The Young And The Useless: How Millennials Left Democrats Hanging On Election Day

Everybody knew that Democrats were likely to have a rough time on election night. But hardly anyone expected the avalanche that buried Democratic candidates up and down the ballot, across the country. Republicans won in red states where they were expected to romp, blue states where they were given little hope of competing, and plenty of purple states in between. And now, they want Americans to know: The midterms gave them a mandate, and they intend to use it.

“Republicans were affirmed both to go to Washington … and affirmed at home,” Republican National Committee chair Reince Priebus gloated after the election, speaking for many of his fellow Republicans.

But by giving the GOP control of the Senate and a number of statehouses, did voters really sign on for a right-wing revolution? Not exactly. Even as Democratic candidates across the country collapsed, progressive ballot iniatives — most notably, increases in the minimum wage — fared very well. Millions of Americans did not join the Tea Party overnight.

The true secret to Republican success was simpler, albeit less inspirational: Democrats just didn’t show up.

Given the strong Republican tilt of the electoral map, Democrats always knew that to avoid disaster, they would have to increase voter turnout to make the electorate look more like a presidential year than a midterm. They spent some $60 million to build a voter turnout machine (the oft-hyped “Bannock Street project”) to bring single women, minorities, and young voters to the polls. And they failed miserably. According to NBC News exit polling data, all three groups fell off from their 2012 levels.

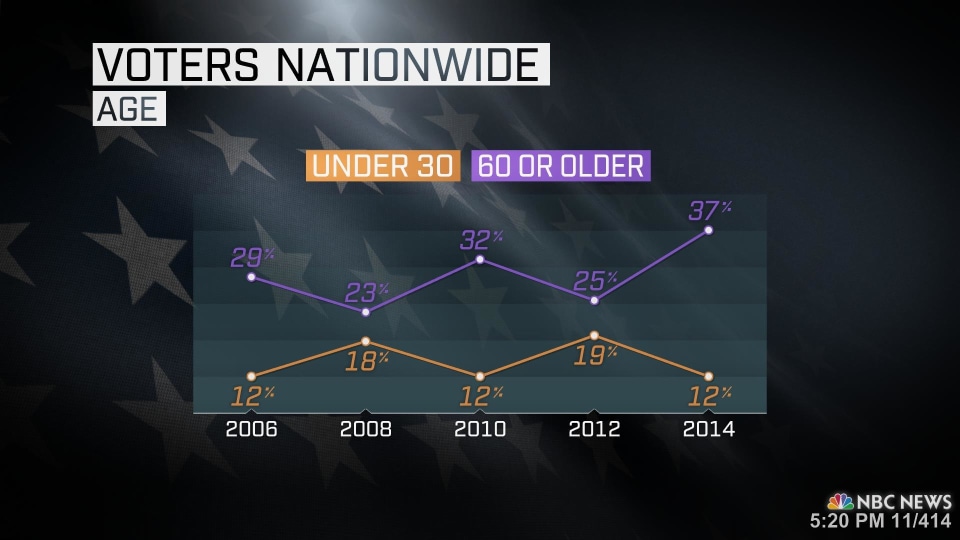

Young voters in particular declined to show up for Democrats. The exit poll shows that voters between the ages of 18 and 29 supported Democrats by a strong 54 to 43 percent margin. But they made up just 12 percent of the electorate — down 7 percent from 2012, and equal to their dismal turnout from 2010.

By contrast, 37 percent of midterm voters were 60 or older — and these voters backed the Republicans by more than 15 percent.

Democrats may take solace in the fact that young voters still strongly favor their party over Republicans, and will likely return to the polls in 2016 when Republicans are defending a tough map. But that will be cold comfort with Mitch McConnell running the Senate for at least the next two years.

AFP Photo/Brendan Smialowski

Want more political news and analysis? Sign up for our daily email newsletter!