Trump Makes A Stunning Confession

Reprinted with permission from DC Report

In an astonishing admission, Donald Trump said Thursday that instead of hiring only "the best people," as he promised voters, he hired "garbage."

He also complained Thursday that these former appointees didn't follow his version of omerta after a new book revealed that he wanted to execute an unidentified White House leaker. Omerta is the ancient Sicilian mob tradition of never talking outside their criminal gang, an offense punished by death.

Each day America's beggar-in-chief issues "Save America" statements via email. Most are petty, many deranged, but now and then, truth inadvertently comes through because of his utter lack of self-awareness, his emotional immaturity and his rank incompetence as a leader. I've shown for three decades his failures to his furious denials.

Now the people he chose for his White House team are telling their stories of Dr. Jekyll and Mr. Hyde, the White House years.

Here is what Trump declared at 12:49 on Thursday afternoon: Let's dissect this unintended confession.

Let's dissect this unintended confession.

First, many of the people Trump says are "all of a sudden" talking to reporters have been talking to them for months and years. Trump doesn't read books nor did he read his Presidential Daily Brief when he was president. Not reading more deeply than the cover of a book often leaves Trump badly, sadly — and when he was president — dangerously misinformed.

If Trump cracks the spines of the bookshelf of tell-alls coming out now, he would know that the authors carefully cultivated these sources and won their trust while he was president.

Second, notice that people who worked with Trump and now speak about him, other than as he wants, are "losers."

The reason Trump made oh so many people sign nondisclosure agreements, even some 2016 campaign volunteers, was that anyone who gets inside could see the truth about Trump: He is and always has been a fraud.

The reality: He's the self-made man who blew daddy's fortune. He's the Don Juan sued repeatedly for groping and allegedly raping women because he lacked the charm to seduce them. And now he's the beggar-in-chief, a faux billionaire reduced to pleading for alms from the people he says he loves, the "poorly educated" whom he hurt so badly while in office.

Third, Trump is back to his "many say" device, as if that lends credence to what he says.

The fact is that many say he is the worst president of all time. Many say he is a Kremlin stooge. If these documents published in The Guardian on Thursday are true, Vladimir Putin owned him. Many say he is a lousy businessman.

I could go on here with enough examples to fill three books—oh, wait, Thursday I finished my third Trump book, The Big Cheat, out September 28.

Fourth, who conflates stars and garbage? There are great metaphors, there are mediocre metaphors, and then there are Trumpian trash metaphors.

But at least this one was honest trash in which Trump admitted, finally, that he didn't hire the best and the brightest, but a bunch of losers.

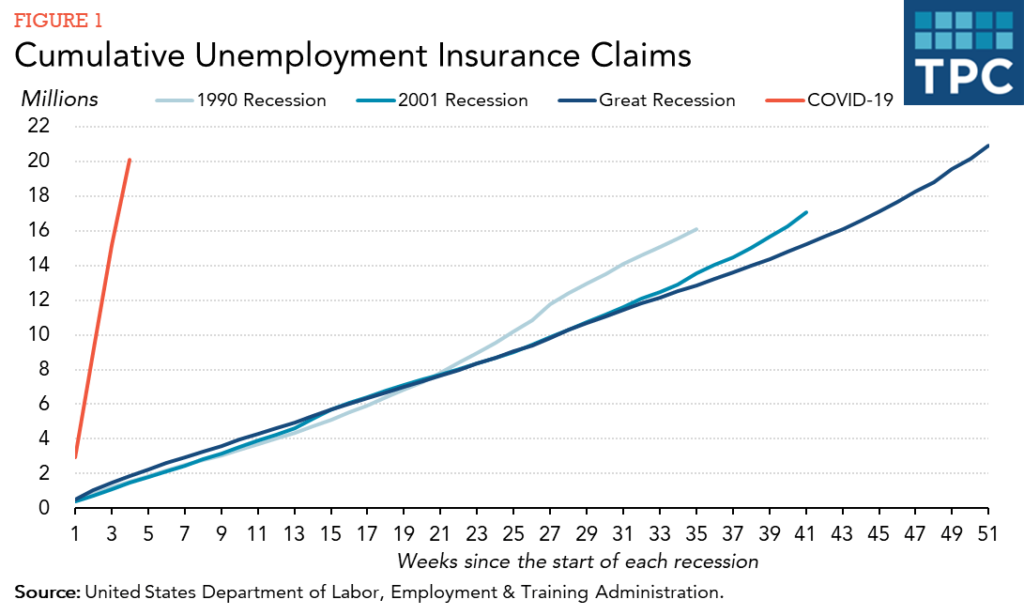

No matter whose figures you decide to rely on, the jobless numbers would be higher but for the state systems for claiming jobless benefits being overwhelmed. Many people have reported they cannot complete their claims and others say they are waiting until those systems are not so overwhelmed because they can file retroactively to when their employment ended.

No matter whose figures you decide to rely on, the jobless numbers would be higher but for the state systems for claiming jobless benefits being overwhelmed. Many people have reported they cannot complete their claims and others say they are waiting until those systems are not so overwhelmed because they can file retroactively to when their employment ended.