Reprinted with permission from DCReport

As Donald Trump fights to keep his tax and business records from Manhattan prosecutors it's time to alert Americans that tax returns used to be public. Congress could make them public again. If it did every honest taxpayer would benefit.

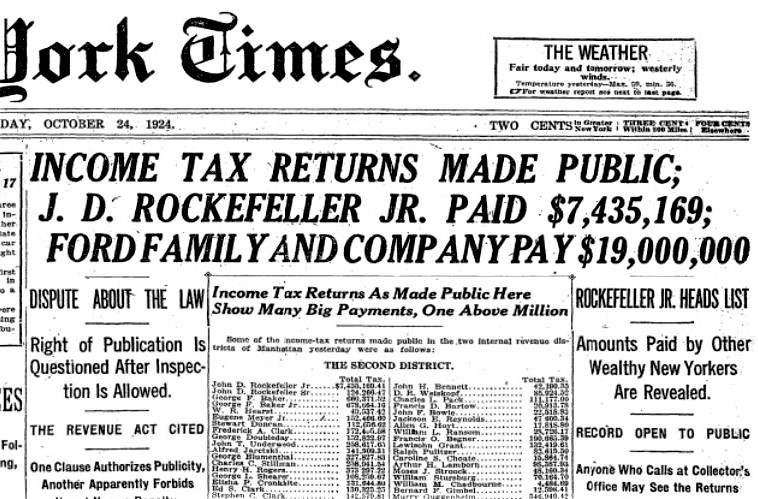

In 1924 how much the rich paid the taxman was front-page news. Newspapers back then published lists that revealed who was really rich (John D Rockefeller stands out) and those who were either poseurs claiming great wealth yet paying little tax or were likely tax cheats who failed to report their income fully.

Strong evidence exists that Trump is both a poseur and a cheat, as we've shown again and again at DCReport since we published Trump's 2005 income tax return three years ago.

Under Trump, the odds are just one in 84,000 that the IRS will recommend prosecution for tax crimes, an all-time low.

Cheating is easy for people so rich who own corporations outright thanks to Congress, which since not long after 1924 has wrapped tax returns in extreme secrecy. That secrecy is a huge boon to rich business owners lacking in scruples and the opposite of how Congress treats workers, pensioners and most stock market investors.

Congress doesn't trust most Americans to file honest tax returns. That's why taxes are withheld from paychecks and pension checks before workers and retirees get paid. And Congress requires employers and pension plans to tell the IRS how much was paid.

Oct. 24, 1924

Stock market investors, in the last decade, have had their profits independently verified by investment houses because of a law Congress passed after I wrote about simple techniques for underreporting stock profits. Before this law, investors could easily inflate the price they paid when they bought stocks, improperly understating their reported profits.

In contrast, Congress trusts people who own their own businesses to fully report their incomes and never take inappropriate deductions. There is little independent verification. Donald Trump and the Trump Organization with its more than 500 separate businesses fit this model of unverified income to a T.

Independent verification works. IRS officials note that in the 1970s Congress required that all children be issued Social Security numbers. To take the child tax deduction, parents then had to name each child and list their Social Security number. Seven million American children suddenly disappeared, at least from tax returns.

Our tax system is riddled with unproductive loopholes, including a big one Trump lobbied for that benefits real estate owners who buy property entirely with borrowed money.

Reagan On Tax Fairness

President Ronald Reagan, who sought office as a tax rate cutter and then delivered, opposed such favors and argued against a system that "allows the wealthy to avoid paying their fair share."

Reagan complained that loopholes "sometimes made it possible for millionaires to pay nothing, while a bus driver was paying 10% of his salary, and that's crazy," he said a 1985 speech at a Georgia high school.

"What we're trying to move against is institutionalized unfairness. We want to see that everyone pays their fair share, and no one gets a free ride. Our reasons? It's good for society when we all know that no one is manipulating the system to their advantage because they're rich and powerful. But it's also good for society when everyone pays something, that everyone makes a contribution," Reagan said.

Ever heard Trump say anything like that?

I've been researching tax secrecy and cheating because I'll be on an American Bar Association panel Oct. 2 with Professor George K. Yin of the University of Virginia, a former chief of staff for the Congressional Joint Committee on Taxation. Pamela Fuller will moderate the panel, for which lawyers can get Continuing Legal Education credits. I'm not a lawyer but have taught tax and other legal issues at Syracuse University's College of Law since 2009.

What struck me while reviewing the secrecy issue was that restoring the law from 1924 would have saved our country a lot of pain, allowed prosecutors to do their work efficiently, and ended any doubt about whether Trump is an honest taxpayer or a criminal tax cheat who belongs behind bars.

Just peeling back part of the tax secrecy wrapper could go a long way to make our tax system fair while discouraging crooked tax filings.

Under existing law, the tax returns of corporation owners like Trump are untouched, unless the IRS audits. If not, whatever the business owner puts down is accepted as accurate. It's a system that invites cheating. Reports and studies by the IRS, the Taxpayer Advocate, the Government Accountability Office, experiments designed by economists and tests devised by state governments all show that integrity in taxes requires independent verification and enough audits to make the least honest comply out of fear of prosecution.

The problem for honest taxpayers is that Congress has for decades been reducing the size of the IRS. Since 1999, the economy has grown 70%, adjusted for inflation, while the number of tax auditors has been cut by a third and the number of tax collectors halved.

Few Tax Crime Cases

Our government has nearly stopped trying to identify criminal tax cheats. Under Trump, Americans filed nearly 154 million individual tax returns in 2018. The IRS recommended just 1,824 taxpayers for prosecution.

