Presumably acting as a surrogate for her husband, Ann Romney is now announcing that no additional tax returns will be released to the public before the election.

Lately the stakes of Romney’s refusal to disclose have risen tremendously. Senate Majority Leader Harry Reid asserts that Romney has effectively paid no taxes over the past ten years. Leading private equity magnates have been unable to explain with any certainty how Romney could lawfully build his “magical IRA”, to a value of $21 million to $102 million.

Now, Romney has raised the stakes even higher. He has flatly declared that his personal tax rate each year over the the past decade was at least 13 percent. He has tried to redirect the campaign’s focus by naming Ryan, and hopes that declaring his own version of his tax record will put Democrats and advocates of disclosure on the defensive.

Maneuvering aside, however, the Republican Party and the American people have a right to know. Romney’s unverified statements about his taxes, his inexplicable accumulation of wealth in his IRA, and the sequestration of wealth in notorious tax havens outside the jurisdiction of the United States all raise ethical questions that transcend the minimum disclosure required by law. How can America elect a President who has not dispelled the lingering suspicion that he is a liar or engaged in highly questionable financial activities?

Here are four lessons from U.S. history — and Romney’s personal history — that show why he must release his tax returns.

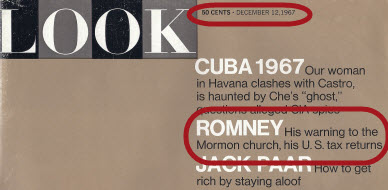

First, it’s widely known that Mitt’s father, George Romney, released 12 years of tax returns prior to his Presidential bid. What is less widely known is his rationale. To write a biography of George Romney published in 1967, George Harris, a senior editor for Look magazine, took a five month leave of absence, When the biography, Romney’s Way: A Man and an Idea, was released, Harris wrote an article on his interactions with George Romney for Look magazine, dated December 12, 1967.

He balked when I badgered him for a copy of his latest Form 1040, the Federal Individual Income Tax Return. Release of the document, while it might serve a political purpose, would not prove very much, he argued. One year could be a fluke, perhaps done for show, and what mattered in personal finance was how a man conducted himself over the long haul.

Stumped by this argument, I was not prepared for the move that it eventually led him to make: He ordered up all the Form 1040’s that he and Mrs. Romney had filed over the past twelve years–including those profitable ones when he saved American Motors Corporation from bankruptcy and became a millionaire on the company’s stock options.

In the published biography, Harris also writes that in examining the tax returns:

Auditors notice two unusual facts in these returns. First, the Romney’s have never made much use of tax loopholes, such as depletion allowances, that are taken for granted by most people who reach their bracket. Second, over the 12-year period, they have donated an average of 19 percent of each year’s adjusted gross income to their church.”

In the August 9th issue of Business Week, Romney asserts that he will be a successful president, because he is a successful executive who learned about leadership from his father. He says, in part,

Well, I had the privilege of growing up in a home with a Dad that was a leader…So I learned something about leadership from a man who was an extraordinary leader.”

Romney’s Dad believed that a man’s past financial history, and what it showed about his character, were important indicators of how he would perform as President. But the American people have no idea how Mitt stacks up, although his extensive use of tax shelters and off-shore tax havens is not a positive sign.

Second, Romney has repeatedly expressed his admiration for Teddy Roosevelt, saying in one interview, “I love Teddy Roosevelt. I read everything I can get my hands on about Teddy Roosevelt.” Somehow he missed one of TR’s most compelling beliefs. In 1901 Theodore Roosevelt declared:

If courage and strength and intellect are unaccompanied by the moral purpose, the moral sense, they become merely forms of expression for unscrupulous force and unscrupulous cunning. If the strong man has not in him the lift toward lofty things his strength makes him only a curse to himself and to his neighbor. All this is true in private life, and it is no less true in public life.

Leadership, as recognized by Theodore Roosevelt, is not satisfying the minimum required by law. It is providing a worthy example to others and a benefit to the community, regardless of personal cost. George Romney recognized the need for such morality in our leaders. Evidently Mitt Romney does not.

Third, it is doubtful, but not impossible, that Mitt Romney’s tax returns contain an unacceptable, campaign-ending secret. In 1973 President Nixon famously declared “I am not a crook.” Until I viewed the clip below, I had forgotten that as part of this statement Nixon also said, “I welcome this kind of examination, because people have got to know whether or not their President is a crook.” Yes Mitt, Americans “have got to know” that the Republican Presidential nominee, and possible next President, has complied with the laws of the land.

Photo by Gage Skidmore/Flickr