That year, the 10-term Shays lost to Jim Himes, only the second Democrat to represent the district since 1943. A former Goldman Sachs executive, Himes is nobody's idea of a socialist. He shares the fiscally conservative, socially liberal bent of his electorate, sort of like Shays.

Charlie Baker was also a business guy. One wishes abused Republicans like him would gird their loins and join the Democratic Party. In the process, they could buttress its moderate coalition.

As of last month, Baker had amassed an impressive campaign war chest and polls showed him in "a very strong position to seek reelection," according to his spokesman.

Baker clearly does not want to subject himself to the attentions of the feral Trump and his bitter elves. He and Lt. Gov. Karyn Polito put it more diplomatically in their explanation for not running."We want to focus on recovery, not on the grudge matches political campaigns can devolve into," they wrote.

And so, on the prospect of facing a Trumpian pillage of himself and his ability to competently govern, his selling point, Baker decided, no thanks. Who, really, can blame him?

Follow Froma Harrop on Twitter @FromaHarrop. She can be reached at fharrop@gmail.com. To find out more about Froma Harrop and read features by other Creators writers and cartoonists, visit the Creators webpage at www.creators.com.