When Scott Bessent Claims Trump Is Making Life Affordable, Who Believes Him?

President Donald Trump with Treasury Secretary Scott Bessent in the Oval Office

When it comes to the economy, the thing American households care most about by far these days is affordability, aka the cost-of-living, aka what things cost.

Note that while, of course, inflation is related to this concern, it is by no means the same thing. Telling people who want lower prices that they’ve got slower inflation is a slight-of-hand that they interpret as gaslighting. They want lower prices; you’re (falsely, as shown below) claiming that you’re delivering slower-growing prices.

Treasury Secretary Scott Bessent has been on a campaign to convince people that life is a lot more affordable under his boss, despite the fact that this is false and people know it’s false. The fact that his boss and party are refusing to reconsider their policy to make health-coverage premiums rise sharply for tens of millions of Americans just makes their affordability falsehoods that much more transparent.

First, here’s Sec’y Bessent on Face the Nation last Sunday:

MARGARET BRENNAN: [Americans] are seeing prices still high on furniture, energy, gardening, lawn care, apparel. Do you expect these things to cool off and when?

SEC. BESSENT: Well, it is cooling off because the core inflation number that you referenced was 0.2% which is down the- from the previous sequence over the previous months. And you listed the things that are up, but we’re seeing plenty of things that are down, whether it’s energy and rents.