Under Trump, the odds are just one in 84,000 that the IRS will recommend prosecution for tax crimes, an all-time low. Such tiny odds make tax cheating arguably the lowest risk white-collar crime in America. During the Obama years, tax enforcement was more rigorous than under President George W. Bush, but only moderately more so.

The record low number of IRS criminal referrals under Trump is less than half the 3,896 cases referred for prosecution in 2014, the peak year for Obama administration actions against suspected tax cheats. In both years most of the cases recommended for indictment involved drug traffickers or corrupt politicians, not business owners who cheat our government.

Prosecutions are plummeting even faster. Federal tax prosecutions in 2020 were down more than 73% from 2015, according to data that by federal court order the IRS must turn over to Syracuse University researchers.

The collapse of tax law enforcement has a silver lining, sort of. The shriveling tax law enforcement numbers indicate that in this one area Trump is no hypocrite since he's not pushing our government to prosecute others for things he has done.

And Trump at least files tax returns. More than 800,000 high-income Americans didn't file a tax return in 2013, 2014, and 2015. The awful truth is that the IRS is not even attempting to contact a half million of these prosperous tax scofflaws, the Treasury Inspector General for Tax Administration revealed earlier this year.

How many high-income Americans failed to file tax returns during the Trump era won't be known unless the Inspector General looks at the issue again. But does anyone believe that Trumpian rhetoric encourages integrity in our tax system?

Trump is not solely to blame here. Congress has for decades been trimming the IRS budget. The odds of audit under President Ronald Reagan in 1988 were around ten percent; today it's around one percent. Reagan also wanted and got corporations to pay higher taxes under the 1986 Tax Reform Act.

The combination of few audits, inadequate staff to pursue high-income people who don't even file tax returns and the secrecy provisions of the tax code are a boon to rich business owners short on scruples. The question we should ask ourselves is why do we elect lawmakers in both parties who trust business owners but not the rest of us? Why do we tolerate rules that help one segment of the rich cheat on their taxes?

Rampant Cheating at Top

Reviving the law that made tax returns public, or at least modifying it to partially back the secrecy wrapper, would go a long way to reducing the rampant tax cheating at the top. So, would authorizing the IRS to let any inquiring citizen know whether any other person has filed a tax return.

Tax secrecy is so prophylactic that the IRS cannot even say if someone is under audit.

Candidate Trump claimed he was under audit, citing it as an excuse for withholding his tax returns. It was a phony argument since the release of a filed tax return has zero impact on the return or the taxes owed.

Trump was asked to produce audit letters. He ignored the requests.

An IRS audit letter is an anodyne document that reveals only what year and what type of tax return is being examined. Thus, Trump's claim could have applied to just one of his hundreds of businesses or to, say, the value he put down on a gift to his youngest son,

Given Trump's thoroughly documented history of lying there's no reason to believe he was in fact under audit.

The Manhattan prosecutors already have Trump's New York State tax returns and the information that the IRS routinely shares with state tax authorities. The grand jury subpoenas Trump is fighting are for records of his accounting firm, Mazars USA. Those records, including the emails and draft returns, would be crucial to nailing a tax crimes case against Trump, his three oldest children, the Trump Organization and perhaps others who enabled their conduct.

The Manhattan case appears to be a garden variety tax cheating case notable only in that it evidently went on year after year. The subpoenas are for records dating to 2011, which is long before Trump assumed office in 2017. It is also long before he made hush-money payments to a porn star and a Playboy model.

Trump lawyer Michael Cohen pleaded guilty to federal charges in connection with the hush money payments and other actions he testified that he took at Trump's direction, Trump is "Individual 1" in that federal case. Trump was not indicted because of the Justice Department's policy is to not indict sitting presidents.

There's good reason to believe Trump knows the accounting records he wants to keep secret will reveal he is a serial tax cheat deserving of a long prison sentence.

First, Trump lost two income tax fraud trials over his 1984 state and city tax returns, a story I broke four years ago. The trials showed that Trump not only fabricated more than $600,000 of phony tax deductions, but he also altered one return to put his tax accountant's name on the return he filed. The accountant, Jack Mitnick who was also Trump's longtime tax lawyer, testified that he never signed the tax return in evidence.

Second, Trump has gone to extreme lengths to hide accounting records. Trump and his crew came up with one absurd excuse after another to hide records of the Grand Hyatt Hotel from New York City auditors. Eventually, the auditors proved that Trump tried to cheat the city out of almost $3 million for a single year, as I reported in The Making of Donald Trump.

Third, the tax and business documents that Mary Trump, the president's niece, gave to The New York Times showed he and his siblings are calculated tax cheats. The president's older sister, Maryanne Trump Barry, resigned from the federal bench to shut down a judicial inquiry into whether she is a tax cheat. (A nice privilege that judges grant themselves, terminating ethics investigation if a judge who resigns.)

Tax secrecy is a modern concept. In ancient Athens, where democracy began, public officials had their transactions recorded in stone, and individuals who failed to keep accounting records were not allowed to leave Athens.

It's time to embrace the wisdom of the ancients. Tax secrecy benefits cheaters, not honest taxpayers. Donald Trump's fear that prosecutors might see his tax and business records makes that clear.

- Manhattan DA Reportedly Subpoenas 8 Years Of Trump Tax Returns ›

- Why Does America Want To See Trump's Tax Returns? - National ... ›

- 9 Key Points About Trump's Income Taxes (And Many More Questions) ›

- New Subpoena Will Demand Trump Tax Returns (Including Ivanka ... ›

- Trump Insists That You Taxpayers Pick Up His Lunch Tab - National Memo ›