Trump Insists That You Taxpayers Pick Up His Lunch Tab

Trump Uses Taxpayer Money To Feed Himself

Reprinted with permission from DC Report

Buried near the end of the 5,593-page law granting new coronavirus relief is a special interest tax favor of the kind that Republican saint Ronald Reagan cut in half when he waged war on the "three-martini lunch."

This new special interest tax break is worth a lot more to business owners than the long-delayed and miserly $600 or smaller checks for most people. The Trump administration and Mitch McConnell, the Senate majority leader, once again favor business over people.

The law doubles the tax deduction for most business meals from 50 percent to 100 percent.

'It just doesn't seem right for a wage earner carrying his tuna fish sandwich to work to subsidize exorbitant business lunches at luxury restaurants.' —President Ronald Reagan

Ever since Reagan's 1986 Tax Reform Act, as a general rule, Section 274 of our tax code allowed only a 50 percent deduction for meals while traveling on business, meeting with customers, partners or associates or attending a business seminar. Employees got fully reimbursed, but employers could only deduct half, which prompted personnel policies restricting how much all but the most highly paid workers could claim for meals while on company business.

This new favor benefits most businesses, but few as much as Donald Trump, who will enjoy a double benefit. The change was introduced at the last minute at the insistence of the Trump White House. There has been no public hearing or even public debate about its merits.

Three Benefits

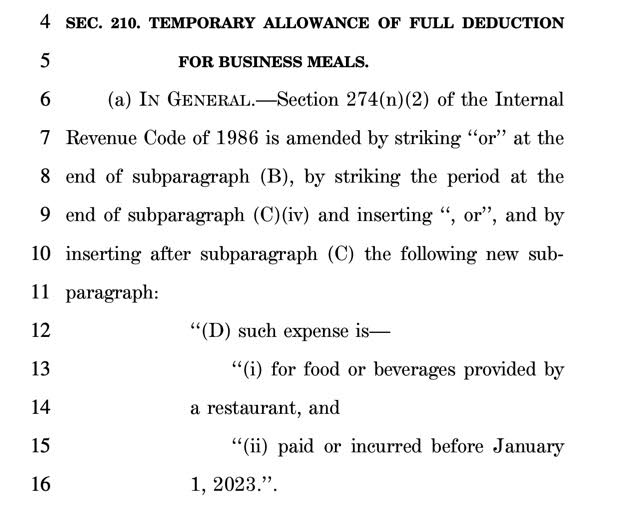

The 12 lines of revised tax law on Page 4,956 of the Consolidated Appropriations Act, 2021 provide these tax benefits:

- Businesses with a lot of employers on the road or many meetings can deduct the full cost of such meals, the equivalent of a slight tax rate cut.

- Sole owners, like Trump, who bear the full burden of spending by their enterprises, will feel concentrated benefits. Had the provision been in effect during the last decade it would have saved me thousands of dollars in income taxes because of extensive global travel for investigations and lectures.

- Restaurant owners benefit because businesses will be more liberal in expense allowances.

That third point matters because as many as 85 percent of small, individually owned restaurants may go broke due to COVID-19 shutterings, restaurant industry advocates say. But these mom-and-pop operations will benefit far less overall than the kind of expensive dining establishments favored by corporate executives, sales executives and other highly paid workers.

Trump as owner of golf, hotel and restaurant businesses will benefit every time he or his employees wine and dine a customer, vendor or potential customer because he will get to deduct the entire cost of meals instead of just half.

Then he benefits again when others spend money dining at his golf resorts, hotel and restaurants because full deductibility should result in more spending on meals.

But wait, there's more.

This complete deductibility of business meals will continue from New Year's Day until the end of 2022. The pandemic is likely to be history sometime early in 2022, making clear that this tax break is not targeted at the beleaguered restaurant industry but at a return to the era of the three-martini lunch. Expect lobbying to extend the tax break.

Reagan's Tax Policy Killed

Republicans voted to level the playing field when it comes to restaurant meals in 1986. That's when Reagan championed a tax code that actually raised levies on business and reduced deductions for extravagances. Trump, who often claims Reagan's mantle, consistently promotes tax policies that would infuriate The Gipper.

Reagan said this during a June 7, 1985 meeting with economics writers at the White House:

"Why not find smarter ways to put our money to work than investing so heavily in executive lunches? It just doesn't seem right for a wage earner carrying his tuna fish sandwich to work to subsidize exorbitant business lunches at luxury restaurants.

"We'd still allow for legitimate expenses, but to those who complain they can't live quite so high off the corporate account, we can only ask: Why not brown-bag it once in a while?"

Business lobbyists, from the get-go, have been gutting the many level-the-playing field provisions Reagan championed, loading up on favors for themselves and shifting the burden onto working Americans. That includes the massive borrowing required under Trump's 2017 tax law to shower tax savings on the richest among us.

Also, under the 2017 tax law that Trump signed, his only significant legislative achievement, 20 percent of taxpayers lost the ability to deduct mortgage interest, state income tax, local property taxes and other tax breaks. The changes mostly affected married couples with three or more children, especially among the upper-middle class.

This year only about one in ten taxpayers, and perhaps as few as one in 20, will itemize deductions. But those who own their own businesses – from people operating on the scale of Trump to freelance graphic artists – will get benefits. Under Trump the tax code has become more favorable to the self-employed and business owners and less so for employees.

- How Democrats Can Make Trump Pay For His Tax Fraud - National ... ›

- The Trump Tax Cuts Were A Mammoth Fraud - National Memo ›

- 9 Key Points About Trump's Income Taxes (And Many More Questions) ›

- How Tax Secrecy Protects Trump — And Hurts You - National Memo ›

- GOP Tax Plan Hides Trillions In Sweetheart Deals For Apple And ... ›

- Trump Tax Plan: Exploding Deficits And Bonanzas For the Super-Rich ›

- Trump's Tax Plan: The Grifters Do 'Tax Reform' - National Memo ›

- Trump business deductions: sketchy, normal or in-between? ›

- Trump Tax Write-Offs Are Ensnared in 2 New York Fraud ... ›

- President Trump's Tax Deductions—and Yours - WSJ ›

- White House secures 'three martini lunch' tax deduction in draft ›

- Opinion | Republicans, Not Biden, Are About to Raise Your Taxes ... ›

- Trump's Tax Plan: How It Affects You ›