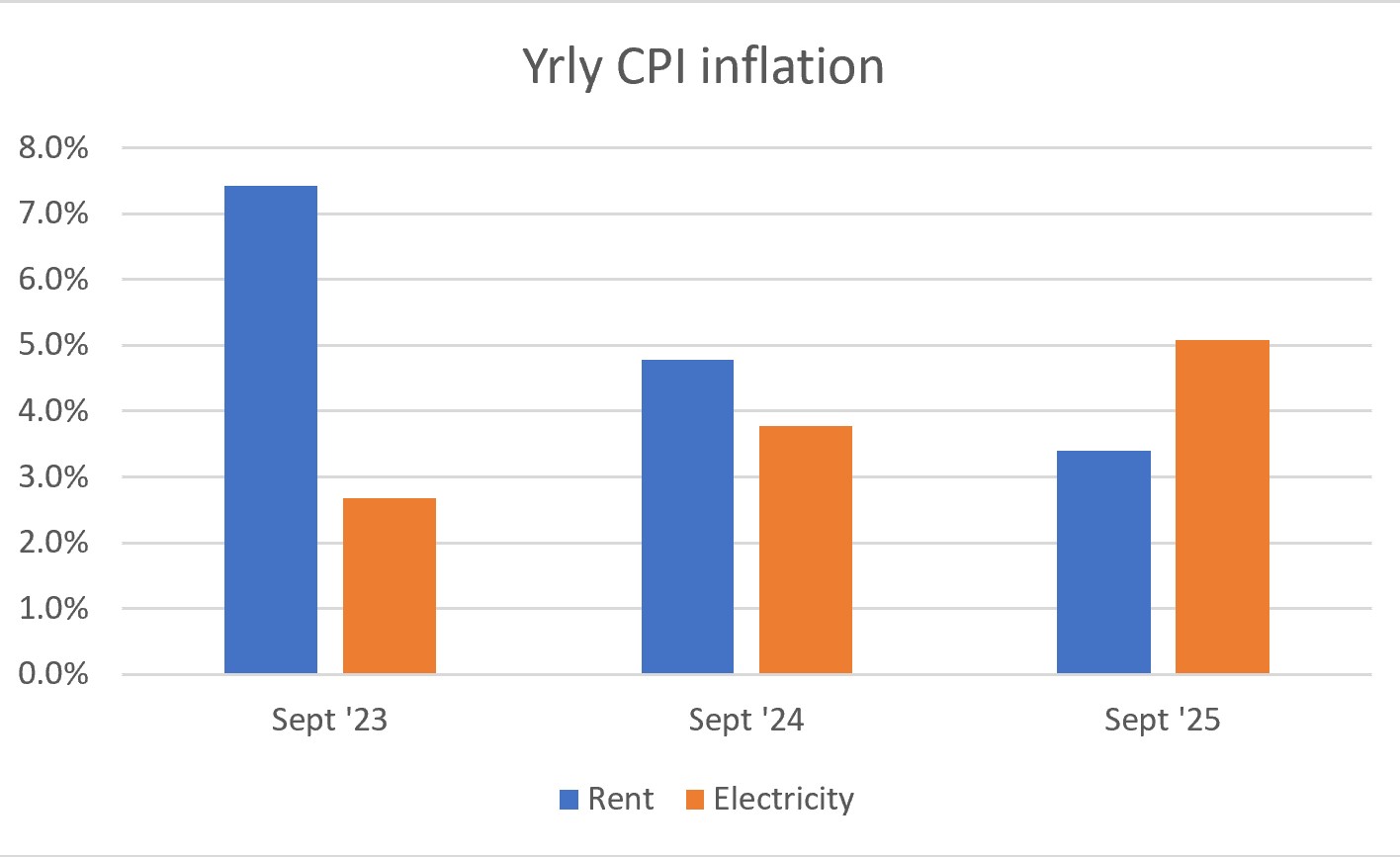

The gas price is down, as I’ll show in a moment, and that’s certainly a price people notice, but electricity prices are way up. CPI rents are up, not down, though the Zillow rent index is down $50 over both the past month and the past year. Rental inflation is, in fact, consistently down as shown in the figure below. It started falling in the spring of 2023, but again, that just means average rents are growing more slowly. Electricity prices are not just up, they’re accelerating (figure), in part due to data-center demand, meaning consumers in states like mine (VA) are getting hit with spillovers from insatiable data-center energy draws. No one’s loving that, either.

