How Republicans Would Gut Regulations That Guard Against Another Meltdown

Republicans might not repeal Dodd-Frank outright, but they’d eliminate the system of rules that make it work.

It was just announced that Tim Pawlenty will become the head of the bank lobbying group Financial Services Roundtable. The powerful financial lobbying group, which represents groups like JP Morgan and Bank of America among other big financial sector players, appears to be aligning itself more closely with the Republican Party and betting on the idea that Republicans will control at least part of Congress. But what do they want? Earlier in the year, I argued in Washington Monthly that they’d like to repeal the core parts of financial reform.

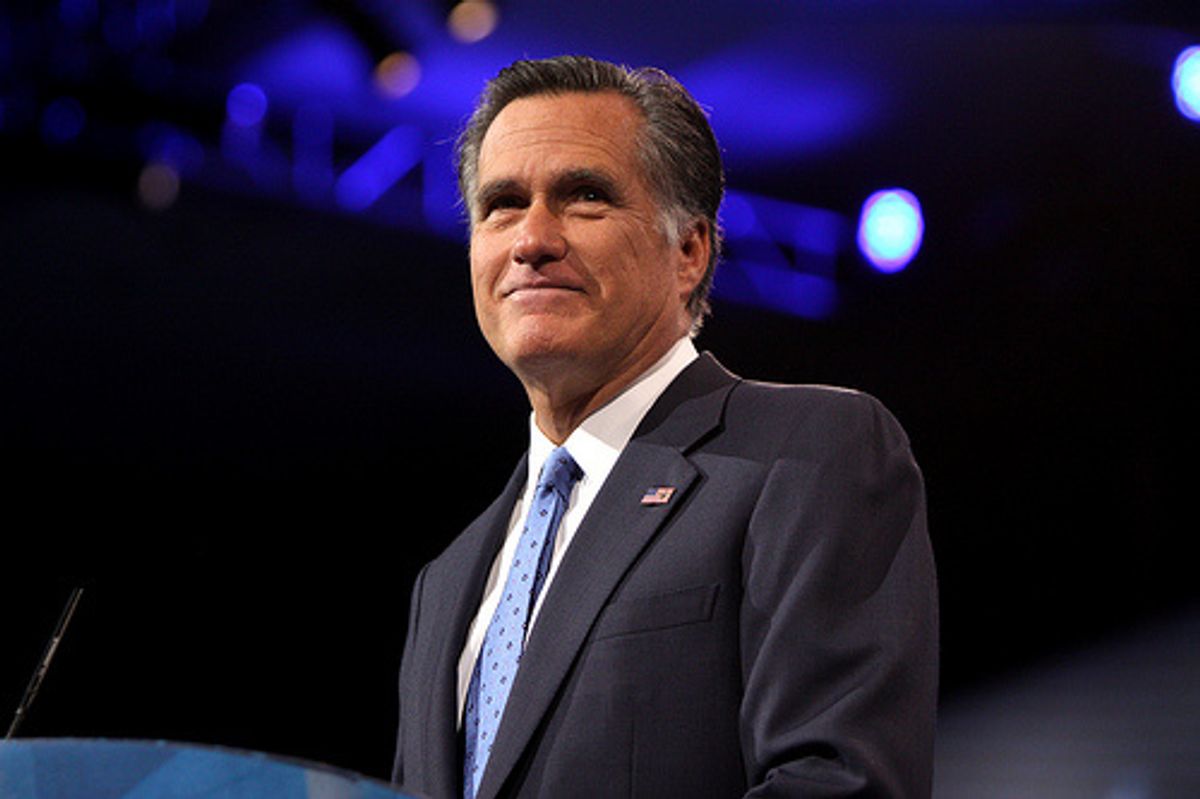

Recently, Phil Mattingly had an article at Bloomberg Businessweek about how the GOP and Mitt Romney would approach Dodd-Frank. This is with a hat-tip to Reihan Salam who notes that this article “has confirmed something I’ve heard from well-informed insiders” and makes additional arguments [1]. So it seems well-sourced.

Mattingly’s argument is that it is unlikely that the Republicans will outright repeal Dodd-Frank. “Instead, President Romney would likely try to give the financial industry something it wants more: a diluted financial reform law that would relax restrictions on some of its most profitable—and riskiest—investments but maintain enough government oversight to give the banks cover.”