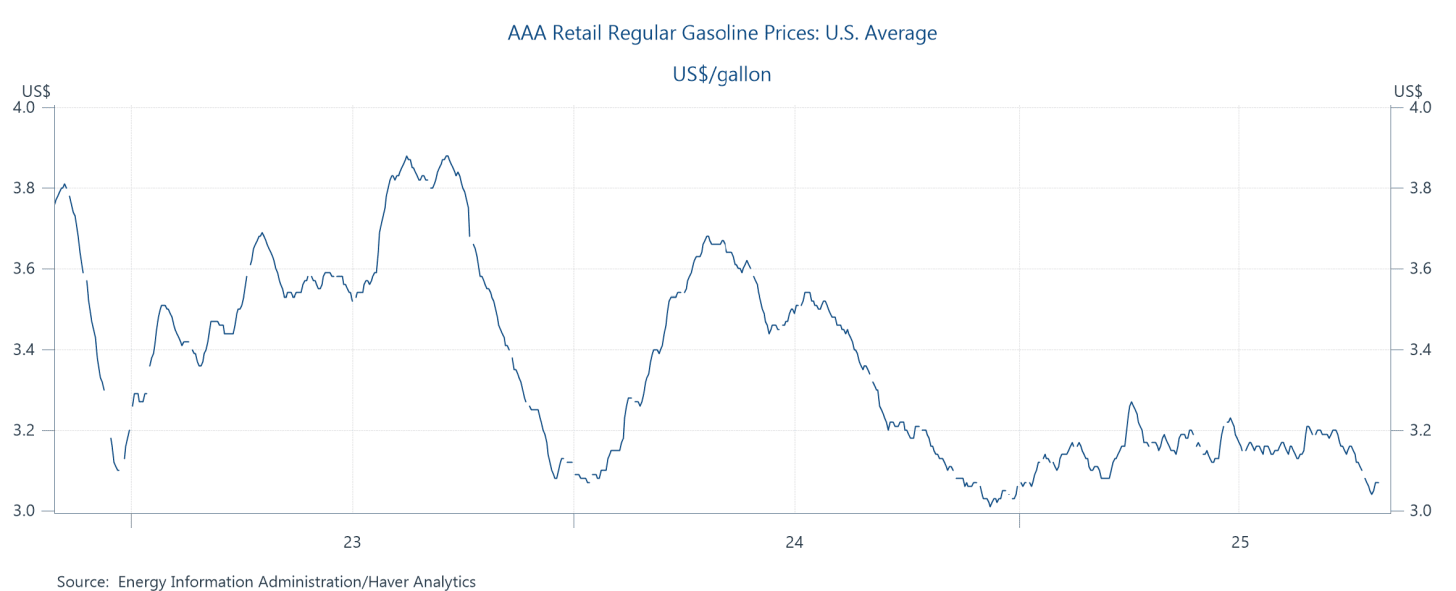

Gas is down—the figure shows the per gallon price from AAA—to about where it was in late 2024. You might think that boosted people’s economic vibes back then but it failed to do, much as it’s failing to do so now. Consumer sentiment is at or below recessionary levels.

Bessent went on to correctly point out that the mortgage rate is down, from about seven percent when Trump took office to just above six percent now, which is good news for home buyers and refi-ers. But while housing prices have flattened, they’re not coming down and they’re up by more than 50 percent since the pandemic (Case-Shiller index). When more than a third of Americans are “housing cost burdened,” meaning it takes at least 30 percent of their income to pay rent or mortgage, dismissing housing affordability is not your best play.

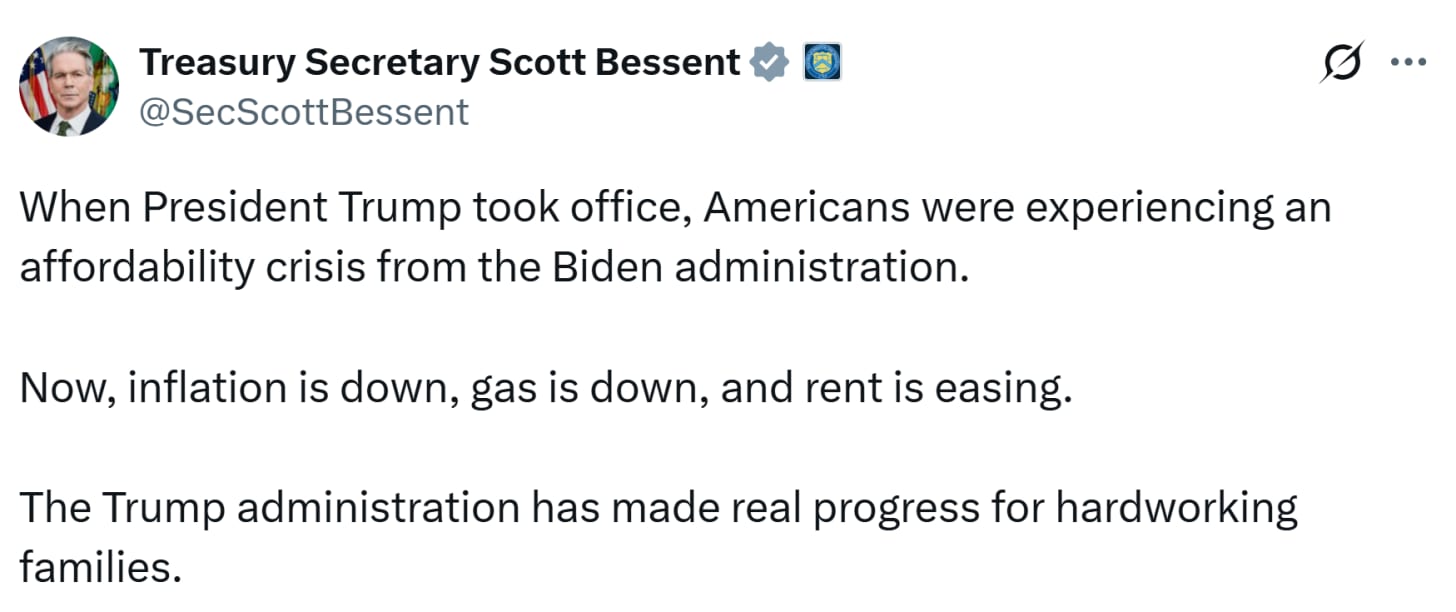

But, as is their wont, Bessent doubled down on X:

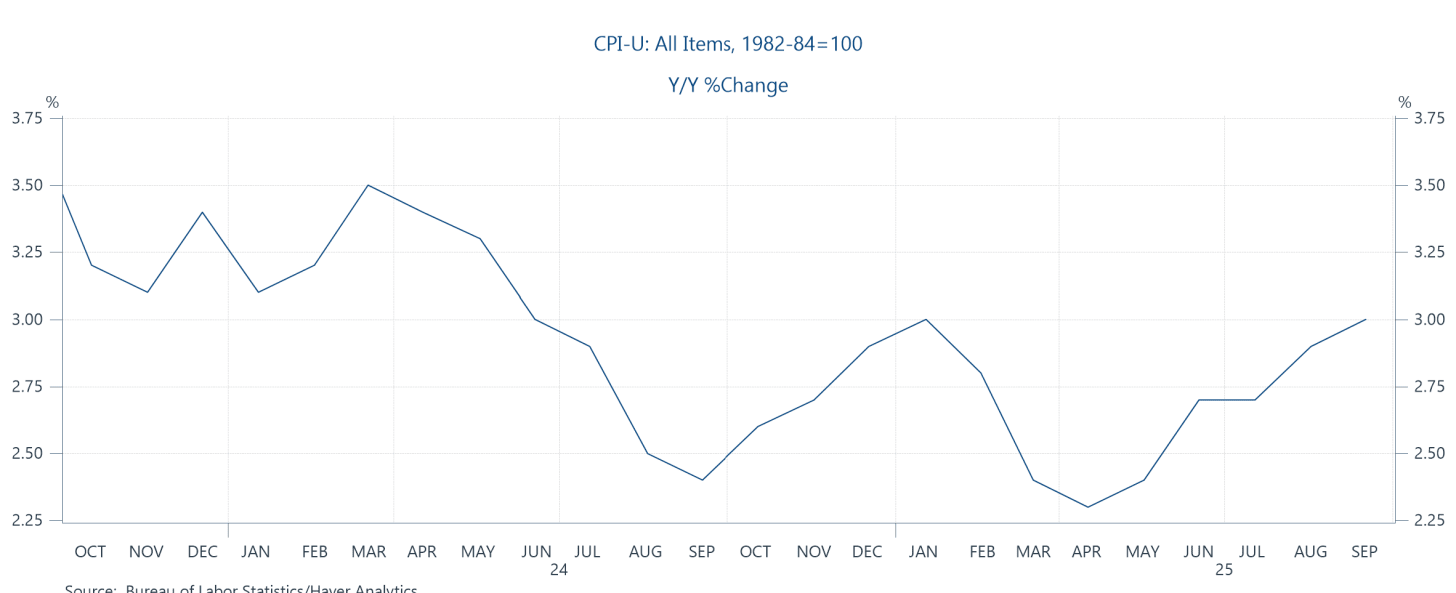

Inflation is down?? Yearly CPI inflation was ~2% in April and its ~3% now. We’ve got a pocketful of receipts on this one! As noted, some prices are down, but the rise in the average price level, i.e., inflation, is not in question. In every inflation report, you’ll always find some prices down and more prices up, but to claim “inflation is down” when it’s up over the past few months is not credible.