So what would the Republicans try to dilute and remove? Mattingly:

“Wall Street wants to loosen rules governing the swaps market, which generated $7 billion in revenue in the first quarter of 2012, according to government records. The banks would also get rid of restrictions on bank investment in private equity and hedge funds, pare back the power of the new federal consumer protection agency, and block the Volcker Rule, which bars banks from trading with money from their own accounts, a practice that can put customer deposits at risk. […]

Wall Street doesn’t oppose everything in the law. Banks support the “resolution authority” that spells out how and when the government can seize and wind down struggling banks before they catastrophically fail.”

So they want to go after derivatives rules (swaps), the Volcker Rule and the related law on restrictions on hedge fund investments, and also the CFPB. It’s important to understand this isn’t like removing random parts of the bill, as strict as they may be, but is instead gutting the core logic of the law. It’s the equivalent of Republicans saying they’d keep the Obamacare bill, but stop the exchanges, remove the individual mandate, and lose the ban on pre-existing conditions while getting rid of the means-tested subsidies and Medicaid expansion. We’d understand that all of the parts of this system are interconnected and inseparable; the ban requires everyone to be in the market, which requires subsidies and well-developed markets.

Let’s make sure we understand how derivatives, the Volcker Rule, and the CFPB all work together. Imagine that we’re car engineers, and we want to design a car and road system so that if the car crashes, it does so as safely as possible. There are four things we can do. We can put airbags and seatbelts in the car and other cars so that when it does crash the damage is limited and controlled. We can design the car with things like a brake override system so that if it hits a rough patch the driver can keep control of it and make it less likely to crash. We can put some speed limits on the road, as well as clear traffic signals to guide cars from running into each other. And we can have some protection for pedestrians, like cops watching for DUIs or barriers to prevent cars from driving into crowds of people. Easy, right?

Now let’s think of Dodd-Frank. There are the legal powers that deploy to resolve a firm if it fails, like an airbag, which are called resolution authority. This allows the FDIC to take down a failed financial firm as if it were a bank, subject to serious rules and restrictions. And, like requiring certain car features, there are specific policies for large, systemically risky financial firms, like enhanced capital requirements, limits to investments in risky hedge-funds, and the Volcker Rule, which are designed to make it less likely for a firm to crash.

Dodd-Frank also introduces speed limits and rules of the road in the financial sector, designed to make the system as a whole less likely to crash or spiral out of control when a panic does happen. One primary place it does that is through derivatives regulations. And “cops on the beat” is the metaphor for the Consumer Financial Protection Bureau.

So there’s Dodd-Frank law to allow a firm to fail, law to make it less likely a financial firm fails, laws to prevent the interconnected financial markets from going into crisis if a firm does fail, and law to gives consumers a representative in dealing with the regulatory field. This is like thinking of Dodd-Frank as a system of deterrence, detection, and resolution, a related model we’ve developed elsewhere.

If Wall Street and the Republicans are looking to seriously gut the Volcker Rule, derivatives, and the CFPB, then they’re looking to gut the entire logic of the bill. Interestingly, they are less interested in “resolution authority,” the legal process to fail a financial firm. This is evidently no problem with everything else removed, perhaps because they believe congressional bailouts will then happen. This should remind us that resolution authority is strengthened and made more credible by other strong regulations, including things not in Dodd-Frank, like size caps or Glass-Steagall. Preventing these dilutions is crucial to building a regulatory system for the financial sector that works in the 21st century.

[1] Reihan notes that banks “also understand that [Dodd-Frank] favors incumbents over new entrants, particularly incumbents with the legal acumen and lobbying resources to shape the emerging regulatory regime. My strong preference, very much in line with conservative and libertarian sensibilities, would be for a financial reform that would aim to facilitate rather than stymie entry.”

I’d like to see more on how Dodd-Frank as blocking new firm entry works. While this is a generic complaint of regulations in general, I’m not sure in what ways it applies to Dodd-Frank. Parts of Dodd-Frank actually are designed to scale up with size and risk, e.g. Sec. 171 requires capital requirements to scale with “concentrations in market share for any activity that would substantially disrupt financial markets if the institution is forced to unexpectedly cease the activity,” which is not for new entries. The idea is to hold larger and riskier firms to tougher standards and higher capital, which is regulation that scales with size.

Cross-Posted from Rortybomb

Mike Konczal is a fellow with the Roosevelt Institute