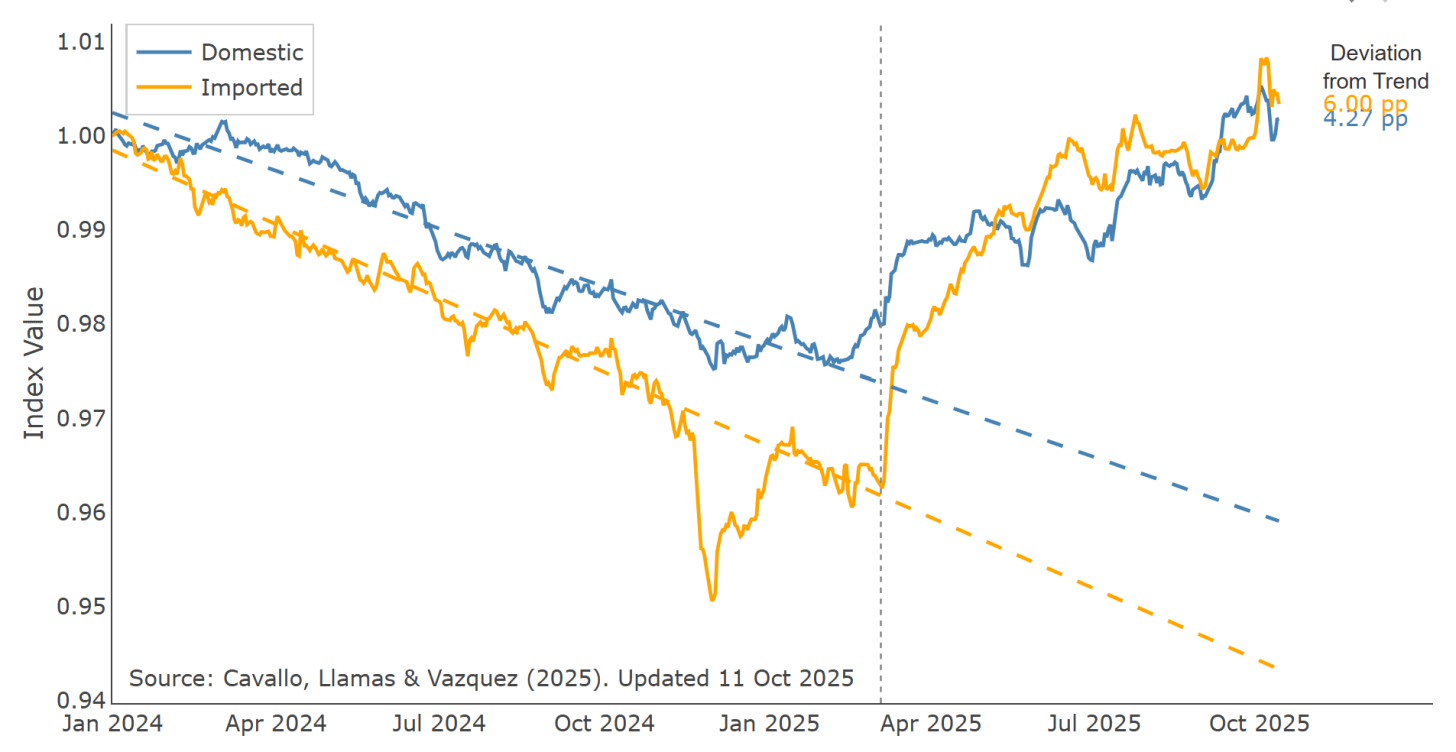

Moreover, tariffs are part of the reason inflation is up. I’ve shown this for goods prices in a recent post, but here’s the latest update from Cavallo et al, who have been tapping their unique dataset of five major retailers (the vertical line is when Trump’s tariffs were introduced):

Closer to home, and I mean your home and my home, where the day does not begin without an excessively large cup of coffee, Trump’s 50 percent tariff on Brazilian coffee is partially responsible for that price rising 19 percent over the past year (it’s not just tariffs; droughts have pushed up both coffee and beef costs). Some commentators responded to Bessent’s tweet above with pictures of what they were paying for groceries.

With all these mostly-up price movements going on in the background, the Trump administration and Congressional Rs voted to make health coverage a lot more expensive for over 20 million people by ending subsidies that were offsetting that cost.

Given those facts on the ground, Mr. Sec’y, here’s some free advice: Stop trying to convince people life is more affordable than they believe to be the case. You’ve got to know that average prices almost always go up, unless there’s a deep depression upon the land. So, BS’ing people that they can have their old prices back is, as noted, just feckless gaslighting.

Instead, you need to explain what you’re doing to make life more affordable, which has two broad policy thrusts: supporting real income growth and helping to offset the high costs of key sources of price pressures, including housing, groceries, health care, child care, utilities (e.g., electricity) costs. Neale Mahoney and I explain the policy framework and give some policy examples here; Chao and Konczal go deep here.

But before you can pursue policies to help with affordability, you’ve got to stop making the problem worse. That means unwinding tariffs and restoring health coverage subsidies.

On the income side, you’ve also got to start worrying about the unusually low-hire job market, which, unlike the booming stock market, is where the people most concerned about affordability get their income. For them, it’s paychecks, not portfolios.

So, when the Wall Street Journal reports the following…:

American employers are increasingly making the calculation that they can keep the size of their teams flat—or shrink them through layoffs—without harming their businesses. Part of that thinking is the belief that artificial intelligence will be used to pick up some of the slack and automate more processes. Companies are also hesitant to make any moves in an economy that many still describe as uncertain.

…you need to get the team thinking about ways to help restart the job-growth engine, which, for the record, isn’t tariffs, deportations, or Fed harassment. It is, in part, restored business and consumer confidence, less chaos and uncertainty, and standing up policies that nudge AI-use to upweight labor complementarity and down-weight labor substitution. I grant you, this is hard policy work, but it’s the only honest way forward.

I know—free advice, worth what you pay for it. But I learned much of the above the hard way. And for all the endless noise your boss generates, all the breaking of norms and laws, at the end of the day, affordability, as prosaic as may sound relative to reshaping everything from trade to immigration to the rule-of-law to the White House itself, is what people really need your help with.

Telling them that’s what you’re doing when in fact you’re doing the opposite won’t cut it.

Jared Bernstein is a former chair of the White House Council of Economic Advisers under President Joe Biden. He is a senior fellow at the Council on Budget and Policy Priorities. Please consider subscribing to his Substack.

Reprinted with permission from Econjared.

- GOP Insiders Fear Trump Economy Is 'Ticking Timebomb' For Midterm ›

- The Issue That Won Trump Another Term Is Now His Worst Nightmare ›

- Trump's Tariffs Are Actually A Tax That Democrats Can Cut ›

- New Polls Show Voters Rapidly Turning On Trump Over Economy ›

- Donald Trump's 'Love' Is Still Driving American Farmers Into Ruin ›

- New Data: Rich Got Richer, But Most Americans Fared Worse Under Trump ›

- Fed Chair Bluntly Warns Trump Tariffs Will Risk Inflation And Recession ›

- - National Memo ›

- When Will Trump Focus On Inflation? Aides Say Just Wait Till New Year - National Memo ›

- After The Blue Wave, Affordability Trumps Tariffs At The MAGA White House - National Memo ›

- Fox News Spinning Madly To Make Sense Of Trump's 'Affordability' Message - National Memo ›

- A Decent Slice: The Affordability Crisis Isn't Only About Prices - National Memo ›

- Danziger Draws - National Memo ›

- 'No No No No!" Treasury Secretary Roasted For Denying Inflation Under Trump - National Memo ›

- Hapless Hassett: Will Trump's Next Fed Chair Transform America Into Argentina? - National Memo ›

- Trump Grades His Performance On The Economy: 'A-plus-plus-plus-plus' - National Memo ›

- Sorry Mr. President, But The Affordability Crisis Isn't A 'Hoax' - National Memo ›

- Wall Street Deems Trump A Major Risk Factor As Markets Sink - National Memo ›

- Virginia's First Female Governor Inaugurates Her 'Affordability Agenda' - National Memo ›